Everyone likes a bargain and the same is true in the stock market. But while picking up items on sale in a store is a simple task, picking up shares on the cheap is a more complex endeavor.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

That’s because a cheap stock often means that it has been through the wringer, and the immediate question that comes to mind is, why have the shares taken a beating?

A beaten-down stock could be down for a whole host of reasons, from weak fundamentals to broader macro concerns to unreasonable behavior by investors. The trick of course in buying the dip, as the saying goes, is to recognize the names that are only temporarily down and are due to push ahead once again.

But how to find these bargains? Some advice from the Wall Street pros could come in handy here. Their job after all is to point out which stocks are worth leaning into at any given time.

With this as backdrop, we opened the TipRanks database to get the lowdown on two stocks that have witnessed a big drop recently, but which certain Street analysts are recommending investors participate in the time-honored act of “buying the dip” ahead of an anticipated rise. Here are the details.

Roblox Corporation (RBLX)

We’ll start with a look at a gaming and metaverse company, Roblox. Roblox has been around since the early 2000s, offering users an interactive platform to create, play, and share games – and to interact with each other through them. Roblox bills itself as a metaverse company, giving its users more than the usual online experience can offer. The company has combined community building with gaming, to foster creativity and positive relationships across its user base.

Some numbers will give the scale of Roblox’s operations. As of the end of Q2 this year, Roblox could boast some 65.5 million daily average users, who collectively spent more than 14 billion hours engaged with the platform. This huge user base makes Roblox one of the world’s top platforms for the under-18 audience. The company is popular with its target users, and credits that popularity to its ability to develop community among users, gamers, and developers.

In the recently reported 2Q23 results, Roblox showed an increase at the top line. Revenues came in at $680.8 million, for a 15% gain year-over-year.

Other results were not as solid. The bottom-line earnings, a net-loss EPS figure of 46 cents per share, compared unfavorably to the 30-cent net loss EPS from 2Q22, but was 2 cents less than had been anticipated. The company delivered $38 million in adjusted net EBITDA and reported $780.7 million in bookings, a forward-looking metric that came in well above the $639.9 million from the year-ago quarter.

However, the results were not what the analysts were looking for. Expectations for bookings were $785 million, and for EBITDA to hit $46 million. The miss here was decisive, as RBLX shares are down 23% this month, with most of the loss coming after the earnings release.

For Wedbush analyst Nick McKay, the key points here are Roblox’s strong position and user base, combined with a lowered price that gives investors an attractive entry point. McKay writes of Roblox, “Q2:23 results brought light to some soft spots within the company, but we think that the data trackers, seasonality, and stubbornness contributed to the misses. On balance, however, Roblox may have the most compelling growth trajectory among the video game names in our coverage universe after taking into account its user base size, its new products, and the potential to revisit its approach to profits.

“With Roblox shares trading well below our price target after a selloff, the risk/reward profile has become favorable to the upside… We expect patient investors to be rewarded by continued topline growth coming from the expansion of key user metrics, a slew of new product introductions, and a more aggressive approach to cost control in future periods,” McKay went on to add.

Looking forward for RBLX shares, McKay rates the stock as Outperform (a Buy), with a $37 price target implying a one-year upside of 24%. (To watch McKay’s track record, click here)

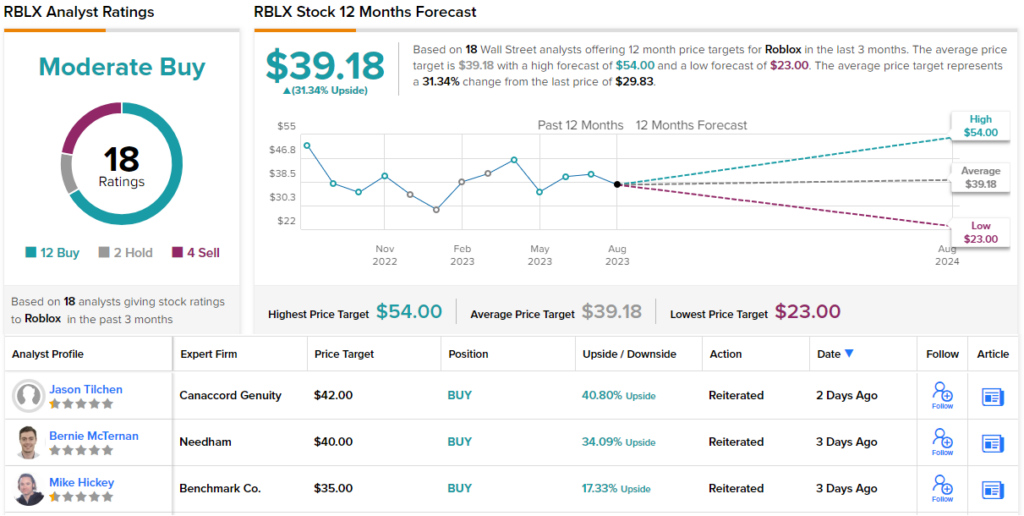

The Street generally has also come to a bullish stance on Roblox, with 18 recent analyst reviews breaking down into 12 Buys, 2 Holds, and 4 Sells, for a Moderate Buy consensus rating. The $29.83 trading price and $39.05 average price target combine to give an upside of 31% for the year ahead. (See Roblox stock forecast)

Kornit Digital (KRNT)

Next up, Kornit Digital, bring high tech and textiles together. The company is a global digital printing firm, with a specialty in high-speed, industrial-grade ink jet printing technology, and it also produces pigments and other chemical products. These are used in a range of textile industries, including garments, apparel, home goods, and decorating; Kornit’s printing machines can translate complex designs from the computer directly onto the fabric and the finished fabric products, allowing textile workers to call up patterned products on demand.

The ability to do this, create patterned finished products as needed, allows textile artists, makers, and factories, to free up inventory space, eliminate redundancies, and otherwise streamline operations. Kornit’s customers can use the technology to support direct-to-garment solutions for a more sustainable fashion industry, that generates less waste and overproduction, and produces a seamless experience to ensure that customers will return.

While Kornit holds a leading position in its niche, the stock is down 27% so far in August. The company’s losses have come in the days after its August 9 release of the 2Q23 financial numbers. Kornit posted a sixth quarter in a row of net-negative EPS, although the non-GAAP 15-cent per share loss was 6 cents better than had been expected. At the top line, the company’s revenues disappointed, coming in at $56.2 million, down 3.3% y/y and more than $550 million below the forecast. The revenue miss fed into the share price drop as did a forward 2H revenue guide that came in 7% below Wall Street’s forecast.

When it’s all said and down, Morgan Stanley analyst Erik Woodring believes that Kornit’s share price loss is investors’ gain, as it opens up the stock for opportunistic buying. Woodring takes note of the headwinds, but states that the company has plenty of room for growth, writing, “We are looking past the near-term challenges to what we believe should still be a year of robust growth in 2024, and continue to forecast high 20% Y/Y revenue growth in CY24 (+26% Y/Y vs. +28% Y/Y previously), albeit off a lower 2023 starting base. At a 3.0x target EV/Sales multiple, we are implying KRNT’s shares still trade at a slight discount to its 2015-2019 valuation when the company was compounding revenue at double digits given the risks associated with the weak near-term spending environment. Combined, these factors [are] driving our upgrade to Overweight.”

That upgrade to Overweight (Buy) is accompanied by a $29 price target, indicating confidence in a gain of 26% on the 12-month horizon. (To watch Woodring’s track record, clickhere)

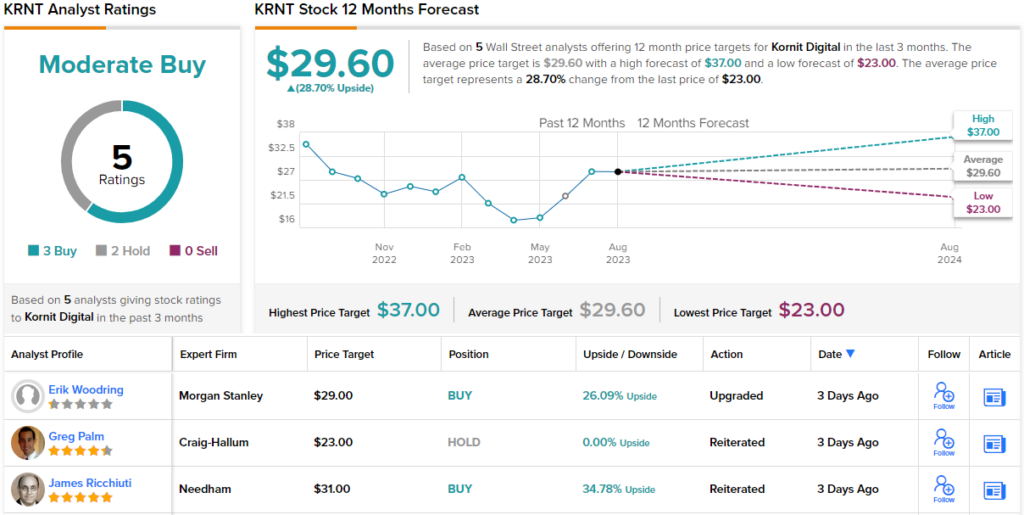

Taking a broader look, we find that Kornit has 5 recent share reviews, with a breakdown of 3 Buys and 2 Holds supporting a Moderate Buy consensus rating. Shares are trading for $23 and have an average target price of $29.60; this suggests a 29% increase from current levels. (See Kornit stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.