Let’s start with the bad news. Given the supply shortages seen during the peak holiday season amidst soft global demand, iPhone unit sales in FY23 are expected to be down 9% year-over-year to 218 million units. For the record, this amounts to the biggest y/y unit drop for the iPhone since FY19.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Moreover, with the addition of other near-term issues such the difficult macro environment, FX headwinds, lower spend on consumer electronics, Apple (NASDAQ:AAPL) could realistically deliver the first fiscal year of revenue and EPS declines since 2019.

The good news, according to Morgan Stanley analyst Erik Woodring, is that “if we look beyond the near-term, we see a catalyst-rich event path over the next 12 months… including reaccelerating iPhone and Services growth, record gross margins, two new product launches, and the potential introduction of an iPhone subscription program.”

The upshot to the iPhone production disruptions is that Woodring expects the iPhone replacement cycles will lengthen to 4.4 years by the end of FY23 – setting a new record and almost 0.7 years longer than the investment firm’s prior expectation. Essentially, Woodring reckons the prolonging of the replacement cycle has led to a 10-30 million iPhone “demand deferral” this year.

On top of iPhone units dropping in FY23, Woodring also believes investors have been worried with Services decelerating from double-digit growth in FY21 to mid-single digit y/y growth in the past 6-9 months. However, Woodring points out that behind the drop are “the most extreme FX headwinds” Apple has come across since the firm began tracking the data, and which suggests that in constant currency, Services growth remains at low double-digits. Looking ahead, Woodring also anticipates a “re-acceleration” of Services growth through FY23’s end and into FY24.

Furthermore, when taking FX headwinds into account, Woodring thinks that what is “most underappreciated” by investors right now is just how robust Apple’s “underlying” gross margins are. According to Woodring’s analysis, a gross margin deep dive implies ~150bps of “average upside” to Street forecasts in FY23 and FY24.

Bottom line, these “underappreciated catalysts” cement Apple’s status as a “Top Pick” and result in Woodring raising his price target from $175 to $180, implying the stock will gain ~19% over the coming year. Woodring’s rating remains an Overweight (i.e., Buy). (To watch Woodring’s track record, click here)

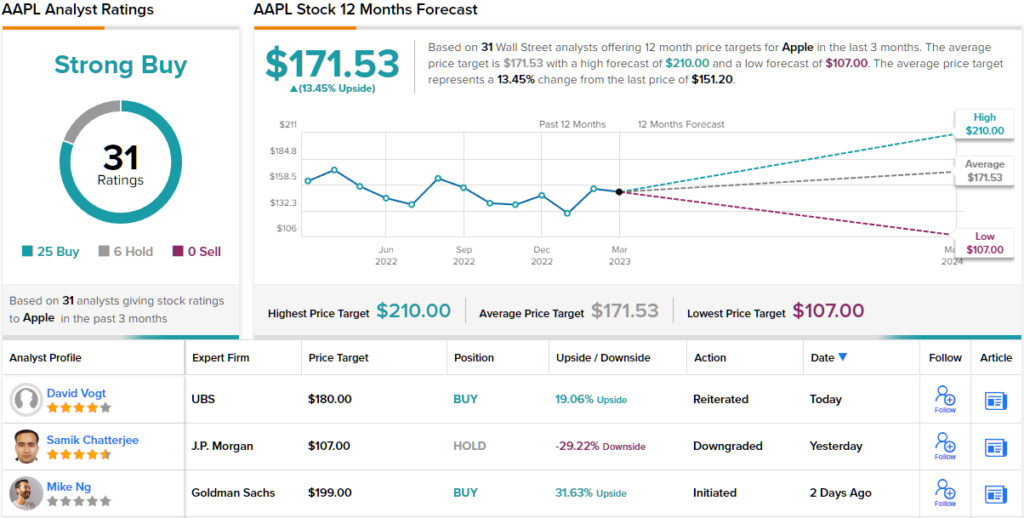

So, that’s Morgan Stanley’s outlook, but what does the rest of the Street have in mind for the tech giant? AAPL holds a Strong Buy rating from the analyst consensus, based on 25 Buys and 6 Holds given in recent weeks. The stock is selling for $151.19, and the average price target of $171.53 implies ~13% growth in the year ahead. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.