Booking Holdings’ (NASDAQ:BKNG) upbeat first-quarter results should be of little surprise to TipRanks’ Website Traffic Tool users. The tool helps enhance stock research by allowing investors to monitor how a company’s website is performing. This information can be used to predict the upcoming earnings report.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company provides an online platform for making travel and restaurant reservations.

Ahead of the Q1 earnings release, the tool showed that website traffic for booking.com witnessed a 50.6% surge in unique visits when compared to the year-ago quarter. The company’s website traffic jumped to 697.2 million unique visits from 463 million in the first quarter of 2022.

Consequently, Booking’s Q1 results reflected a 40% year-over-year jump in revenues to $3.78 billion. Moreover, gross travel bookings increased 44% from the last year’s quarter. Demand for domestic and international travel is likely to have supported the company’s performance in the quarter.

What Are Analysts Saying about BKNG?

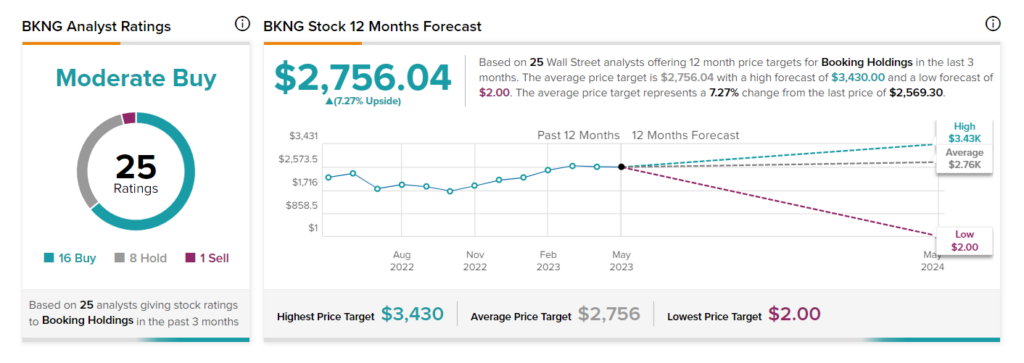

Following the Q1 results release on May 4, seven analysts rated BKNG stock a Buy. Among these, analyst James Lee of Mizuho Securities maintained a Buy rating with a price target of $2,950. Lee is optimistic about the company’s long-term performance in light of its significant presence in Europe and its initiatives to expand in the United States.

Also, it received seven Hold ratings and a single Sell rating from Bernstein analyst Richard Clarke.

Is Booking Holdings a Buy?

BKNG stock has a Moderate Buy consensus rating on TipRanks. This is based on 16 Buy, eight Hold, and one Sell recommendations. The average price target of $2,756.04 implies 7.3% upside potential from current levels. Shares of the company are up 26.4% in 2023 so far.

Concluding Thoughts

The performance of Booking this year is likely to continue to be supported by the rebound in travel, particularly from China. Also, the company benefits from its efforts to broaden its reach internationally.

Importantly, website traffic trends are only one part of your stock research. TipRanks offers easy access to key information such as analyst forecasts, insider and hedge fund transactions, stock analysis, and more, which can guide investors in making data-driven investment decisions.

Learn how Website Traffic can help you research your favorite stocks.