In the latest 13F filing, Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) disclosed that it has divested holdings in Johnson & Johnson (NYSE:JNJ) and UPS (NYSE:UPS), among others, during the third quarter. This decision by the firm to unload these stocks could be interpreted as a bearish signal. Nonetheless, it is best for retail investors to analyze stocks on multiple parameters. Savvy investors can leverage TipRanks’ Experts Center tools to enhance their decision-making process and make well-informed investment choices.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

With this backdrop, let’s check what the future holds for these stocks.

What is the Outlook for JNJ Shares?

Johnson & Johnson recently delivered stronger-than-expected third-quarter earnings. However, the pharmaceutical giant’s MedTech division is battling an unfavorable product mix and commodity inflation, which is hurting its margins and keeping analysts cautiously optimistic about its prospects.

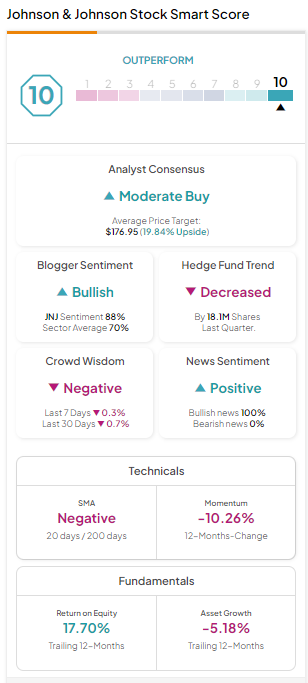

JNJ stock has received 12 Buy and seven Hold recommendations for a Moderate Buy consensus rating. While analysts are cautiously optimistic, the Hedge Fund Confidence Signal is Negative on JNJ stock. Nonetheless, the stock sports a “Perfect 10” Smart Score on TipRanks. It’s worth noting that the shares carrying a “Perfect 10” Smart Score have easily outperformed the S&P 500 Index (SPX) by a significant margin over the past several years. Meanwhile, the average JNJ stock price target of $176.95 implies 19.84% upside potential from current levels.

Is UPS Stock Expected to Rise?

UPS stock has underperformed the broader markets so far this year. Factors such as a challenging global macro environment and uncertainties in U.S. labor have negatively affected shipment volumes. Despite these headwinds, UPS’ emphasis on generating high-quality revenues has increased revenue per piece, indicating positive growth potential. Additionally, the company’s efforts to enhance productivity, favorable base rates, and customer and product mix improvements have left analysts cautiously optimistic about its future prospects.

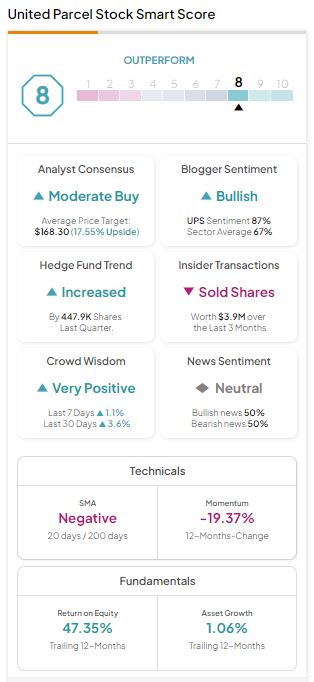

UPS stock has received eight Buy, 11 Hold, and one Sell recommendations for a Moderate Buy consensus rating. While analysts are cautiously optimistic, the Insider Confidence Signal is Negative on UPS stock. Nonetheless, the stock sports an “Outperform Smart Score of eight” on TipRanks. At the same time, the average UPS stock price target of $168.30 implies 17.55% upside potential from current levels.

Bottom Line

Monitoring the trades of major hedge funds can assist retail investors in creating their investment plans. It’s worth noting that when top hedge fund managers buy or sell stocks, it’s usually viewed as either a positive or negative sign. But, for retail investors, it’s essential to carefully consider different factors like recommendations from Wall Street analysts, insider transactions, and fundamental and technical indicators when planning for long-term investments. To improve decision-making, they can use TipRanks’ valuable tools, such as Smart Score and Expert Center.