Sometimes you just have to get in the mix to get a real idea of a company’s progress. Indeed, that is exactly what Goldman Sachs analyst Noah Poponak has been up to in trying to gauge the path ahead for Boeing (NYSE:BA).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The analyst recently hosted a trip to the Boeing Charleston, South Carolina 787 aircraft production site and came away with some encouraging findings. “The Charleston 787 facility is very impressive,” Poponak said. “It looks surprisingly clean and efficient, and is full of automation and precise modern manufacturing techniques.”

Even better, given how much excess capacity there remains vs. pre-pandemic times when the production rate was 14 per month, Poponak makes the case that it looks “very much ready to go to higher rates.” With Boeing noting it is seeing plenty of demand for what is still “the most desired widebody aircraft in the market,” management believes the popularity warrants a doubling of production from existing levels.

The facility has shifted to a production rate of 5 units per month and Boeing revealed its plans for establishing a second final assembly line, with the intention of also achieving a production rate of 5 units per month. This expansion is part of the overall strategy to reach the mid-term goal of producing 10 units per month. “Incremental margins coming out of this facility looked poised to be particularly strong as rate goes higher, empty capacity becomes utilized, and they mix up by aircraft variant,” Poponak noted.

On the 737 MAX, the company said that the progress of the 737 MAX aft fuselage work – the manufacturing flaw currently being fixed – is going according to plan, and this positive development is expected to facilitate an increase in the delivery pace by the end of 2023.

Once the aft fuselage work is completed, the primary focus will shift towards stabilizing the entire system at a production rate of 38 units per month. From then, it’s just a timing issue on the decision to increase production to 42 units per month, eventually progressing toward a target production rate in the 50s. The company sees “very strong narrowbody demand,” saying the talk around exact monthly deliveries and when to bump up production rates are just minor details. The company thinks there’s enough demand to crank up production significantly and is working towards hitting those goals. That should ultimately result in “much higher earnings and cash flow over time.”

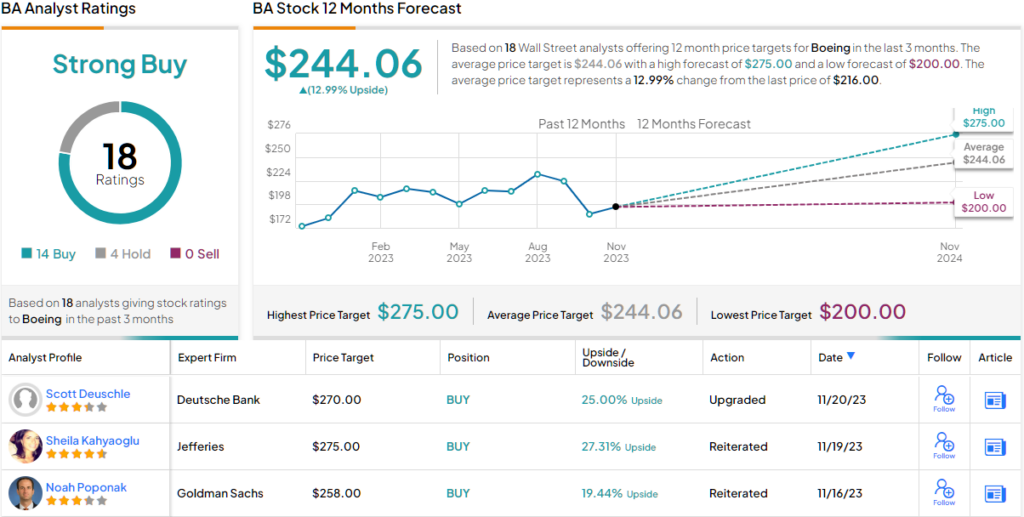

All told, Poponak keeps BA on his Conviction List, recommending a Buy rating, backed by a $258 price target. Investors stand to take home about 19% gain, should the target be met over the next 12 months.

Turning now to the rest of the Street, where most agree with Poponak’s thesis. Based on a mix of 14 Buys and 4 Holds, the stock claims a Strong Buy consensus rating. Going by the $244.06 average target, a year from now, investors will be pocketing returns of ~13%. (See Boeing stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.