Boeing (NYSE:BA) is scheduled to report its first-quarter 2023 results on April 26, before the market opens. The aerospace and defense company might have benefitted from the post-pandemic recovery in travel along with the strong demand for its airplanes.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Boeing announced earlier this month that Q1 deliveries were 27% higher than they were in Q1 of the prior year. Nevertheless, supply-chain headwinds and labor instability, particularly in Boeing’s Defense, Space & Security segment, are likely to have impacted the company’s profitability.

Currently, the analysts expect Boeing to report a loss of $1.07, compared with a loss of $2.75 in the last year’s quarter. Meanwhile, revenue expectations are pegged at $17.5 billion, representing a year-over-year jump of about 25%.

Last week, analyst Ronald Epstein of Bank of America Securities maintained a Hold rating on BA stock with a price target of $225 following the company’s announcement that the 737 Max jets’ most recent manufacturing flaws would cause a delay in deliveries. The analyst expects that fixing the issue could cost from $70,000 to $1 million per plane.

Two weeks ago, another analyst, Scott Deuschle of Credit Suisse, reaffirmed a Hold rating on the stock and raised the price target to $220 from $200. Deuschle raised his loss forecast for the full-year 2022 to $2 per share from $1.71.

However, the analyst believes that the company has the potential to become profitable starting in 2024, thanks to increased aircraft deliveries.

Is Boeing Stock a Buy, Sell, or Hold?

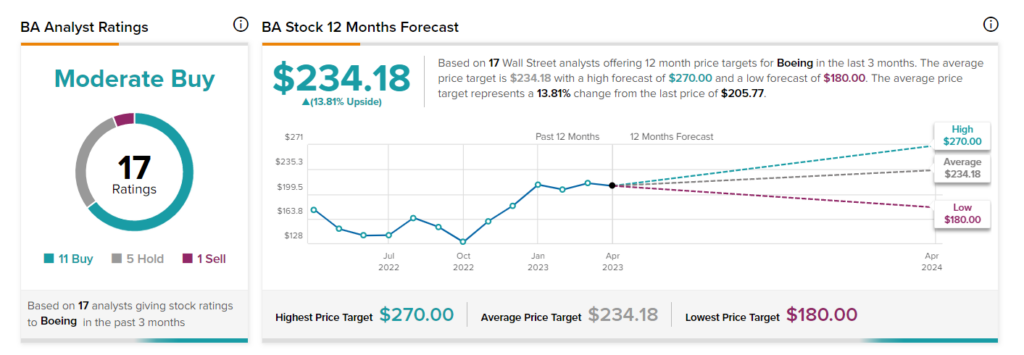

Overall, Boeing has a Moderate Buy consensus rating based on 11 Buys, five Holds, and one Sell. The average stock price target of $234.18 implies 13.8% upside potential. The stock has gained nearly 5% so far in 2023.

Ending Thoughts

The latest manufacturing issue with the Boeing 737 Max is likely to have a negative impact on its performance and could necessitate increased regulatory oversight. Also, the delay in deliveries might result in the company missing its target to deliver 400-450 of its 737 Max aircraft.