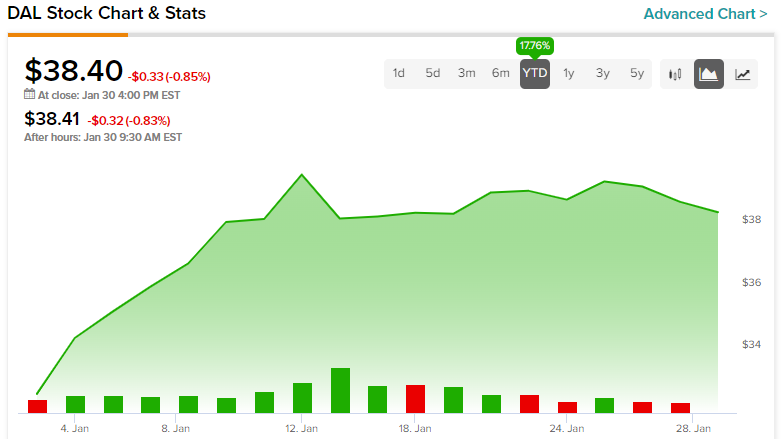

Delta Air Lines (NYSE:DAL) stock has outperformed the S&P 500 (SPX) year-to-date by a significant margin. DAL reported robust operating results for its fourth quarter and Fiscal 2022, marked by solid growth in revenues. With a strong uptick in U.S. airline demand, we expect DAL stock to continue trading in the green this year, offering strong upside potential at current prices. Hence, we are bullish on DAL stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The fourth quarter was a great one for Delta. Not only did the airline see record Q4 revenues, but it was its third consecutive quarter of double-digit EBITDA margins. Clearly, the airline is only continuing to soar from a financial and operational standpoint. Delta has already declared that it will be back to pre-pandemic capacity levels by this summer, a goal well within view.

Furthermore, the financial outlook for Delta for 2023 is incredibly encouraging. The company expects double-digit growth for both revenue and earnings, providing a solid foundation for continued growth. It expects to achieve even greater levels of success as it continues along its upward trajectory.

Incredible Q4-2022 Results

The airline industry is flying high following the strong demand seen over the holiday period. Delta Air Lines reported a solid quarter with revenues of $13.44 billion, while its earnings per share of $1.48 beat analysts’ expectations ($1.32 per share) by a considerable margin. For the full year, the airliner earned $3.20 per share with adjusted revenues of $45.6 billion, solidifying its position as one of the largest carriers in the industry. After such a stellar performance, it’s likely for DAL stock to continue its momentum.

Furthermore, Delta’s CEO, Ed Bastian, stated, “As we move into 2023, the industry backdrop for air travel remains favorable, and Delta is well positioned to deliver significant earnings and free cash flow growth.”

A Robust Outlook

Based on analysts’ estimates, Delta Air Lines will continue making strides toward financial growth this year. The expectation is for revenue growth to fall in the 15% to 20% range in 2023, putting the company on pace to earn between $5 to $6 per share in 2023 and over $7 per share in 2024. Moreover, Delta’s management expects over $2 billion in free cash flow this year, positioning the stock for healthy long-term gains.

Meanwhile, Delta’s troubles mainly relate to its operational costs associated with labor deals and network rebuilding. However, these costs were included in the December financial update and are now part of its official forecast for the upcoming quarter. On top of that, it’s likely to be a challenging quarter for airlines due to seasonal influences. Nonetheless, the preemptive changes made by Delta will set them up nicely for later months as long as travel demand stays strong.

After two years of navigating rough terrain, Delta Air Lines is clawing its way back to stability. It still remains one of the best-run businesses in the industry. For savvy investors focusing on the long term, now might be the perfect time to consider buying DAL stock.

Is DAL Stock a Buy, According to Analysts?

Turning to Wall Street, DAL stock maintains a Strong Buy consensus rating. Out of 13 total analyst ratings, 12 Buys, one Hold, and zero Sell ratings were assigned over the past three months.

The average DAL stock price target is $50.54, implying a 31.6% upside potential. Analyst price targets range from a low of $39 per share to a high of $81 per share.

The Takeaway

Delta Air Lines delivered solid operating results in its fourth quarter. There wasn’t anything in its earnings results that changed our bullish sentiment on the stock. The future looks remarkably bright for the airliner, with strength in domestic travel.

Additionally, DAL stock is trading at attractive multiples, preparing it for what seems to be massive upside potential ahead. For instance, it’s trading at under 0.5 times forward sales estimates, 67.5% lower than the sector average and roughly 45% lower than its five-year average. Moreover, its also trading at 4.3 times its trailing-12-month cash flows, roughly 27% lower than its five-year average.