While electric vehicles (EVs) are currently a small part of the world’s auto fleets, their numbers are growing. EVs are benefitting from a mix of tailwinds, including improved technologies, social approval, and political will, combining to give a strong impetus to the EV industry.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The rapid expansion of EVs has opened up wide fields of opportunity for investors. While the car makers tend to soak up the headlines (think Elon Musk’s Tesla), there are also companies working on charging stations, battery technology and production, and, further back in the supply chain, lithium mining. These offer places for investors to cash in on the growth of EVs.

With all this as backdrop, we’ve opened up the TipRanks database and pulled up the details on two EV charging stocks that investment firm Needham has recently tagged as potential winners for the year ahead. Both are Buy-rated names with over 50% upside potential. Let’s see what’s behind this confident take.

Solid Power (SLDP)

First up is Solid Power, an industry leader working on all-solid-state tech for battery charging systems. This is a new frontier in battery technology, and if successfully developed into practical applications, will offer serious advantages over current liquid-based lithium-ion batteries. These advantages will include higher energy density, longer battery life-spans, greater safety, and long-term cost savings.

The technology the company is using to develop and realize these advantages is based on solid sulfide electrolytes, a new battery design that will allow for high charge rates with lower temperatures, while avoiding the high and rising cost of the lithium used in current systems.

In the meantime, Solid Power is working to be ready as the battery and charging sectors take off in the next few years. The company went public in December of 2021 and since then has seen a gradual increase in quarterly revenues. Those revenues are still modest, as the company has not yet entered full production, but we can get a good feel for where the company stands by looking at the 2022 financial results.

To start with, Solid Power stated that it remains on track to open its electrolyte production facility, a key milestone in achieving full production, during 1Q23. The company began production of EV cells in the final quarter of 2022, and anticipates starting deliveries to partners this year. Solid Power has strengthened its existing relationship with BMW through an expansion of the two companies’ partnership agreement.

Solid Power saw total revenues last year of $11.8 million, a year-over-year increase of 29% from the $9.1 million top line reported in 2021. While the company ran a net loss for the year of $9.6 million, it did report cash holdings of $50.1 million as of December 31, 2022.

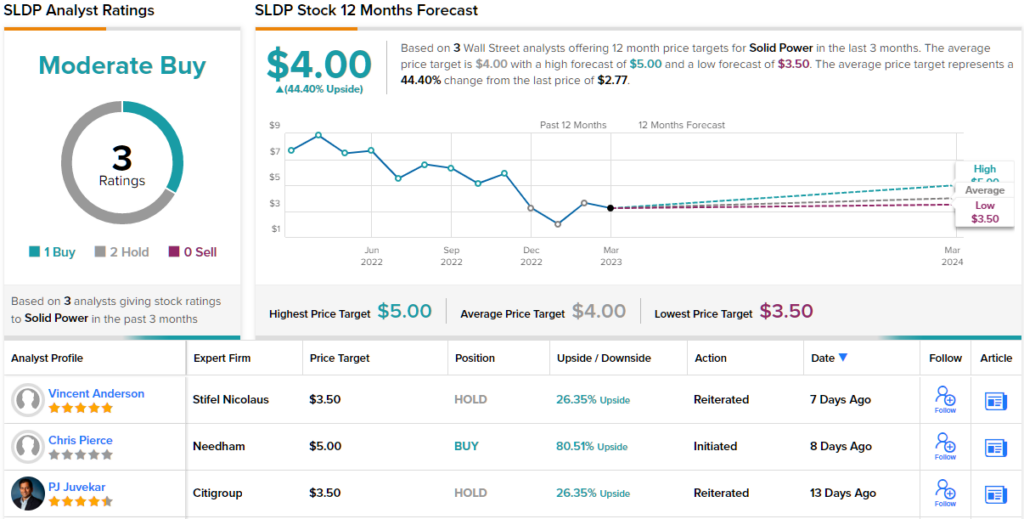

Needham analyst Chris Pierce takes a detailed look at this company, and sees it in a strong position for the near future.

“We view SLDP as a well-funded call option on the future of solid state batteries in electric vehicles,” Pierce wrote. “The potential advantages of solid state battery technology over current Lithium-ion battery technology are readily apparent, and SLDP has partnerships and investments from two global auto OEMs (F and BMW) at opposite ends of the consumer spectrum. We see two compelling paths forward, with SLDP pursuing a capex-light licensing model for its battery technology, while also developing a sulfide-based electrolyte that can be a raw material input for any OEM or battery manufacturer looking to develop its own solid state batteries.”

In Pierce’s view, this justifies a Buy rating on SLDP shares, with a $5 price target to indicate confidence in a robust 80% upside potential for the next 12 months. (To watch Pierce’s track record, click here)

Overall, Solid Power has garnered two other recent analyst reviews who remain on the fence for now, all coalescing to a Moderate Buy consensus rating. The average price target of $4 implies a one-year gain of 44% from the current share price of $2.77. (See SLDP stock analysis)

ChargePoint Holdings (CHPT)

The second stock we’ll look at, ChargePoint, is an industry leader in the EV charging niche. ChargePoint operates in both North America and Europe, and has more than 225,000 charging points on its networks. The company boasts a 70% market share in the level 2 charging market in North America, giving it a powerful advantage over even its closest competitor. ChargePoint has more than 5000 fleet and commercial customers worldwide.

The world’s EV fleets are growing, increasing demand for charging stations, and ChargePoint has built on that to show steadily rising quarterly revenues since going public just over two years ago; in fact, the company has posted seven quarters in a row of increasing revenues. The last quarterly results released, 4Q of fiscal year 2023 reported earlier this month, showed a top line of $152.8 million, for a 93% y/y gain. This included revenue from networked charging systems of $122.3 million (up 109% y/y) and subscription revenue of $25.7 million (up 50% y/y). ChargePoint’s full-year revenue for fiscal ’23 came to $468 million, translating into a y/y gain of 94%.

ChargePoint ran a heavy net loss in fiscal 2023, totaling $344.5 million. This compared unfavorably to the $132.2 million net loss in fiscal 2022. Even so, the company did have available liquidity of $399.5 million as of January 31, 2023. Despite the big revenue gains, the company missed Street expectations on both top-and bottom-line metrics.

That, however, hasn’t dampened Needham’s Chris Pierce enthusiasm. He lays out a strong case for backing this stock, writing: “We are bullish on CHPT as it is the dominant player in US EV charging at a time when EV adoption is accelerating for consumers and fleets. CHPT runs the industry’s cleanest business model, in our view, selling hardware directly to site owners for upfront revenue, and a longer trail of subscription revenue for system software and maintenance that accrues deferred revenue based on contract length.”

“We like CHPT’s capital-light model, which uses contract manufacturers vs vertically integration. Importantly, CHPT does not attempt to monetize drivers by selling power directly. We think investors will favor this cleaner/faster approach to shareholder returns, and given CHPT’s market position we think customers prefer this model as well, validating CHPT’s future growth prospects,” Pierce went on to say.

All told, Pierce gives ChargePoint a Buy rating, along with a $14 price target that suggests a 51% upside potential on the one-year time-horizon.

Overall, there are 7 recent analyst reviews of ChargePoint’s stock, and these break down 5 to 2 in favor of Buys over Holds for a Moderate Buy consensus rating. The shares are selling for $9.26 and their $16.57 average price target implies a strong gain of ~79% over the next 12 months. (See CHPT stock analysis)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.