Intel’s (NASDAQ: INTC) stock price has more than halved from its 52-week highs. The legendary semiconductor manufacturer has lately found itself under tremendous pressure, as competition is eating its lunch and its future expansion prospects remain uncertain. That said, with shares now trading at the same levels they did around a decade ago and the dividend yield standing at a juicy 4.9%, investors have been arguing back and forth whether Intel makes for an attractive buying opportunity or if it presents a value trap, bearing further losses ahead. Due to Intel’s future success in the semiconductor industry appearing wildly speculative, I am neutral on INTC stock.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

What’s Wrong with Intel, Anyway?

The core issue with Intel starts with the fact that the company has failed to innovate for more than a decade. Once the dominant player in the space, Intel is now seeing its sales plundered by its competitors. The biggest threat comes from Advanced Micro Devices (NASDAQ: AMD), which is using Taiwan Semiconductor (NYSE: TSM) fabs, eradicating Intel’s previously monopolistic qualities.

You may wonder what stops Intel from investing in new technologies and capabilities. Well, there’s something called Moore’s law, which is a key concept in the semiconductor space. It basically states that the number of transistors in a dense integrated circuit doubles roughly every two years.

The “law” works surprisingly well in predicting the future course of the industry, and thus semiconductor companies like Intel utilize it to set their R&D targets. The problem, however, is that the semiconductor industry is super capital-intensive. So, projecting your future R&D needs is pointless if you can’t fund them.

Now, combine that with the fact that Intel’s revenues have been declining, resulting in compressed margins and, thus, suppressed profits, and you can see why it may not be able to keep up with Moore’s law. This case implies that the company will gradually decay against its competitors’ momentum, whose growing profits will spur further innovation, leaving Intel further behind as time goes by and so on.

That’s what’s wrong with Intel and why institutional investors, including hedge funds, have sold the stock off to oblivion lately.

What is Intel Doing to Advance Forward?

Ok, so Intel’s future prospects appear bleak as its declining profits make it increasingly hard to keep up with the competition while already being in a tough spot. This doesn’t mean, however, that its management team sits with their hands between their legs. The company does seem to try to get out of its current predicament. Specifically, in Q3, Intel presented the Semiconductor Co-Investment Program, a revised, new funding model for its capital-intensive needs.

As part of this program, Intel made a deal with Brookfield Asset Management (NYSE: BAM), under which the two companies will collectively invest up to $30 billion in Intel’s manufacturing expansion in its Arizona plant. Brookfield is considered one of the best asset management firms globally, with a decades-long market-beating track record. This is a great vote of confidence for Intel.

Furthermore, Intel has made headway toward forming a geographically balanced, protected, and resilient semiconductor supply chain as it recently commenced two state-of-the-art chipmaking facilities in Ohio. These sites are supposed to drive a new era of innovative products from Intel, which, combined with Brookfield’s backing, may just be what will save the company from its forenamed predicament. Or, it may not, and the truth is, nobody can tell you what the general outcome is going to be.

What to Consider When Valuing Intel

Valuing semiconductor companies is tricky, but that’s especially true with Intel. To say that the stock is cheap or expensive based on its projected earnings is incidental. For instance, Intel is currently trading at a forward P/E of 14.6x based on this year’s projected earnings ($2.05/share).

On the one hand, this is a rich multiple for a cyclical company whose earnings are on the decline. On the other, it’s a cheap multiple if Intel’s earnings were to rebound towards, say, last year’s levels. Ultimately, however, no valuation metric is going to tell you whether the stock is a good buy or not because it all comes down to where Intel will be in five or ten years from now, which is very hard to predict given its current state.

Is INTC a Good Stock to Buy, According to Analysts?

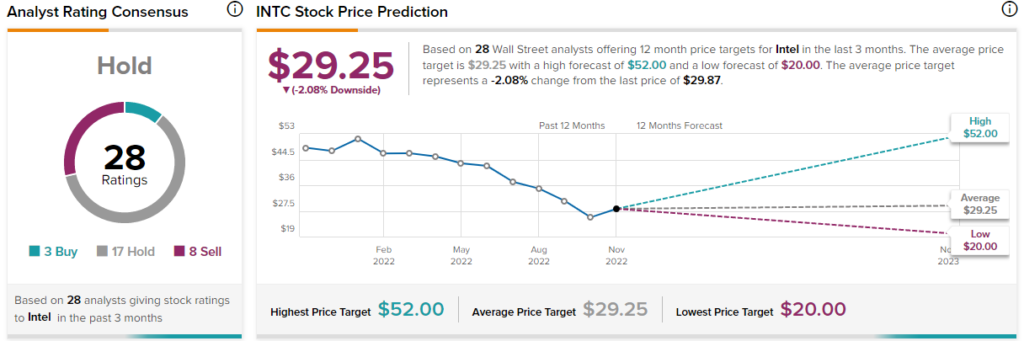

Turning to Wall Street, Intel has a Hold consensus rating based on three Buys, 17 Holds, and eight Sells assigned in the past three months. At $29.25, the average Intel stock forecast implies 2.1% downside potential.

Takeaway: It’s Better to Stay on the Sidelines

Intel has attracted very mixed ratings from analysts lately, which aligns with my point that its investment case is currently wildly speculative. The market may celebrate or criticize its earnings in the short term, but ultimately its results over the next few quarters will only partially matter when it comes to where the company is headed.

Regardless, unless investors see tangible developments that will ease their minds regarding what Intel’s chances are of winning its future battles against its competitors, shares will likely remain depressed. Accordingly, I will remain neutral on the stock for the time being.