Block (SQ) shares were on the backfoot last week, following the release of a report by Hindenburg Research alleging the company was involved in fraudulent activities.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Amongst a litany of allegations, the short seller claimed that Block’s popular Cash App was most likely helping con artists take advantage of government stimulus programs during the pandemic. It also accused the company of taking advantage of the populations it says it is helping: the “unbanked” and the “underbanked.” The note also mentions former employees who claim the business engaged in actions meant to inflate particular user data.

After scanning the report, for Oppenheimer analyst Dominick Gabriele, the biggest accusation is that SQ is “effectively a fraudulent business both in operations/reporting while allowing nefarious activities on its platform.”

“We believe the probability these accusations are correct is incredibly low,” the analyst went on to add. “We don’t have a way to directly prove or disprove these accusations, but SQ does. In our view, SQ should share special data given the magnitude of these allegations to quell investor fears vs. current response.”

Putting to one side the fraud allegations, Gabriele notes that some parts of the report chime with his own reservations made in a downgrade note earlier this year. Specifically, “growth longevity” of the Cash Cpp and the EBITDA valuation compared to peers. Gabriele also believes that in comparison to credit cards, P2P most probably has more fraud, noting that after reviewing 2021 activity, even PayPal got rid of 4.5 million accounts.

Given that Block’s activities have been put under the microscope in the wake of the report, Gabriele believes that similar to the actions taken at PayPal, there could also be a wipeout of accounts at Block. “Given targeted unbanked population, it would be more likely, in our view, these customers have more multifaceted risks associated with them than a traditional bank customer,” he said, before suggesting the company could “release its fraud rates.”

All told, Gabriele remains on the sidelines for now, reiterating a Perform (i.e., Neutral) rating with no fixed price target in mind. (To watch Gabriele’s track record, click here)

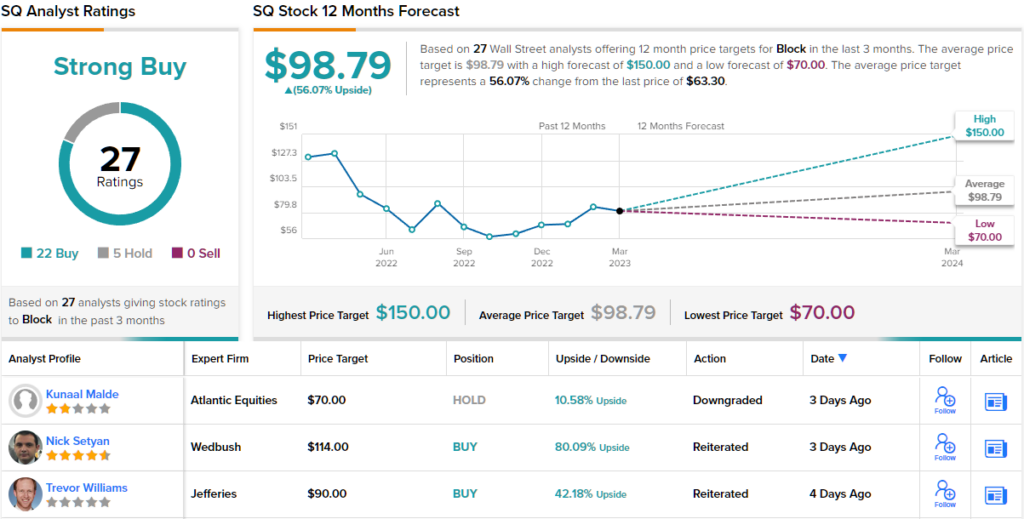

Most analysts, however, still remain in SQ’s corner; based on 22 Buys vs. 5 Holds, the stock claims a Moderate Buy consensus rating. There’s plenty of upside projected here; at $98.79, the average target makes room for one-year returns of 56%. (See SQ stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.