Academy Sports and Outdoors (NASDAQ:ASO) shares have rallied over 23% year-to-date, fueled by solid expansion and strong fourth-quarter earnings that surpassed analysts’ estimates. The company also announced a 20% dividend hike, backed by a healthy cash position. Additionally, the company’s optimistic long-term growth plans and the bullish analysts’ sentiments suggest that the stock’s rally may continue.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Academy Sports operates a chain of sporting goods stores. It offers hunting, fishing, and camping equipment as well as sports and leisure products.

At its investor event held yesterday, Academy Sports announced its ambitious plan to generate $10 billion in revenue by 2027. The business anticipates accomplishing this by opening 120 to 140 new stores. Additionally, it aims to strengthen its current business by boosting store productivity, accelerating the supply chain, and drawing in more clients.

Meanwhile, the company reaffirmed its 2023 outlook. Academy Sports expects net sales between $6.5 billion and $6.7 billion and gross margins in the range of 34% to 34.4%.

Will ASO Go Up?

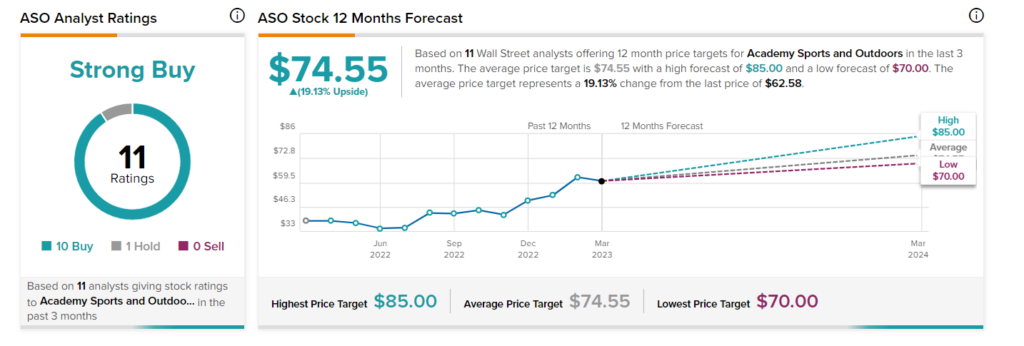

The analyst consensus on Academy Sports is a Strong Buy based on 10 Buys and one Hold. The average price target of $74.55 implies a 19.1% upside from current levels.

Ending Note

Academy Sports’ strong financial position supports its ambitious long-term plans. Additionally, the sports equipment market is expected to grow at a compound annual growth rate (CAGR) of 6.2% in the next four years, according to Statista. This bodes well for the company’s future prospects.

It is worth mentioning that the stock looks undervalued despite the share price rally. Its current price-to-earnings ratio of 8.7x is trading at a 57.6% discount to its sector’s average of 15.11.