Wall Street was taken aback last month, when Disney (DIS) announced the return of ex-boss Bob Iger. Taking over the reins from Bob Chapek following his unsuccessful stint, Iger’s task is to get Disney back in shape; recent times have seen the House of Mouse’s share price take a beating while streaming service Disney+ has been piling up the losses.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While Iger plans to stay in the role for a couple of years until a suitable successor is found, Morgan Stanley analyst Benjamin Swinburne notes he has plenty on his plate to deal with in the meantime.

Swinburne thinks that over the past year, Disney’s Media segment (DMED) “lost control of expenses.” The segment’s FY22 SG&A and other costs rose to $12 billion, amounting to more than 20% of DMED revenues. “Mr. Iger has already announced plans to set a new organization structure in place that empowers senior creative executives, including those that lost P/L responsibility in the 2021 reorg,” notes the analyst. “However, the new structure will need to simultaneously empower creatives and lower the expense base.”

The company should also stop thinking about “asset value and earnings power in pieces” – a line of thought taken following the entry into streaming and once the pandemic took hold – with Swinburne believing the “focus internally and externally should be on the overall earnings power and growth potential for the Walt Disney Company, not the divisions.”

What it all boils down to, however, is that old axiom – “content is king.” Meaning, it’s all well and good seeking to “optimize distribution and returns,” but if the content does not “resonate” then all else is in vain.

As such, over the next couple of years, the Marvel Cinematic Universe’s (MCU) health plus the plans in store for the Star Wars franchise will be key focal points for Swinburne. A bounce back for the commercial fortunes of Disney’s “key” animation studios both in Film (Pixar, Disney animation) and TV will also be on the agenda, as well as “continued momentum” for overall entertainment both in the US (FX, Hulu) and abroad. And on the sports front, the primary focus should go toward picking up a renewal with the NBA on ESPN.

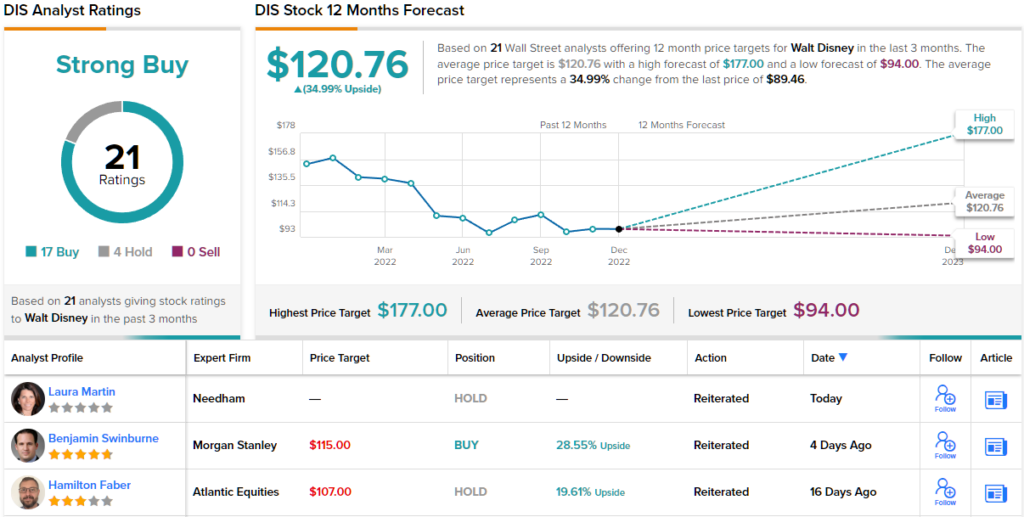

All told, Swinburne keeps an Overweight (i.e., Buy) rating on Disney shares, although the price target is lowered from $125 to $115. The implication for investors? Upside of ~28% from current levels. (To watch Swinburne’s track record, click here)

Amongst Swinburne’s colleagues, most remain on Disney’s side, too. The stock claims a Strong Buy consensus rating, based on 17 Buys vs. 4 Holds. At $120.76, the average price target makes room for ~35% gains over the coming year. (See Disney stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.