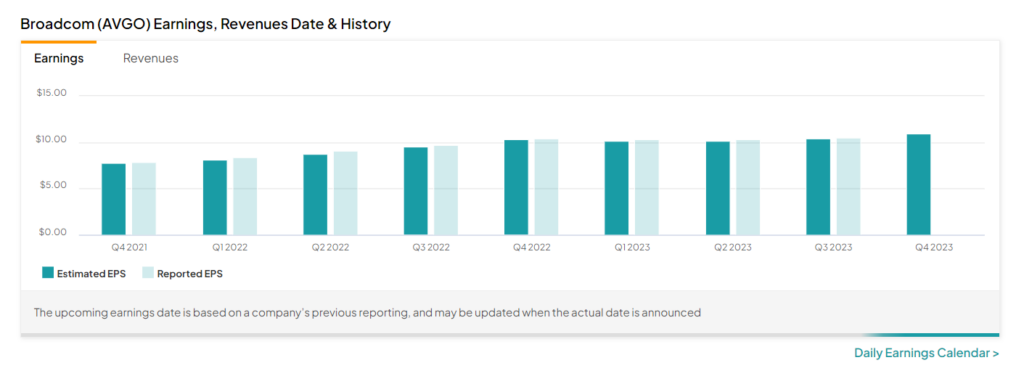

Semiconductor company Broadcom (NASDAQ:AVGO) is scheduled to report its results for the fourth quarter of Fiscal 2023 after the stock market closes on December 7. AVGO’s impressive history, with 12 straight quarters exceeding analyst expectations, coupled with the rising demand for artificial intelligence (AI) chips, fuels optimism among Wall Street analysts regarding the upcoming earnings report.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

For the to-be-reported quarter, the Street currently projects Broadcom to report earnings of $10.96 per share, up about 5% from the year-ago quarter. Furthermore, analysts expect the company’s sales to have increased by 4% from the same quarter last year.

Here’s What Analysts Are Saying About AVGO Stock

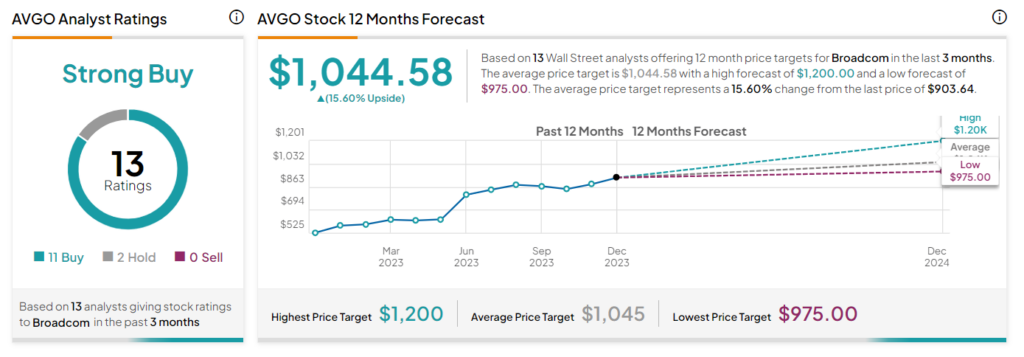

Heading into the company’s earnings release, three analysts have rated AVGO stock a Buy in the past week.

Rosenblatt Securities analyst Hans Mosesmann expects Broadcom to report inline results in Q4. He believes that strong growth in AI-driven networking continues to offset softness in the enterprise and telecommunications sectors. Mosesmann reaffirmed a Buy rating on AVGO stock with a price target of $1,000.

Similarly, BMO Capital analyst Ambrish Srivastava assigned a Buy rating on the stock with a $1,000 price target. The analyst’s Buy rating is attributed to optimistic projections regarding the recently closed acquisition of cloud computing firm VMware. With this $61 billion deal, Broadcom seeks to diversify its business beyond semiconductors, entering the lucrative cloud computing market. Also, Srivastava sees the company as undervalued.

What is the Forecast for AVGO Stock?

Wall Street’s Strong Buy consensus rating on Broadcom is based on 11 Buys and two Holds. Following the impressive year-to-date rally of 66%, the average price target of $1,044.58 suggests a further upside of 15.6%.

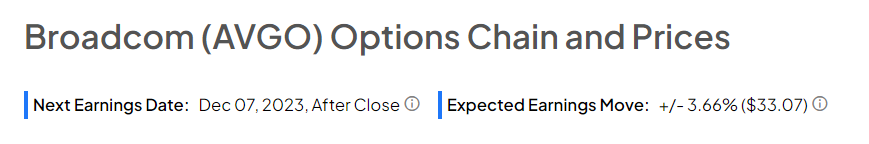

Insights from Options Trading Activity

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a +/- 3.66% move on Broadcom’s earnings.

Ending Note

Wall Street predicts strong future growth for Broadcom, fueled by the chipmaker’s custom chip offerings and the growing AI market. Additionally, the VMware acquisition is expected to enhance the company’s future growth and profitability.