Amid a troubling environment for the consumer economy, retailers, even the giants of industry like Walmart (NYSE:WMT), found themselves rolling up their sleeves as they attempted to scrounge for whatever available dollars they could get. To up the ante, the iconic big-box retailer decided to dive deeper into the burgeoning buy now, pay later (BNPL) arena. However, investors shouldn’t treat this narrative as a panacea. Nonetheless, I am long-term optimistic about WMT stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

According to a report from The Information, fintech enterprise One will offer its own BNPL program to the retailer’s customers. Walmart backs One, which earlier offered banking accounts to the company’s employees. Further, the announcement comes amid other major blue chips – particularly Apple (NASDAQ:AAPL) – entering the BNPL space.

While this new take on lending has always been popular, high inflation sparked intense interest in the underlying payment mechanism. Essentially, BNPLs allow consumers to purchase discretionary items via monthly payments. Naturally, the holiday season generates additional incentives for these loans.

Also, WMT stock may benefit as the underlying company attempts to shift perceptions positively. Roughly a year ago, according to Business Insider, Walmart customers sharply criticized the company for abandoning its popular layaway program. Previously, this program allowed customers to pay for items over time without incurring extra fees, so long as they paid a small deposit.

At the time, Walmart stated that customers could use the BNPL provider Affirm (NASDAQ:AFRM), a service it offered through a partnership dating back to 2019. However, not all customers qualified for Affirm, leading to angry outbursts that Walmart killed the holiday spirit.

Presumably, One will offer a better and more inclusive customer experience. However, BNPLs represent a tricky subject.

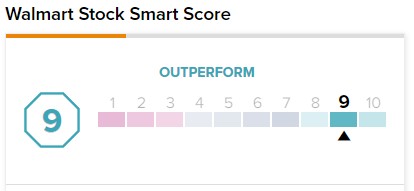

Notably, on TipRanks, WMT stock has a 9 out of 10 Smart Score rating. This indicates strong potential for the stock to outperform the broader market.

WMT Stock May Benefit from a Take-No-Prisoners Approach

As with any economic venture, sustainability is key. In other words, it might not make sense to kill the cow if it provides years upon years of milk. Still, when times are tough, companies must do whatever they can to survive, and that’s where WMT stock might benefit from the underlying BNPL venture.

At the end of the day, investors must face reality. According to data from the U.S. Bureau of Economic Analysis, the personal saving rate in October of this year dropped to 2.3%, a low not seen since July 2005. Thus, moving forward, it may be difficult to convince people to spend on discretionary items amid broader market pressures.

To be fair, economists state that while the rate of savings diminished considerably since the post-pandemic peak, Americans collectively are still sitting on a cash pile worth trillions. However, this argument is difficult to believe in light of credit card debt that recently hit a record high. Indeed, the combination of rising rates and rising personal debt only makes the consumer economy weaker, not stronger.

Cynically, then, Walmart may have had little choice but to venture deeper into BNPLs. If it didn’t do it, someone else would. From that perspective, it’s a positive for WMT stock.

Is WMT Stock a Buy, According to Analysts?

Turning to Wall Street, WMT stock has a Strong Buy consensus rating based on 21 Buys, five Holds, and zero Sell ratings. The average WMT price target is $162.56, implying 11.8% upside potential.

Sustainability Becomes a Major Concern

In one of the early episodes of Fear the Walking Dead, a main character in the apocalyptic series admonished a group of survivors who killed farm chickens to satisfy immediate urges rather than raise them for eggs. Similarly, the BNPL push might hurt not just WMT stock but the discretionary retail segment as a whole.

In truth, the same fundamental arguments that supported Walmart’s BNLP venture also impose longer-term headwinds. Primarily, the consumer economy already staggers in a weakened state. Thus, encouraging customers that are already stretching their budgets to stretch more presents sustainability concerns. It’s a classic case of robbing Peter to pay Paul.

Further, WMT stock itself is already stretched in valuation terms. For instance, the market prices shares at 45.3-times trailing-12-month (TTM) earnings. As well, it prices WMT at 22.55-times forward earnings. Both stats rank unfavorably above at least 81% of industry players.

Stated differently, while investors may be willing to pay around 23-times forward earnings today, they might not be willing to pay higher premiums, especially if news gets around that Walmart tapped out its customers.

To be sure, Walmart’s everyday low-pricing business model should help WMT stock stay relatively afloat during these hard times. However, investors should tread carefully. While the company’s foray into BNPL may look attractive on paper, it’s worth reading the fine print.