As investor interest in artificial intelligence (AI) continues to surge, it comes as no surprise that the Global X Robotics & Artificial Intelligence ETF (NASDAQ:BOTZ) just hit a 52-week high. AI is clearly an exciting sector with enormous long-term potential. However, there are several reasons for caution that investors may want to consider before jumping into BOTZ near its 52-week high.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Concentration Risk

One thing investors should be aware of is that BOTZ is not particularly diversified. BOTZ holds just 45 positions — this isn’t a bad thing per se, as BOTZ is a thematic ETF focused specifically on artificial intelligence, so its fund managers want to key in on what it believes are the best opportunities within AI.

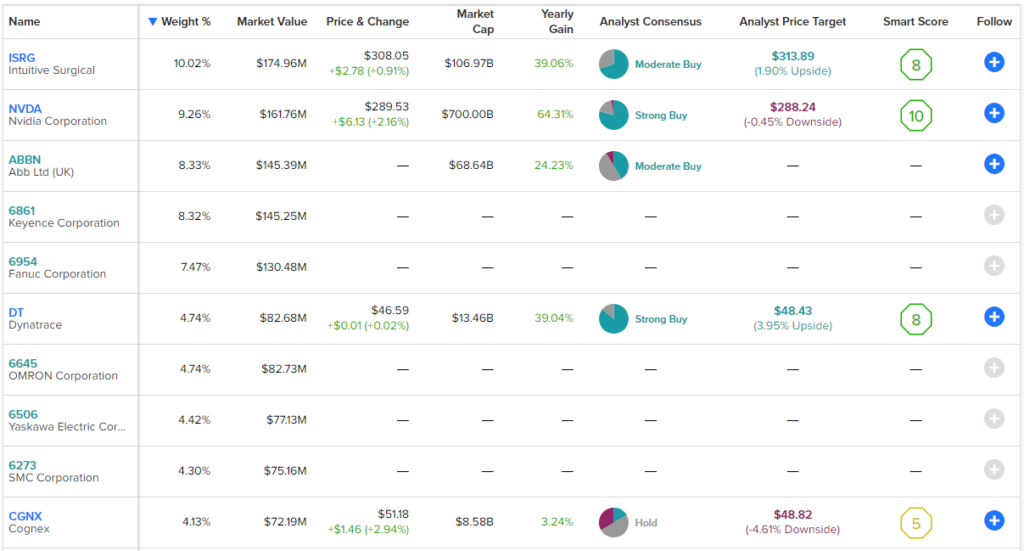

However, this ETF’s top 10 holdings make up 65.7% of the fund, so this is a fairly top-heavy portfolio. Furthermore, it’s even more concentrated when it comes to its top positions — robotic surgery device maker Intuitive Surgical has a 10% weighting, and semiconductor giant Nvidia has a 9.3% weighting. Below, you can check out an overview of BOTZ’s top 10 holdings using TipRanks’ holdings screen.

To be fair, these are great, innovative companies (with great Smart Scores to boot), but this leaves BOTZ investors with a lot of exposure to these two names, both to the upside and downside. Also, the market seems to be pricing both Nvidia and ISRG for perfection right now based on their current valuations, meaning that their share price could take a haircut based on any earnings disappointment or other misfire.

Nvidia currently trades at 62.5 times forward earnings, and even going all the way out to January 2025, it trades at 46.3 times consensus 2025 earnings estimates. Meanwhile, Intuitive Surgical isn’t much of a bargain either — the maker of robotic surgery equipment trades for 55.8 times earnings and 47.4 times next year’s earnings.

BOTZ’s Steep Valuation

This brings us to the second concern when it comes to BOTZ, which is the ETF’s overall valuation. As you might guess, with its top two holdings trading at such lofty valuations, BOTZ itself has a fairly steep valuation, with a weighted average price-to-earnings ratio of about 34.2. This is significantly more expensive than the S&P 500’s P/E multiple of 23.9.

Of course, AI is cutting-edge technology that has the potential to reshape the economy as we know it, so you can certainly make the argument that the broad universe of AI stocks deserves a premium valuation to the overall market.

However, there are plenty of stocks that are heavily involved in AI that trade at a discount to the broader market or at least on par with it. Look no further than mega-cap tech leaders like Meta Platforms and Alphabet, which are both heavily involved in AI and trade at 20.4 times and 22.2 times earnings, respectively.

Taiwan Semiconductor, which fabricates the semiconductors that Nvidia and many other chipmakers use for AI applications, trades at just 16.2 times earnings. As you can see, it’s possible to invest in compelling AI plays without paying a huge premium to the broader market.

What’s Missing?

The mention of Meta Platforms, Alphabet, and Taiwan Semiconductor brings up another point that investors should be aware of about BOTZ. None of these leading AI names are held by this fund. I give BOTZ credit for going beyond the usual suspects when it comes to AI, delving deep into international markets to find plenty of under-the-radar names that most generalist investors won’t be familiar with, and there are likely some hidden gems in this mix.

However, it also seems like some key names are missing from the fund, in addition to the three stocks mentioned above. For example, Microsoft is a key investor in privately-held OpenAI, which is perhaps the most prominent name in the space, and Microsoft is surprisingly absent from BOTZ’s holdings.

Another name that is conspicuous in its absence is semiconductor giant Advanced Micro Devices. Morgan Stanley analyst Joseph Moore recently said that AMD’s opportunity within the AI market may be much larger than initially anticipated.

Relatively High Expense Ratio

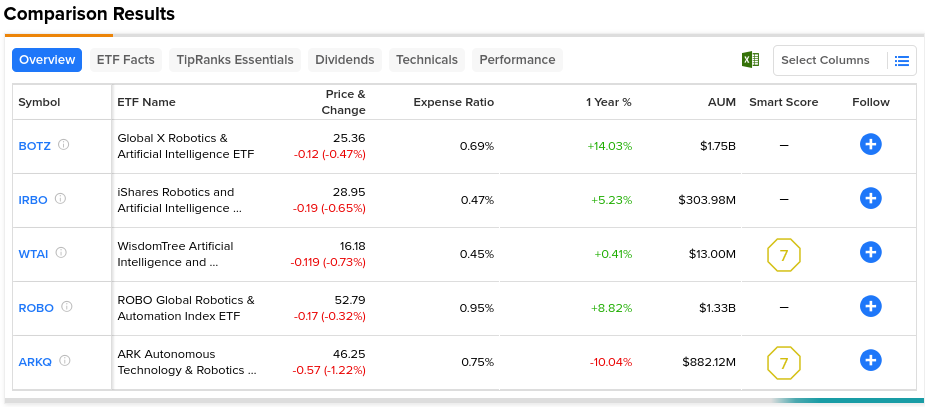

Lastly, one final thing to be aware of is that BOTZ has a relatively high expense ratio of 0.69%. This means that an investor putting $10,000 into the ETF would pay $69 in expenses in a year. These fees can add up over time — over the course of a 10-year investment, assuming a 5% return each year and no change to the fund’s operating expenses, this same investor would pay $859 in fees, according to the ETF’s prospectus.

BOTZ is a thematic ETF with a very specific focus and quite a few international holdings so I’m not expecting this type of an ETF to have an 0.1% expense ratio like some of the low-cost, broad-market SPDR or Vanguard ETFs.

But even compared to the rest of the universe of popular AI-focused ETFs, its expense ratio is in the middle of the pack. For example, the iShares Robotic and Artificial Intelligence ETF (NYSEARA:IRBO) has a lower expense ratio of 0.47%, while the WisdomTree Artificial Intelligence and Innovation Fund (BATS:WTAI) has a 0.45% expense ratio. Still, to its credit, BOTZ is cheaper than other high-profile AI-themed ETFs like the ROBO Global Robotics & Automation ETF (NYSEARCA:ROBO) and ARK Invest’s ARK Autonomous Technology & Robotics ETF (BATS:ARKQ), which have expense ratios of 0.95% and 0.75%, respectively.

Below, you can view a comparison of the fees and other key metrics for these five ETFs, such as price, one-year performance, assets under management (AUM), and their Smart Scores using TipRank’s ETF Comparison Tool. Readers can also customize these fields to compare ETFs based on other key data points of their choosing.

Conclusion

In closing, none of this is to say that BOTZ is bad — it has a carefully selected portfolio of AI holdings, and it recently surged to a 52-week high after gaining ~29% year-to-date. However, investors who are excited about AI and want to gain more exposure to it should be aware of the fund’s expense ratio, the relatively steep valuation of its portfolio, and its high degree of concentration in its top holdings.

Additionally, investors looking for an AI ETF and expecting to find familiar names like Microsoft, Alphabet, Meta Platforms, Advanced Micro Devices, and others should be aware that BOTZ does not have positions in these stocks.