Shares of sports footwear and apparel giant Nike (NYSE:NKE) are down 9.6% YTD. In fact, the stock is down about 41% from its all-time high of $179.10 seen in November 2021. Still, Nike remains one of the top brands across the globe. Plus, the company seems to be showing signs of a recovery, especially after its latest earnings beat and bullish outlook. Therefore, I think the time is right to “just do it” and invest in Nike stock with a longer-term horizon.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s take a look at Nike ahead of the peak holiday shopping season when retailers and footwear companies see a jump in sales.

The Road Ahead: Key Positives from Q1 Earnings

On September 28, Nike reported better-than-expected Fiscal Q1-2024 earnings, while revenues slightly missed expectations. Q1 EPS of $0.94 easily beat analyst’s expectations of $0.76 per share. Revenues, however, missed expectations, growing by only 2% year-over-year, given the tough inflationary environment.

More importantly, though, Nike highlighted a number of strategic initiatives being undertaken to help with its growth and profitability. Overall, Nike forecasts its results to improve during the second half of the year, predicting mid-single-digit revenue growth and improved margins.

Nike has made active efforts to reduce its inventory ahead of the holiday season. As a result, during Q1, its inventory fell by 10% to $8.7 billion. What’s more impressive is that Nike expects improved gross margins (+100 basis points) in the upcoming second quarter as the company plans to offer fewer discounts.

The firm also announced other strategies like investing in regional centers and a new transportation management system to further bolster its distribution network and meet consumer demand in more efficient ways.

Management expects Nike Direct to continue to lead growth throughout the remainder of this fiscal year based on increased average order values and member engagement. Therefore, it will continue to contribute incrementally to revenues and margins.

To further accelerate its innovation strategy and growth targets, Nike recently announced several leadership changes, including some key roles. John Hoke, Nike’s first Chief Design Officer and a 30-year veteran at Nike, will become the chief innovation officer.

Solid History of Share Buybacks & Dividends

Nike has consistently raised its quarterly dividend, growing at a 10-year compound annual growth rate (CAGR) of more than 13% between 2013 and 2023. Despite a tough economic environment, the company maintained its track record of increasing its dividend.

On November 15, Nike increased its quarterly dividend for the 22nd consecutive year by 9% to $0.37 per share. I believe Nike’s current dividend yield is attractive at 1.3%, and it’s superior to the peer group’s average yield of 1%. Its current payout ratio of 42% is also reasonable. Importantly, the company has ample cash flows to support dividends and buybacks.

Overall, during Fiscal 2023, the company returned $7.5 billion to shareholders via dividends and buybacks. This implies an attractive return of around 4.6% of the current market cap of $161.8 billion. In Q1 of Fiscal 2024, the company returned $1.7 billion to shareholders via dividends and repurchases. On top of that, the company reported a return on invested capital (ROIC) of 31.5% during FY2023, which is also reassuring.

Usually, company management resorts to share buybacks when they believe that the company shares are undervalued and the time is right to repurchase the shares. Regular buybacks lead to a reduction in the number of shares outstanding, thereby boosting earnings per share (EPS).

Notably, Nike has consistently engaged in buybacks over the past few years, leading to a significant reduction in the total number of shares outstanding. The number of total weighted average shares outstanding has come down by 14% over the past 10 years, from 1.81 billion in Fiscal 2014 to 1.57 billion at the end of Fiscal 2023.

As of August 31, the company had $12.1 billion worth of shares outstanding under its share repurchase plan of $18 billion, approved in June 2022. This implies more room for share repurchases in the coming months.

Is Nike Stock a Buy, According to Analysts?

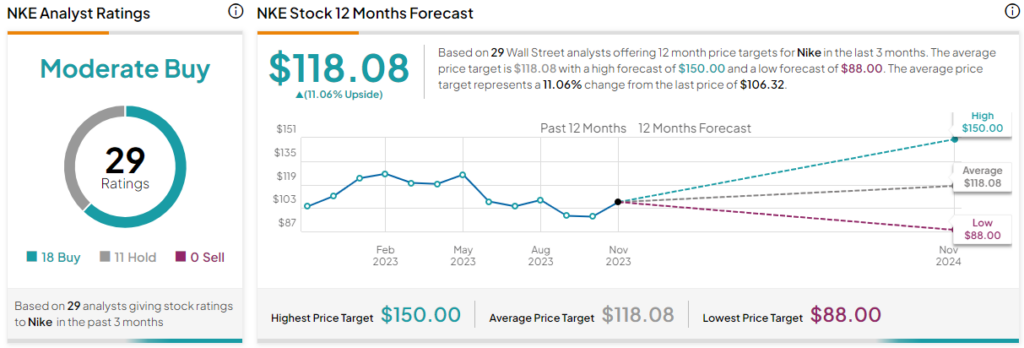

The Wall Street rates the shares of Nike as a Moderate Buy. There are 18 Buys and 11 Hold recommendations out of 29 analyst ratings. The average price target for Nike stock is $118.08, which indicates a potential gain of 11.1%.

Meanwhile, the stock is currently trading at a P/E ratio of 29x, reflecting a 20% discount from its five-year average of 36x. However, it is trading at a premium to the sector median P/E of 15x.

Conclusion: Consider NKE Stock for the Long Term

Nike has been a top brand in sports footwear and apparel for decades, standing the test of time. Possibly, an anticipated recession, curbed consumer spending, soft demand in the U.S., and a slower-than-expected recovery in China may put pressure on revenues and profits for discretionary retailer Nike in the near term. Also, the stock’s short-term performance will vary based on the results from the holiday season sales.

However, I believe the worst is over for Nike as it fixes its inventory issues and prepares well for the holiday season. In the long term, it continues to be an attractive stock with stable dividend income, solid business fundamentals, and margin growth.