Quite possibly a business enterprise that materialized too quickly, the concept for meal-kit delivery pioneer Blue Apron (NYSE:APRN) initially looked promising. However, immediately following its initial public offering, reality capsized the underlying company. While management is doing everything it can to stay afloat, the operating model doesn’t make much sense today. Therefore, I am bearish on APRN stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Fundamentally, Blue Apron attempts to tread water while lost at sea in a torrential thunderstorm. As TipRanks reporter Vince Condarcuri stated, APRN stock suffered badly from a disappointing third-quarter disclosure. Back in October, management revealed that it expected “Q3 revenue to land between $109 million and $112 million, much below consensus estimates of just under $130 million.”

Condarcuri added that “the revenue miss is due to Blue Apron missing out on a $15 million bulk sale from one of its customers. The bulk sale was expected in Q3. If this sale comes in Q4 instead, along with the already-anticipated bulk sale for Q4, they will add up to about $30 million in revenue.”

Late last week, Blue Apron announced that it would cut approximately 10% of its total corporate workforce. The stated reason, in part, was to “better align internal resources with strategic priorities.” Still, the bottom line is that if APRN stock looked promising, management would think twice about cutting. It’s not as if its current business profile is ample.

Therefore, the only real positive for APRN stock centers on its potential use as a tax-loss harvesting tool. This practice refers to selling losing investments to offset capital gains, perhaps accrued from selling winners. While commonly associated with hedge funds, any investor meeting certain tax criteria may benefit from the tactic.

Otherwise, there’s probably no good reason to acquire APRN stock.

APRN Stock Faces Irrelevance

Although Americans generally carry a never-say-die attitude, when it comes to investing, knowing when to call it quits represents a vital skill. For APRN stock, the main headwind is that the underlying business lacks relevance amid brewing macroeconomic pressures.

Centrally, the pain point focuses on the broader health of the consumer. On paper, it might seem that APRN stock could be due for an eventual comeback. After all, the latest November jobs report came in much hotter than anticipated. While this dynamic ordinarily bodes well, it also means that more dollars chase after fewer goods.

Unfortunately, the Federal Reserve committed to sparking the opposite scenario: fewer dollars chasing after more goods. In other words, for all the rate hikes that the central bank implemented throughout this year, they failed to arrest the key catalyst for inflation. Therefore, it’s quite possible that the Fed will take the gloves off, acting even more aggressively against escalating prices.

Moreover, the economy – as it pertains to white-collar workers – already suffers the consequences of a high interest-rate environment. With several blue-chip enterprises distributing pink slips for well-paying tech jobs, Blue Apron’s addressable market will likely diminish. Obviously, such a circumstance would not bode well for APRN stock.

To be fair, Blue Apron as a business model might succeed under a framework where the gig economy thrives. Under this scenario, time quite literally is money for gig workers (i.e. independent contractors). Therefore, to maximize earnings, people within the gig economy may utilize meal-kit delivery services for efficiency’s sake.

However, the gig economy will likely hit $455.2 billion by the end of 2023. It’s a sizable leap from where it was. Still, it’s nowhere near big enough (at the moment) to save APRN stock.

Is APRN a Good Stock to Buy?

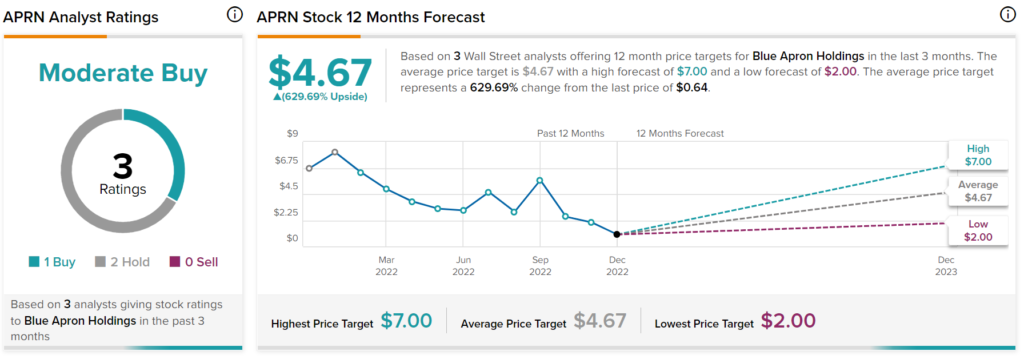

Turning to Wall Street, APRN stock has a Moderate Buy consensus rating based on one Buy, two Holds, and zero Sells assigned in the past three months. The average APRN price target is $4.67, implying over 629% upside potential.

The Quantitative Data Will Scare Investors Away from APRN Stock

From a purely speculative perspective, the fact that APRN trades in literal penny-stock territory might appeal to gamblers. At the same time, a proper fundamental analysis suggests that Blue Apron is a possible value trap.

For instance, the company’s price-to-sales ratio sits at 0.05 times. This metric rates far lower than the industry median value of 0.67 times. However, the meal-kit specialist’s three-year revenue growth rate (on a per-share basis) sunk 26% below parity. It’s hard to imagine getting out of this hole, particularly with management cutting 10% of its workforce.

As you might expect, the profitability angle is a mess. While gross margin hit nearly 34%, both operating and net margins sit more than 24% below breakeven. With macro forces weighing heavily on consumer sentiment, Blue Apron lacks the resources to mount a credible comeback.

As if investors needed more reason to be concerned, Blue Apron’s Altman Z-Score pings at 5 points below parity, reflecting a deeply distressed business. Moreover, the company incurs a higher-than-normal risk of bankruptcy in the next two years. Thus, whether you look at circumstances from a financial or outside fundamental view, APRN stock remains deeply troubled.