Last week ended with the worst day for bank stocks since the financial crisis of 2008. The collapse of Silicon Valley Bank, the country’s 16th largest banking firm and the lender of first resort for the start-ups of California’s tech world, has sparked fears of a larger bank run, or even a repeat of the systemic financial troubles.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That’s the worst-case worries – but according to Goldman Sachs’ chief credit strategist, Lotfi Karoui, these fears may be overblown.

“We think the risk of contagion from small to large banks is remote, considering the low share of regional banks in the IG market. Similarly, the risk of a capital or liquidity event among large banks is also remote,” Karoui opined.

Against this backdrop, Goldman analysts have been recommending banking stocks that they see as potential winners for investors taking advantage of the dip in prices. We’ll take a closer look at two of these stock picks.

Charles Schwab (SCHW)

The first banking institution we’ll look is a familiar name, Charles Schwab. This is the US’ largest publicly traded investment services firm, and held $7.05 trillion in client assets at the end of 2022. The firm boasts a total of 34 million brokerage accounts, befitting its reputation for making stock investment more accessible to the mass of retail investors. In that niche, Schwab operates as both an investment manager and discount broker, and offers its clients a full range of banking and investment services.

This past January, Schwab reported mixed financial results for the final quarter of 2022, and the full year. For the quarter, the net top line of $5.49 billion was up 17% year-over-year, but missed consensus estimates by $60 million. The adjusted EPS of $1.07 was up 24% from the prior year, but below consensus estimate of $1.09.

At the annual level, Schwab saw net revenues of $20.7 billion, for a y/y increase of 12%. Adjusted net income grew 19% y/y to reach $7.9 billion, and the adjusted EPS was up 20% y/y to reach $3.90. Schwab gathered new assets totaling $428 billion in 2022, and added over 4 million new customer accounts. In one of the firm’s downers, it reported that the new assets added was offset by lower market values in last year’s bear, resulting in a y/y decline in total assets held.

In an indication of management’s confidence, Schwab declared its most recent common share dividend. The payment, which went out on February 24, was increased by 14% from the previous quarter, to 25 cents per common share. At this rate, the $1 annualized payment yields 1.7%. The company has a history of keeping reliable dividend payments, going back to 1990.

Shares in Schwab showed a strong reaction to the SVB collapse, tumbling 23% over the past two trading sessions.

Goldman’s 5-star analyst Alexander Blostein focuses on Schwab’s prospects, noting that the firm has ‘enough liquidity to meet customers’ needs without having to force sell its AFS portfolio.

“We estimate core deposit outflows in January were marginally worse the 2022 monthly average, with cumulative 1Q22-Jan decline of ~25%. Although we think that SCHW’s recent issuance of higher-cost funding is likely to weigh on NIR in 1H23, management reaffirmed their expectations for a temporary use of these facilities, and we do not see funding/liquidity concerns that have become more acute with some financial institutions as warranted here. With the stock down [29]% YTD, the risk/reward remains attractive, in our view,” Blostein opined.

Blostein quantifies his stance with a Buy rating for the stock and a $98 price target that shows confidence in a 67% one-year upside potential. (To watch Blostein’s track record, click here)

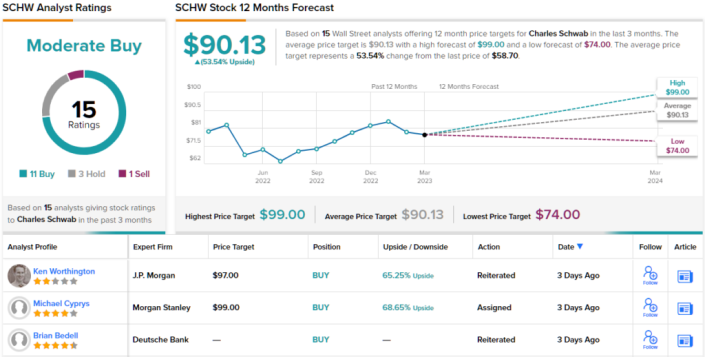

Overall, Schwab claims 15 recent analyst reviews, including 11 Buys, 3 Holds, and a single Sell, for a Moderate Buy consensus rating. The shares are trading for $58.70 and their $90.13 average price target implies a one-year gain of 53.5%. (See SCHW stock forecast)

Bank of N.T. Butterfield & Son (NTB)

Next up is a lesser-known name in the banking industry, the Bermuda-based Bank of N.T. Butterfield. This bank, whose market cap of $1.5 billion puts it in the small-cap category, serves well-heeled customers in Switzerland, the UK, and Singapore, as well as in Bermuda, the Cayman Islands, the Bahamas, and the Channel Islands. The bank offers a wide range of specialized financial and wealth management services, as well as residential property loans in the UK.

Butterfield managed to dial in a solid 4Q22 report, beating the forecasts on both the top-and bottom-line. Revenue increased by 17.7% year-over-year to reach $148.5 million, beating consensus estimate by $5.24 million. Non-GAAP EPS of $1.27 also came in above the analysts’ forecast of $1.14.

Taking 2022 as a whole, Butterfield posted net revenues of $549.3 million, for a 10% y/y gain, while the company had a bottom line net income of $214 million, for an even more impressive 31% y/y increase. The full-year diluted EPS showed the same 31% y/y improvement.

Of note for investors, Butterfield has been keeping up a regular common share dividend payment of 44 cents per quarter since the summer of 2019. The next payout is set for March 14, and the annualized payment, of $1.76, yields an above-average 5.85%.

Like Schwab above, this appears to be a fundamentally sound bank that got hit by the sudden crisis last week. By the close on Friday, Butterfield’s shares were down more than 14.5% from Wednesday’s levels.

That’s a dip that Goldman Sachs would recommend – and that opinion is backed up by analyst Will Nance’s recent coverage of this stock.

“We see a number of reasons to be positive here with 1) mgmt pointing towards continued NIM expansion over the next few quarters as the company deploys excess liquidity into higher yielding securities 2) the company now approaching their target level on TCE/TA, and is likely to resume shares repurchases, adding to the already attractive 5% dividend, and 3) fee income coming in much stronger than expected, and while this is likely benefiting from some reopening tailwinds in the company’s markets, we believe this is one of the first signs of a more ‘normal’ runrate for fee income post several years of travel restrictions in the company’s island markets,” Nance wrote.

“We believe NTB is an attractive holding for income oriented investors, offering solid ~[6]% dividends and attractive capital allocation opportunities from shares repurchases,” the analyst summed up.

Tracking this forward, Nance rates NTB shares a Buy, with a $41 price target to suggest a gain of 36% for the next 12 months. (To watch Nance’s track record, click here)

Overall, it would appear that the Street is in-line with the bulls on this one. There are 4 recent analyst reviews for Butterfield, and all four agree that it’s a stock to Buy, making the Strong Buy consensus rating unanimous. The average price target is $41.50 and implies a one-year upside potential of ~38% from the current trading price of $30.09. (See NTB stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.