Bank of Montreal (TSE: BMO) (BMO) is a Canadian multinational bank and financial services company. It provides personal and commercial banking, lending, mortgages, credit cards, and investment advisory services.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It also offers specialized banking programs, treasury and payment solutions, risk-management products, and other solutions to small business and commercial banking customers.

BMO recently reported earnings, which beat expectations. Earnings per share came in at C$3.23, above analysts’ expectations of C$3.22. In addition, revenue was C$10.12 billion, an increase of 59.1% year-over-year.

BMO’s share price is down roughly 2.5% year-to-date but up approximately 7.5% in the past year (not including dividends). Nevertheless, it may be undervalued at the moment despite its share price bouncing in the past few weeks.

Valuation

To value BMO, we will use the excess returns model. This approach is more appropriate for financial companies because they tend to have volatile free cash flows.

As a result, trying to create forecasts for them is ineffective. The excess returns model allows us to use historical numbers instead, which are actual results. There are a few steps to follow for this valuation method.

First, you calculate a company’s excess returns. Next, you calculate the terminal value. Add them up, and you get your valuation. Here’s how it works:

Excess Returns = (Average ROE – Cost of Equity) x Book Value Per Share

Terminal Value = Excess Return / (Cost of Equity – Growth Rate)

Fair Value = Book Value Per Share + Terminal Value

We will use the following assumptions for our calculations:

Average ROE: 12.6% (five-year average)

Cost of Equity: 7.8%

Book Value: C$93.15

Growth Rate: 2.95% (used 30-year Government of Canada bond yield as a proxy for long-term growth expectations)

Now that I have my assumptions, let’s plug them into the formulas:

C$4.47 = (0.126 – 0.078) x C$93.15

C$92.16 = C$4.47 / (0.078 – 0.0295)

C$185.31 = C$93.15 + C$92.16

As a result, BMO is currently worth C$185.31 per share under current market conditions. For reference, it is currently trading under C$140 per share.

BMO Has a Solid Dividend

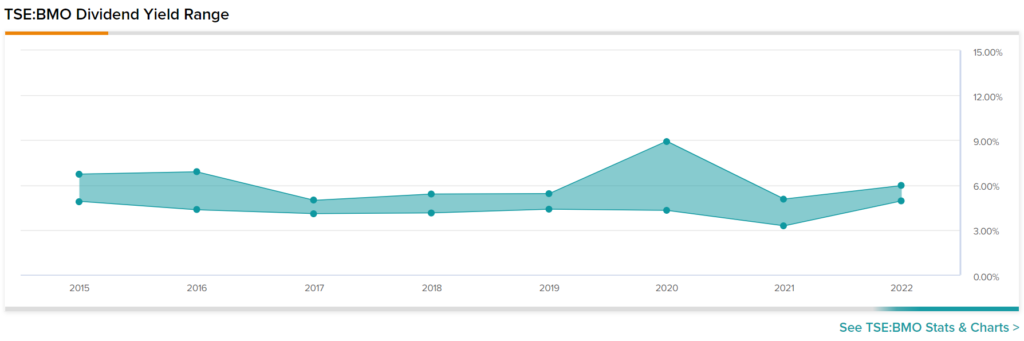

For income-oriented investors, BMO pays a 4% dividend yield on an annualized basis. When taking a look at BMO’s historical dividend yield, you can see that it has remained relatively flat:

At 4%, the current yield is on the low end of the range, indicating that income-oriented investors are paying a slight premium relative to yields they have been able to receive in the past.

Analyst Recommendations

Bank of Montreal has a Strong Buy consensus rating based on nine Buys, three Holds, and zero Sells assigned in the past three months. The average Bank of Montreal price target of C$154.47 implies 12% upside potential.

Final Thoughts

BMO had a good quarter, as it eked out a slight beat on earnings. Although analysts see good upside potential, the excess returns valuation model suggests that the stock is more undervalued than analysts think.