What happens when headwinds meet tailwinds? In meteorology, head-on collisions of opposite air masses gives birth to thunderstorms; add some Coriolis force, and the storm becomes cyclonic. As historian Bruce Catton once described such action, in a political context, ‘tornado weather: sultriest and most menacing.’

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But it seems, for now, that we’ve missed that bullet. As Oppenheimer’s chief investment strategist John Stoltzfus writes, “While economic data continues to show persistently high levels of inflation attributable to supply chain shocks as well as labor shortages, more people are returning to work and demand for services has increased. GDP for the third quarter disappointed, but a recession doesn’t look to be in the cards as the consumer remains in good financial stead and there continue to be more jobs available than people who care to work.”

The question for investors, of course, is will these strong earnings give markets a lasting bounce, or will it be a fleeting moment?

The answer to this question remains to be seen, but Stoltzfus’ colleagues at Oppenheimer are pointing out that some equities have room for tremendous growth in the current climate. A look into the TipRanks data shows us that these Oppenheimer picks are Buy-rated stocks – and that the firm’s upside forecast for them is well upwards of 100%. Here are the details.

Life Time Group (LTH)

The first stock we’ll look at is Life Time Group, a holding company in the fitness and recreation niche. The company’s subsidiaries own and manage chains of fitness centers and recreational sports centers, with more than 150 locations across the US and Canada employing more than 30,000 professionals. Life Time even offers its clients a comprehensive digital platform. The company works to promote a healthier, fitter, lifestyle.

Life Time has been in business for more than 30 years, but it is new to the public markets. The company held its IPO just this past October. Initial plans had been to sell 46 million shares with a price range of $18 to $21; in the actual event, the company downsized the offering to 39 million shares and priced them the low end of the range, $18. The company boasts a market cap of $3.37 billion, after raising $702 million in net proceeds from the IPO.

The initial offering opened on October 7, and just three weeks later Life Time released its first quarterly results as a public company. The Q3 top line revenue came in at $385 million, up 66.7% year-over-year. It got a boost from comp store sales, which grew 58.7% yoy. Customer memberships grew 16.7% in Q3, to reach 668,310 by September 30. The company opened two new centers during the quarter, and has 12 more under construction. Looking ahead, the company expects Q4 revenue between $350 million and $360 million.

Oppenheimer’s 5-star analyst Brian Nagel, rated #31 overall by TipRanks, is bullish on Life Time’s forward prospects.

“Over the past several years, under private equity ownership and largely out of view of public markets, Life Time has worked to enhance further core disciplines and strengthen underlying longer-term growth and return prospects,” Nagel noted.

“For investors, we think LTH affords nearer-term cyclical recovery potential and longer-term structural expansion, supported by continued, steady new center expansion and improving membership dynamics. We are optimistic that potential, significant competitive fallout within the health club or gym sector through the COVID-19 crisis should continue to lead to meaningful market share opportunities for better-positioned business models, such as that of Life Time Group Holdings, as pandemic headwinds gradually abate,” the analyst added.

Everything that Life Time Group has going for it convinced Nagel to initiates an Outperform (i.e. Buy) rating on the stock. Along with the call, he attached a $40 price target, suggesting ~127% upside potential. (To watch Nagel’s track record, click here)

Overall, LTH shares have picked up 10 analyst reviews since going public. These break down to 6 Buys and 4 Holds, giving the stock its Moderate Buy consensus rating. The average price target of $23.50 implies an upside of ~34% from the current trading price of $17.58. (See LTH stock analysis on TipRanks)

Pharming Group (PHAR)

For the second stock, we’ll switch gears and move over to the biotech sector. Pharming Group is a commercial stage biopharmaceutical company, focused on creating novel, innovative protein replacement therapies and precision medicines. These new drug candidates are used in the treatment of rare diseases, with high unmet medical needs.

Pharming is the maker of Ruconest, plasma-free rhC1INH protein replace therapy approved for the treatment of acute hereditary angioedema (HAE). Ruconest is a first-of-its-kind drug, and the company is commercializing it in the US, the EU, and the UK. Commercialization efforts are ongoing, both in-house and through a distribution network. HAE is rare genetic condition causing severe swelling, abdominal pain, nausea, and vomiting. HAE attacks, without treatment, can last between 2 and 6 days, and can cause death.

Pharming currently has exclusive marketing rights to Ruconest. These rights will last in the EU until 2025, and in the US until 2026. Ruconest US sales were the main revenue driver for the company, which saw 6% sequentially in Q3, to reach $51.1 million, and were up 3% yoy for the first 9 months of the year, totaling $141.1 million.

The company has an active research pipeline, with several new drug candidates in various stages of preclinical development and clinical trials. The leading candidate, leniolisib, is a PI3K delta inhibitor for the treatment of Activated Phosphoinositide 3-kinase delta syndrome (APDS). This is another hereditary condition, an immunodeficiency disease that causes an increased susceptibility to airway infections, along with bronchiectasis and lymphoproliferation. Current treatments focus on prevention of infection and modification of lifestyle; leniolisib offers a direct treatment of the underlying genetic mutation.

Leniolisib is currently undergoing a double-blind placebo-controlled Phase 2/3 clinical trial. While the timeline is subject to delays due to COVID, the company expects to release data in 1H22.

Hartaj Singh, another of Oppenheimer’s 5-star analysts, is bullish on Pharming, writing of the company: “We continue to appreciate Ruconest’s potential in the mild-to-moderate convenience segment with breakthrough attacks. We also point to PHAR’s fruitful year ahead: apart from the leniolisib 1H22 readout (with 4Q22 expected launch), 2H22 could see initiations of pediatric studies and a trial in Japan…”

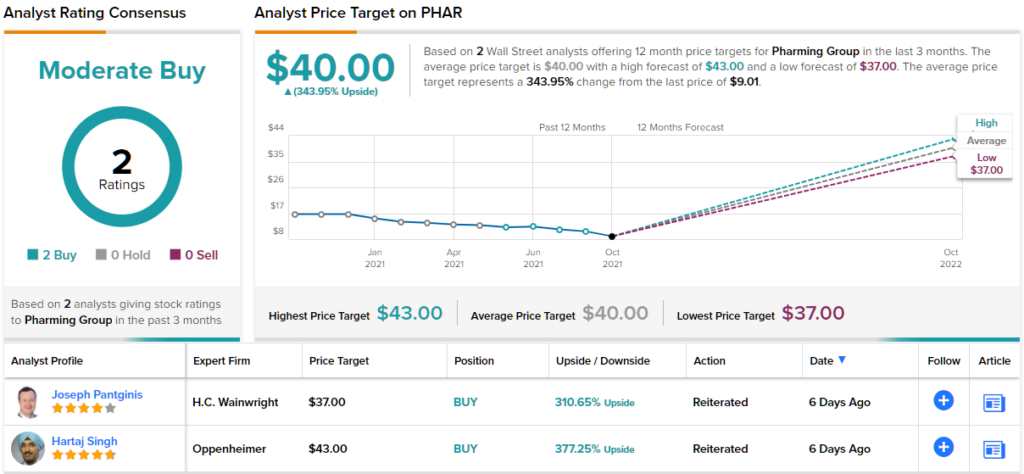

These comments back up Singh’s Outperform (i.e. Buy) rating, and his $43 price target indicates his confidence in a robust 359% one-year upside to the stock. (To watch Singh’s track record, click here)

Pharming has a small, but vocal camp of bullish analysts with positive expectations for its stock. Out of the 2 analysts polled by TipRanks, both rate the stock a Buy. With a return potential of ~344%, the stock’s 12-month consensus target price stands at $40. (See PHAR stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.