It’s all change at Alibaba (NYSE:BABA). In what represents the biggest recalibration of the organization in its 24-year history, the Chinese ecommerce giant announced that it will split its business into six different groups (Cloud Intelligence Group, Taobao Tmall Commerce Group, Local Services Group, Cainiao Smart Logistics, Global Digital Commerce Group and Digital Media and Entertainment Group).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Each group will have its own CEO and board of directors. Each will also be able to raise outside funding and seek an initial public offering (IPO) – the exception being Taobao Tmall Commerce Group, which will stay wholly owned by the Alibaba Group.

The radical overhaul at the company comes just one day following a rare public appearance by founder Jack Ma and as the government has indicated it could be backing off regulatory pressure toward the internet industry.

Mirroring the the company’s statement that said the move is intended to stimulate competitiveness and unlock shareholder value, Truist analyst Youssef Squali agrees that could indeed be the case.

“We think this is a material step to unlock shareholder value by spinning off businesses like Cloud, Cainiao which should command attractive valuations as separate entities, and by bringing in outside capital to underwrite some of the losses at the newer initiatives like Local Services and DME in an effort to protect margins and improve FCF generation, which has been a major focus for shareholders,” the 5-star analyst said.

This way, the businesses will have “more autonomy and flexibility,” while Squali also thinks that due to uncertainties around US – China tensions and still uncertain local government regulatory issues, it could “diversify risks.”

Reorganization efforts aside, Squali also believes that despite a slow start to the March quarter, demand trends have “improved materially since then with the economy reopening, driving positive Y/Y growth.”

As such, with the company’s long-term prospects “attractive,” Squali reiterated a Buy rating on BABA shares along with a $130 price target. The implication for investors? Potential upside of 30% from current levels. (To watch Squali’s track record, click here)

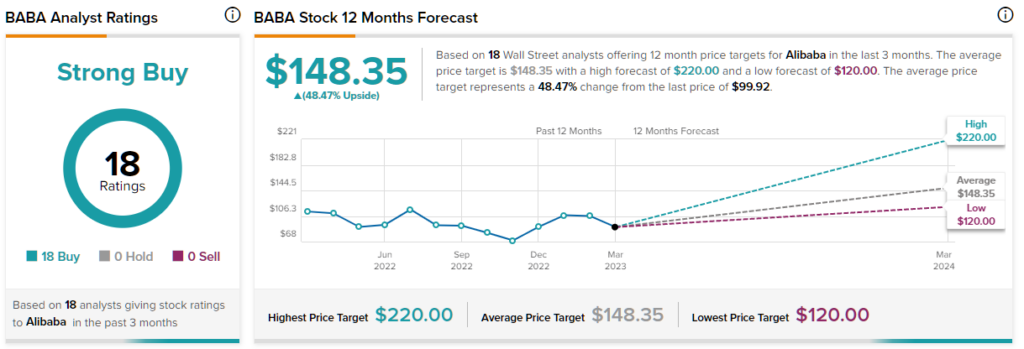

All of Squali’s colleagues concur; the stock claims a Strong Buy consensus rating, based on a unanimous 18 Buys. The average target clocks in at $148.35, making room for gains of ~48% over the one-year timeframe. (See Alibaba stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.