Realty Income Corporation (NYSE: O) and STAG Industrial (NYSE: STAG) have proven themselves to be two of the highest-quality companies in the real estate sector that pay dividends on a monthly basis.

Due to their reliable payouts, modest but gradual dividend growth, and above-average dividend yields, I believe that both names offer a wide margin of safety during the current highly-volatile market environment.

Income-oriented investors, in particular, are likely to appreciate their characteristics. Accordingly, I am bullish on both stocks.

Why are Monthly Dividends Alluring in the Current Market?

Paying monthly dividends can really make a company stand out in the current market environment, as investors can more accurately predict a stock’s total-return potential in the near term.

Retail investors have historically valued monthly dividend stocks as they offer a frequent stream of cash flow that provides increased flexibility. This includes utilizing these routine payouts to pay one’s bills or reinvest the cash towards additional equity units.

Furthermore, due to each and every payment being shortly upcoming, investors are discouraged from selling these equities, which can help sustain their stock prices during periods of high volatility in the capital markets.

Which is the Better Monthly Dividend Stock?

Since both Realty Income Corporation and STAG Industrial are currently trading with a dividend yield of around 5.2%, to compare these two, we will look at the rest of their dividend metrics, including their dividend coverage and overall dividend-growth prospects.

Realty Income’s Dividend Prospects

Realty Income is proud to have trademarked itself as “The Monthly Dividend Company.” Realty Income is also a constituent of the S&P 500 Dividend Aristocrats index for having increased its dividend annually for 27 successive years.

Last month, the company declared another dividend increase, this time by 0.2% versus the prior monthly rate. It marked its 117th dividend increase since 1994. This may look like an insignificant hike, but the company can declare multiple such hikes throughout the year. For instance, last year, the company announced five miniature dividend increases for a total annual increase of 5.1%.

This is also in line with Realty Income’s 10-year dividend per share CAGR, which hovers at around 5.1%. This showcases incredible consistency over the years, which, combined with the frequency and glamour of monthly payments, has truly made Realty Income quite a special name among income-oriented investors.

Moving forward, dividends appear well-covered, with the company having sufficient room to sustain its historical growth pace. The ongoing rise in the dividend could pressure the payout ratio. However, management recently revised its guidance upwards, expecting FFO/share to land between $3.92 and $4.05 in Fiscal 2022. This implies a new record for the company and a healthy payout ratio of roughly 75%.

STAG Industrial Dividend Prospects

STAG Industrial’s dividend-growth track record is not as legendary as Realty Income’s, with the company numbering 11 years of consecutive annual dividend hikes.

Further, dividend hikes have occurred at a much slower pace, usually by fractions each year. Specifically, the company’s five-year dividend-per-share CAGR stands at an underwhelming 0.85%. That’s less than a single percentage point of growth, on average, per year.

The uninspiring dividend growth rate is because STAG has been managed quite conservatively. The company has signed multi-year leases for its industrial properties, which have secured the company robust cash flows moving forward at the expense of adequate rent growth prospects.

Specifically, the company features a weighted average lease term of five years. Additionally, the properties the company acquired during the first half of 2022 feature a weighted average lease term of 7.1 years.

Analysts expect the company to deliver an FFO/share of around $2.19 in Fiscal 2022, implying a healthy payout ratio of 67%. Still, I don’t expect dividend growth to accelerate as, in that case, the payout ratio would increase substantially in the face of the minimal accretive FFO/share growth that is limited by STAG’s multi-year leases.

Is Realty Income Stock a Buy, According to Analysts?

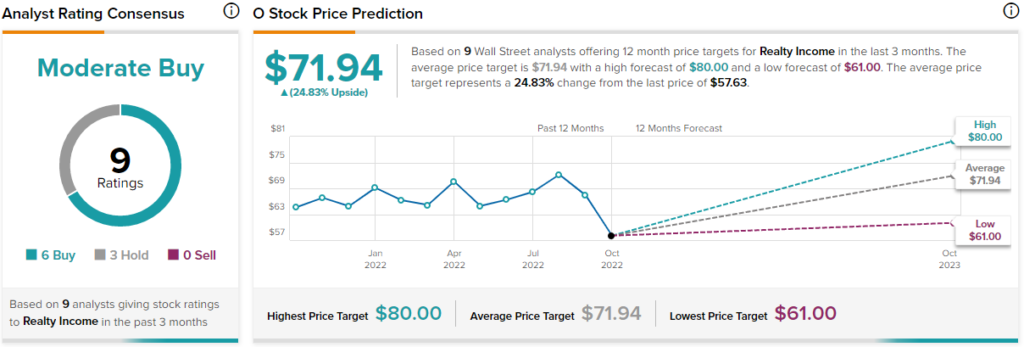

Turning to Wall Street, Realty Income has a Moderate Buy consensus rating based on six Buys and three Holds assigned in the past three months.

At $71.94, the average Realty Income stock forecast suggests 24.8% upside potential.

Looking at Realty Income’s Smart Score, the stock is expected to outperform the market, as it scores an 8 out of 10 on TipRanks.

Is STAG Industrial Stock a Buy, According to Analysts?

STAG Industrial has also attracted favorable sentiment amongst Wall Street analysts. The stock features a Strong Buy consensus rating based on six Buys and two Holds assigned in the past three months.

At $38.06, the average STAG Industrial stock forecast implies 34.25% upside potential.

Like Realty Income, STAG also has a high Smart Score. STAG has a 9 out 10 Smart Score rating, suggesting outperformance ahead.

Conclusion: 2 Trustworthy Monthly Dividend Picks

In my view, both Realty Income Corporation and STAG Industrial can be viewed as reliable monthly dividend stocks.

When it comes to which is the better pick, I lean toward Realty Income due to its prolonged dividend-growth track record and satisfactory pace of dividend growth. That said, STAG’s multi-year leases and lack of exposure to the, in my view, riskier retail property space are likely to be preferred by some investors.

Regardless, both companies offer an above-average yield, which, combined with their frequency of payments, make for attractive investment propositions during the ongoing turmoil in the capital markets.