Earnings season is now in full swing, and expectations are that the Q1 readout will turn out to be the second year-over-year quarterly decline in a row for S&P 500 firms.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As such, BMO’s chief investment strategist Brian Belski points out that many investors are “worried that an earnings recession will significantly hinder market performance in the months ahead and inevitably translate into an economic recession later this year.”

However, according to Belski, such conclusions are “not necessarily accurate,” and he believes the recession fears “may be overblown.”

Belski cites several reasons why the two don’t necessarily correlate. For one, four of the last seven earnings recessions did not coincide with economic recessions while following a second straight quarter of y/y profit declines, historically, the S&P 500 performance has “held up quite well.”

Moreover, 1Q23 earnings growth is also expected to act as the “trough rate of change,” with growth recovery set to take place in 2H and into next year.

If Belski’s analysis proves to be accurate, then investors should make use of the opportunity to buy in now. But into which stocks?

Belski’s colleague, BMO analyst Andrew Strelzik, has pinpointed two specific names that he believes are poised for gains. To gain further insight, we checked these tickers against the TipRanks database to see what other analysts on Wall Street have to say. Here’s what you need to know.

Darling Ingredients (DAR)

Let’s start with Darling Ingredients, a company specializing in the rendering of edible and inedible bio-nutrients. In fact, with 260+ facilities spread across the globe, Darling is the biggest publicly traded company converting edible by-products and food waste into sustainable products. By repurposing around 15% of the global meat industry’s waste streams, the company produces green energy, renewable diesel, collagen, fertilizer, animal proteins and meals and pet food ingredients.

In addition, Darling Ingredients has a joint venture with Valero called Diamond Green Diesel, which positions the company as a leader in North American renewable diesel production, making it the second largest producer of renewable diesel in the world.

That said, despite the Diamond Green Diesel business selling a record 754 million gallons of renewable diesel in 2022, the company’s profit profile took a hit in the most recently reported quarter – for 4Q22. DAR has been busy on the M&A front and has increased the debt load, which given increased interest expense, gnawed at operating profits. As such, EPS came in at $0.96, some distance below the $1.36 forecast. On the other hand, at the opposite end of the scale, revenue climbed by 35% to $1.77 billion, in while beating Street expectations by $50 million.

Heading into the Q1 readout, BMO analyst Andrew Strelzik likes the risk-reward here.

“The breakdown of the natural hedge between Feed segment and Diamond Green Diesel (DGD) profitability created a soft start to 2023 for DAR, with 1Q performance likely to fall short of expectations. That said, we believe the near-term earnings risk is reflected in the shares, creating attractive risk/reward and an opportunity to capitalize on a compelling earnings outlook through the remainder of 2023 and 2024,” Strelzik opined.

To this end, Strelzik puts an Outperform (i.e. Buy) rating on DAR shares to go alongside an $80 price target. What does this imply for investors? A potential upside of 35% from the current trading price. (To watch Strelzik’s track record, click here)

Most on the Street agree with Strelzik’s thesis. The ratings skew 6 to 2 in favor of Buys over Holds for a Strong Buy consensus rating. The average target is more bullish than Strelzik will permit; the figure stands at $91, implying shares will post growth of ~54% over the one-year timeframe. (See DAR stock forecast)

Bunge Limited (BG)

Next up is Bunge, a significant player in the agribusiness and food industry. This multinational firm’s activities involve buying, processing, storing, and selling grains and oilseeds, essentially connecting farmers to consumers across the globe. The company also sells packaged and bulk oils, and wheat flours and bakery mixes, amongst other products.

In business for more than two centuries, Bunge has a workforce numbering 22,000+ and operates over 300 facilities spread across 40 countries. Bunge was actually one of the few to benefit from the recent banking sector woes; following the collapse of Signature Bank, the company took its spot in the S&P 500.

However, it hasn’t all been plain sailing recently for this global farm products force, with the company’s most recent earnings report being something of a mixed bag. At $16.6 billion, revenue stayed flat compared to the same period a year ago and fell short of consensus expectations by $1.54 billion. Although offsetting the underperformance, EPS of $3.24 exceeded the $3.21 consensus estimate. For the full year ahead, the company expects adjusted EPS of at least $11 per share, falling short of the consensus forecast of $12.18.

Still, reaching $11 is no mean feat, says BMO’s Andrew Strelzik, who points to the company’s strong cash position.

“BG is on track to sustainably generate EPS of $11+ reflecting strong fundamentals, returns on projects, incremental cash deployment, and operational improvements. We expect BG to exceed consensus in 1Q23, 2023, and 2024, though earnings cadence this year has shifted incrementally toward 2H,” Strelzik explained. “BG has $1.1 billion of cash on its balance sheet, strong cash generation, and should benefit from eventual unwind of inventory build (~$4 billion). The $250 million of shares BG has committed to repurchasing annually should add nearly $1 to BG’s EPS baseline by 2026, and there is clear opportunity for greater buybacks.”

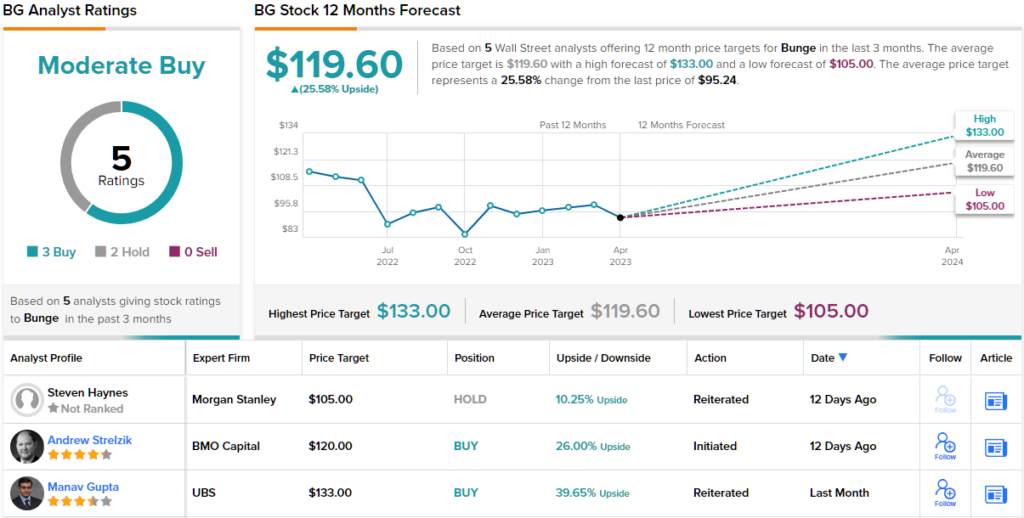

Accordingly, Strelzik rates BG an Outperform (i.e. Buy), along with a $120 price target. Should the figure be met, investors will be pocketing returns of 26% a year from now.

Turning now to the rest of the Street, opinions are split almost evenly. 3 Buys and 2 Holds add up to a Moderate Buy consensus rating. Shares are anticipated to appreciate by 25.5% over the coming months, considering the average target clocks in at $119.60. (See BG stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.