Broadcom (AVGO) designs, develops, and supplies semi-conductor infrastructure software solutions.

I am bullish on the stock. (See Analysts’ Top Stocks on TipRanks)

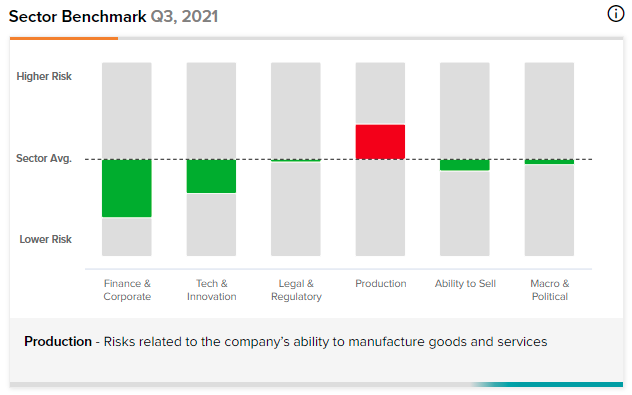

Risk Return Assessment

Relative to the sector, Broadcom’s risks are far and few. The only identifiable risk that investors should be concerned with is its deal flow related to the semiconductor chip shortage.

Contagion is natural in an inter-linked industry such as the semiconductor space, but this is a temporary bottleneck instead of a permanent issue.

The Sharpe Ratio compares the stock’s expected return relative to the implied volatility (a Sharpe ratio of above 1 is usually considered as a sound risk-return tradeoff).

Broadcom has a current Sharpe ratio of 1.3, and an expected Sharpe ratio of 1.8. Market volatility should die down a bit moving forward, which explains the expected improvement.

Dividend Prospects

Broadcom stock could be a pure dividend play to most investors as we enter a period where growth plays are expected to be less popular.

With a forward yield of 2.9%, you’re looking at a decent deal, but it’s the excess dividend capacity that stands out.

Broadcom’s cash from operating activities and net income margin are higher than its fives-year averages by 54.3% and 25.5%, respectively.

In addition, with a yield to payout coverage of 5.5%, you’d have to say that investors could expect higher payouts in the future.

Outlook

Broadcom is continuing to ride both semiconductor solutions and infrastructure software waves. Continued demand for wireless solutions, and the emergence of 5G should sustain top-line growth for the time being, while key acquisitions of CA Technologies and Symantec’s securities enterprise business should provide critical synergies.

The company beat earnings expectations last month, and management subsequently raised its expectations for Q4, upgrading revenue estimates by 14%.

Wall Street’s Take

Wall Street thinks the stock is a Strong Buy, with a mean price target of $570.94. There have been 18 Buy ratings, two Hold ratings, and no sell ratings on the stock over the past three months.

Bottom Line

Broadcom bears fruit in the sense that its risk-return prospects are solid.

Dividend metrics indicate that it’s a high-quality income-based investment.

The outlook suggests accretive acquisitions and the company’s exploitation of a critical gap in the industry could spur on performance.

Disclosure: At the time of publication, Steve Gray Booyens did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.