Enterprise artificial intelligence (AI) application software company C3.ai (NYSE:AI) reported better-than-anticipated fiscal first-quarter results earlier this week. However, management’s statement about not expecting to be profitable on an adjusted basis in the fiscal fourth quarter due to the company’s investments in generative AI raised concerns among investors. Likewise, Wall Street analysts seem cautious about C3.ai’s profitability.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analysts’ Reaction to C3.ai’s Results

C3.ai’s revenue increased about 11% year-over-year to $72.4 billion in Q1 FY24 ended July 31, 2023. The company’s adjusted loss per share narrowed to $0.09 per share from $0.12 per share in the prior-year quarter. Analysts were expecting a loss per share of $0.17 on revenue of $71.6 million.

Management said that while the company is expected to be cash-positive in the fiscal fourth quarter, it is not projected to be profitable on a non-GAAP basis due to the investments in generative AI. The company said that it now expects to be non-GAAP profitable in the course of Fiscal 2025.

Reacting to the Q1 FY24 print, Deutsche Bank analyst Brad Zelnick contended that C3.ai’s results are unlikely to address concerns about customer traction, the path to profitability, and the extent of generative AI monetization on its platform relative to management’s highly bullish commentary. Zelnick has a Sell rating on the stock and a price target of $16.

Similarly, Bank of America analyst Bradley Sills, who has a Sell rating on AI stock with a price target of $18, said that Q1 FY24 results, metrics like average total contract value, and unchanged fiscal 2024 revenue guidance do not indicate any substantial AI tailwinds. Sills said that while there is a possibility of revenue acceleration at some point in FY24, he wants to see more evidence that “ramping pilot deals and larger expansion deals could move growth and scale more meaningfully.”

Meanwhile, Wedbush Securities analyst Dan Ives reiterated his Buy rating and lowered his price target to $42 from $50 on Wednesday. While Ives believes that C3.ai is well-positioned to capture a share of the generative AI market, he views the rise in the company’s investments as “near-term pain for long-term gain.”

Interestingly, Needham analyst Mike Cikos noted that the company’s operating margin of -28.6% came in way better than the guidance range of -36% to -41%. Despite this improvement, Cikos thinks that investors may be disappointed due to the extension in the timeline to profitability owing to the company’s decision to invest in generative AI opportunities.

However, Cikos believes that the company made the right move for its growth over the medium and long term. Nonetheless, he is cautious currently and reiterated a Hold rating on AI stock without any price target.

What is the Forecast for C3.ai Stock?

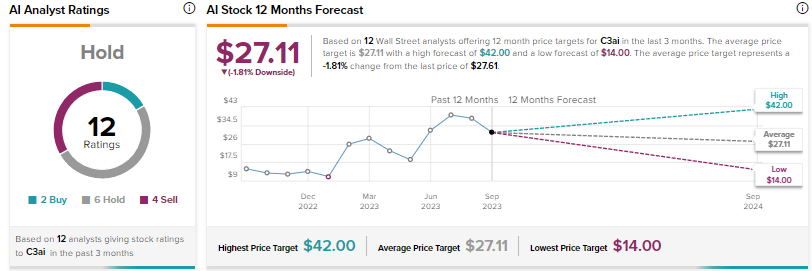

Overall, Wall Street is sidelined on C3.ai stock, with a Hold consensus rating based on two Buys, six Holds, and four Sells. The average price target of $27.11 implies a possible downside of about 2%. Shares declined 12.2% on Thursday in reaction to the results but are still up about 147% year-to-date due to the buzz around generative AI.

Conclusion

Several analysts are worried about the impact of generative AI investments on C3.ai’s near-term profitability. Some analysts have also expressed concerns about AI tailwinds not reflecting in this year’s performance or in the outlook. Overall, after a massive rally, Wall Street does not see any further upside from current levels. Disclosure