Block (NYSE:SQ) investors have had little to shout about this year. While other tech stocks have charged ahead, SQ shares have trended in the opposite direction; to wit, the stock has shed 28% of its value on a year-to-date basis.

Sentiment has been low to such an extent that even after delivering a strong Q2 report boasting beats on both the top and bottom lines in addition to raising its operating income outlook, the less appealing aspects of the report took hold of the narrative.

Assessing the digital payments giant’s current situation, Deutsche Bank analyst Bryan Keane thinks the blame for the poor share price performance lies with “self-inflicted wounds,” and that these are actually masking “solid fundamentals.”

“Despite continuing to show strong fundamentals across its business segments, passing through recent EBITDA beats, and making baby steps forward with regard to its guidance philosophy, SQ shares have been plagued by short-term volume worries and poor communication on the direction of the business,” Keane said.

One of the issues that rankled with investors following the Q2 print centered around the disappointing gross profit growth seen so far in the quarter, and Keane believes that one of the ways to help boost investor confidence would be by providing mid-term gross profit expectations for Square and Cash App alongside a “more specific timeline” around the company’s ‘Rule of 40’ target (the rule used by software companies that states a total of 40% or more should be reached when adding up its revenue growth rate and profit margin).

Additionally, recent worries about a decline in the Square segment, which were amplified by the unexpected departure of former CEO Alyssa Henry, as well as challenging comps for the Cash App, worsened by a recent outage affecting both platforms, resulted in a sell-off in the shares.

“However,” says Keane, “comps in the Square seller business get much easier in October (renewed energy from Dorsey could help ignite sales), and Cash App gross profit growth should remain above 20%, in our view.”

As far as the Q3 print is concerned (slated for November 2), although Keane sees “limited gross profit upside” compared to current expectations, he forecasts another “bottom-line beat and raise” from the readout.

“We remain bullish on the company’s long-term outlook with what we see as sustainably high growth rates and continued progress towards GAAP profitability,” the analyst summed up.

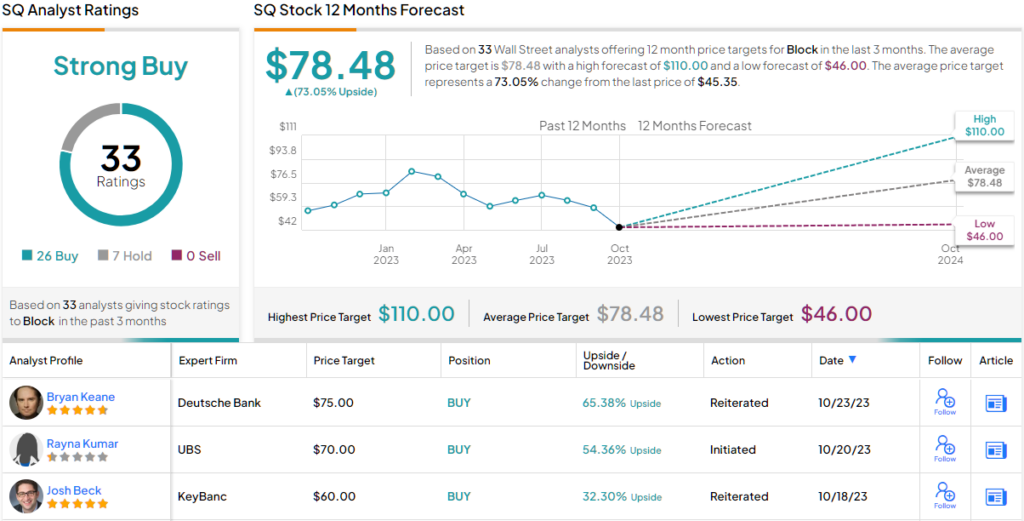

All told, Keane reiterated a Buy rating on SQ shares along with a $75 price target. If correct, investors could be lining their pockets with a 65% gain. (To watch Keane’s track record, click here)

Elsewhere on the Street, based on an additional 25 Buys and 7 Holds, the analyst consensus rates the stock a Strong Buy. The average target remains higher than Keane will permit, and at $78.48, suggests shares will climb 73% higher over the one-year timeframe. (See Block stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.