The non-alcoholic beverage stock space hasn’t looked this enticing through the eyes of high-growth investors for quite some time. As new brands and tastes threaten the seemingly wide moats of large beverage companies, it’s no mystery as to why the analyst community views the following trio of beverage innovators as worth drinking up for investors seeking to caffeinate their portfolios with some growth.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

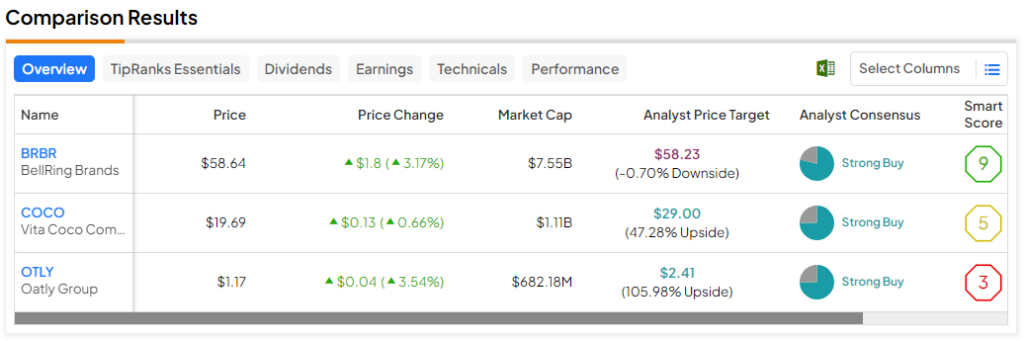

Therefore, let’s check in with TipRanks’ Comparison Tool to investigate three growth-focused beverage firms that have the wind at their tails this year.

BellRing Brands (NASDAQ:BRBR)

BellRing Brands is one of my favorite food/beverage plays in the market right now, as young consumers’ taste for protein stays hot. The company behind the trendy Premier Protein drinks also sells other protein-rich edibles (PowerBar) and powders (Dymatize). Whether you’re looking for an affordable, ready-to-drink bottle after a workout or you’re looking for a high-quality isolate, BellRing Brands has you covered.

With such a strong portfolio of brands, impressive growth prospects, and a stock with considerable momentum behind it, I find it hard to be anything but bullish on the $7.7 billion mid-cap gem that’s made a habit of topping estimates.

Over the past year, shares have soared more than 95%. With last year’s momentum showing no signs of slowing in the new year, the analyst community has been forced to catch up to the hot stock, with a slew of price target upgrades and Buy reiterations rewarded over the past few months. Though today’s price target entails a flat performance for the year ahead, investors should expect more analysts to step forward with more target hikes, especially after the company’s latest first-quarter beat.

In Q1, sales rose by nearly 19% to $430.4 million as volumes surged. There was considerable strength across the board, with Premier Protein and Dymatize experiencing 19% and 21% in sales growth, respectively. More remarkably, BRBR’s gross margin also improved by almost a full percentage point year-over-year.

As margins and sales growth continue to flex their muscles following the launch of its second greenfield co-manufacturing facility, the stock seems destined for higher highs in the new year as BellRing keeps its foot on the gas. If you seek a protein pure-play, look no further than BRBR.

What Is the Price Target of BRBR Stock?

BellBring stock is a Strong Buy, according to analysts, with 11 Buys and three Holds assigned in the past three months. The average BRBR stock price target of $56.08 implies 1.3% downside potential.

Vita Coco Company (NASDAQ:COCO)

Coconut water is a delicious and healthy substitute for sugary sodas. Vita Coco is one of the firms cashing in on the pivot toward healthier beverage alternatives. The $1.1 billion mid-cap has been on the retreat since peaking back in 2023 at around $33 per share. Down 40%, with an ugly technical picture in place, the stock seems like a prime candidate to sell. However, with the confidence of Wall Street and chatter about the firm’s attractiveness as a takeover target, I remain bullish on COCO after its latest tumble.

Late last year, the company announced a fairly sizeable $40 million share buyback program, as management hiked its 2023 revenue growth forecast to 13-15%, up from 10-12%. Going into 2024, I expect top-line growth to stay in the mid-to-low teens as the firm does its best to hydrate a growing thirst for healthy beverage options.

Of course, coconut water is quite expensive compared to a can of sugary soda, and that can be an overhang on growth as consumer balance sheets get pinched. However, as consumers begin to feel more relief from inflation, I’d look for them to keep trading up to Vita Coco as they look to spend more on healthier, arguably tastier beverage options.

At 31.1 times trailing price-to-earnings, COCO stock seems like a fair price for mid-teens sales growth, especially as consumers start feeling better again.

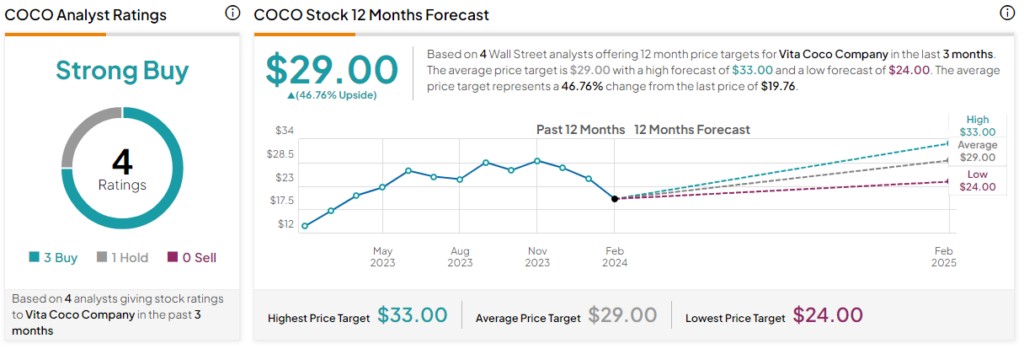

What Is the Price Target of COCO Stock?

Vita Coco stock is a Strong Buy, according to analysts, with three Buys and one Hold assigned in the past three months. The average COCO stock price target of $29.00 implies 46.8% upside potential.

Oatly (NASDAQ:OTLY)

From coconut water to oat milk, we have Oatly, one of the stock market’s biggest IPO busts in recent memory. Undoubtedly, it’s hard not to want to invest in hot, new trends in the beverage scene. Though oat milk (and Oatly stock) has lost some luster in recent years, it’s hard not to be intrigued by the stock if you’re a contrarian investor with an appetite for deep value.

The stock has now shed more than 96% of its value since peaking in 2021. Despite the profound reversal of fortune, Wall Street remains quite bullish. With an easy-to-digest valuation and some exciting new products on the horizon, I’m inclined to stay bullish on the name.

Just a few weeks ago, Oatly stock began heating up following news that it’s joining forces with Carvel to bring oat-milk-based ice cream to the masses. Unless you like the taste of oat milk, seek novelty, or are lactose intolerant, oat milk may seem like a strange beverage to invest in. Still, with Oatly stock already in the doghouse, I think it’s a mistake to discount the company’s impressive positioning in the niche oat milk market.

The recent ice cream initiative could help bring some of the shine back to OTLY stock in 2024 as the brand looks to shine brighter than peers in the space. In any case, product innovation seems alive and well over at Oatly.

Personally, I’m intrigued and curious to give the Oatly ice cream products a try, even if they’re not the one product that helps turn the tide over at the firm. It’s not hard to imagine many other consumers who may also be drawn in by the novelty of the product.

What Is the Price Target of OTLY Stock?

Oatly stock is a Strong Buy, according to analysts, with three Buys and one Hold assigned in the past three months. The average OTLY stock price target of $2.41 implies 109.6% upside potential.

The Takeaway

As consumers demand healthier, tastier alternatives that aren’t completely loaded with sugar, the new entrants to the beverage scene may have to keep their disruptor hats on as they look to steal (and retain) share in a market previously thought of as virtually impenetrable. Of the trio, analysts expect the most upside from OTLY stock (109.6%) for the year ahead. That’s some serious upside potential, but please be mindful of the risks associated with the name.