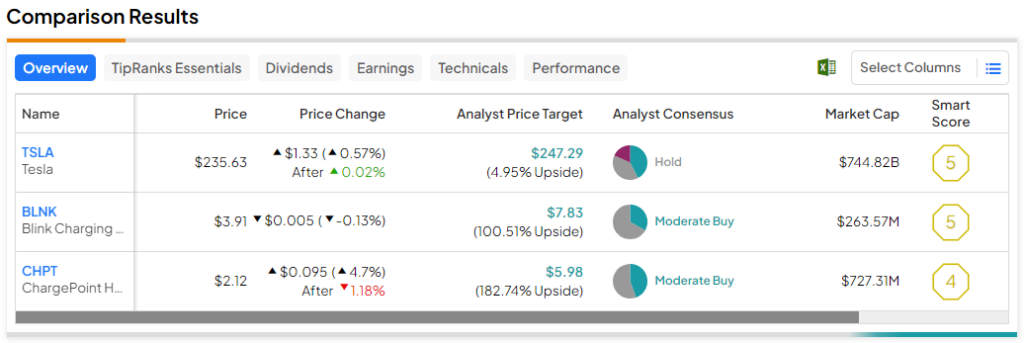

The global shift toward sustainable energy solutions is driving the adoption of electric vehicles (EVs). While Tesla (NASDAQ:TSLA) has long been the market leader, as the EV market expands, many new players have emerged. We’ll use TipRanks’ stock comparison tool to discuss why Wall Street is more bullish on rising EV stars Blink Charging (NASDAQ:BLNK) and ChargePoint Holdings (NYSE:CHPT) than they are on Tesla. I, too, am optimistic about the near-term prospects of both BLNK and CHPT.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While Tesla’s margins have fallen this year as a result of price cuts to combat rising interest rates, the market still favors the stock. TSLA stock has gained 117% year-to-date, while BLNK and CHPT have fallen by 64% and 78%, respectively, compared to the S&P 500’s (SPX) gain of 18%. Nonetheless, Wall Street expects more upside for these two key players compared to EV leader Tesla. Let’s find out why.

ChargePoint Holdings (NYSE:CHPT)

Recent leadership changes and a bleak outlook for Q3 caused investors to dump ChargePoint Holdings stock, bringing it down by 35% on November 17. However, I believe that as macroeconomic conditions improve and EV adoption grows, things could turn out in CHPT’s favor in the long run. Let’s see what made investors go against the stock and why I am still cautiously optimistic about CHPT.

ChargePoint provides a diverse portfolio of charging stations for various applications, including workplace, commercial, and residential use, both in the U.S. and internationally. What sets ChargePoint apart is its broad network, comprising both hardware and cloud-based software solutions.

Moreover, ChargePoint’s charging stations are integrated with its cloud service, offering features like real-time station status updates, remote management, and user authentication. Though ChargePoint’s strategies have been effective, the company is still not profitable despite the rapid revenue growth.

From $146.5 million in Fiscal 2021, ChargePoint’s revenue has increased to $454.2 million in the trailing 12 months. However, its operating losses have also increased from $121 million to $364.8 million during that period.

Current macroeconomic headwinds, such as rising interest rates, have weighed on the EV market. As a result, despite a 39% year-over-year revenue increase to $150 million in Q2 Fiscal 2024, CHPT’s adjusted gross margin came in at 3%, down from 19% in the prior-year quarter. Further, its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) losses increased to $81.2 million from $56.2 million a year ago.

On November 16, the company announced its Q3 preliminary results, which investors found disappointing. ChargePoint now expects revenue to be in the range of $108 million to $113 million, down from the prior estimate of $150 million to $165 million, owing to the pressures in its North American and European markets during the quarter. Meanwhile, analysts now predict revenue of $127 million in Q3.

Furthermore, a non-cash impairment charge of $42 million could drag the company’s adjusted gross margin to a range of -19% to -17%.

The company also announced Rick Wilmer as the new CEO, succeeding Pasquale Romano, and Mansi Khetan as the interim CFO. The new CEO stated, “Overall macroeconomic conditions, along with fleet and commercial vehicle delivery delays impacted anticipated deployments with government, auto dealership and workplace customers.”

Management did not discuss full-year Fiscal 2024 guidance, but the earlier forecast stood in the range of $605 million to $630 million, representing a year-over-year increase of 66% to 73%. Meanwhile, analysts predict revenue to come in at around $559.2 million for Fiscal 2024, an 18.2% increase.

Despite the expected Q3 revenue dip, management is optimistic about achieving adjusted positive EBITDA by the end of the Calendar Year 2024. We will know more about the company’s future plans once it releases its Q3 earnings on December 6.

Typically, abrupt leadership changes have a negative impact on the stock price because they paint an unclear picture of how the new management will impact the company. A new management team, on the other hand, could be beneficial for ChargePoint, which has been growing revenue but struggling to achieve profitability.

What is the Price Target for CHPT Stock?

ChargePoint isn’t profitable, yet analysts are hopeful about its near-term prospects. After its Q2 results in September, UBS analyst Robert Jamieson gave the stock a Buy rating with a price target of $9. The analyst is impressed with the company boasting a 50% market share with the biggest footprint of Level 2 chargers in North America. He believes CHPT will be EBITDA-positive by Q4 2025 as headwinds wane.

More recently, Needham analyst Chris Pierce reduced CHPT’s target price from $8 to $4 following the company’s preliminary Q3 results. However, the analyst remains positive on the expanding EV market and has kept his Buy rating on the stock.

Overall, ChargePoint sports a Moderate Buy consensus rating. Out of the 17 analysts covering CHPT stock, eight recommend a Buy, and nine recommend a Hold. There are no Sell recommendations for CHPT. The average ChargePoint stock price target is $5.98, implying 182.1% upside potential over the next 12 months.

Trading at 1.3 times forward sales, ChargePoint looks absurdly cheap for a growth stock. Analysts predict Fiscal 2025 revenue to increase by 28.7% to $712 million.

Blink Charging (NASDAQ:BLNK)

Florida-based Blink Charging focuses on the development and deployment of EV charging equipment and networked charging services. The company offers a variety of charging solutions, including DC fast chargers and Level 2 AC charging stations, serving both commercial and residential markets.

Its user-friendly, innovative charging technology has been driving its fundamentals. Though a new player like Blink Charging might look volatile now, it is rapidly expanding, not just in the U.S. but globally.

The global EV charging station market is expected to grow at a compound annual growth rate (CAGR) of 36% by 2030 to reach $141.08 billion. Blink could capitalize heavily on this exceptional growth, which makes me optimistic about the stock’s long-term prospects.

On November 13, Blink disclosed the launch of its EQ 200 charger technology in the U.K. and Ireland. Notably, the EQ 200 is compatible with around 90% of modern electric vehicles.

According to the company, these are the “new generation of vehicle-to-grid, bi-directional chargers designed to boost the development of an effective EV charging infrastructure and enable the switch from static EV charging to more dynamic and sustainable energy management as grid technology develops.”

In the recent third quarter, revenue jumped by a whopping 152% year-over-year to $43.2 million, owing to the strong demand for both its products and services, as well as increased network fees. Furthermore, vertical integration has aided in increasing its gross margin to around 29.5% in the quarter compared to 27.7% in the prior year.

Despite rising costs, Blink generated $98 million in revenue for the nine months ended September 30, surpassing the total revenue of $61.1 million generated for all of 2022.

Blink Charging isn’t profitable yet. However, management stated in the Q3 earnings release that the company hopes to achieve an “adjusted EBITDA break-even run rate by December 2024.” The company has been narrowing its adjusted EBITDA losses, which came in at $11.7 million in Q3 versus $17.6 million in the year-ago quarter.

Driven by a robust quarter, management increased its guidance for 2023 revenue from the range of $110 million to $120 million to a new target range of $128 million to $133 million. Meanwhile, analysts forecast revenue of $132.4 million, and management expects BLNK’s gross margin to be over 30%.

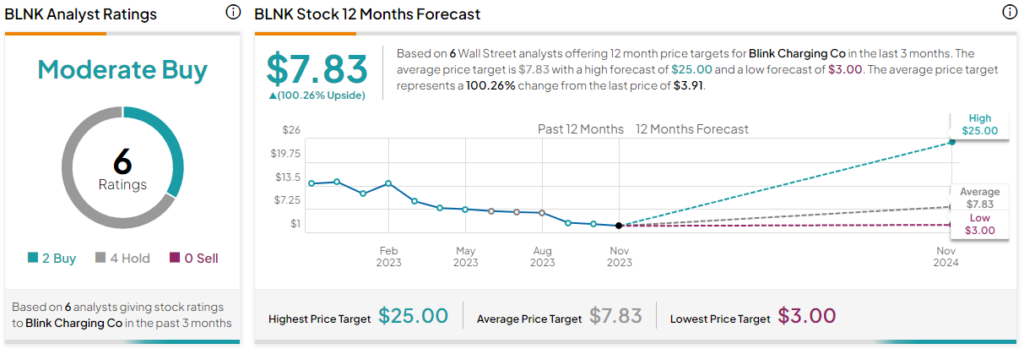

Is BLNK a Buy, According to Analysts?

Following the company’s strong Q3 results, H.C. Wainwright analyst Sameer Joshi discussed his optimistic outlook for BLNK. The analyst believes that management’s updated guidance reflects the company’s strength, and management’s optimism is “likely informed by the anticipated surge in EV adoption and infrastructure investment in the coming quarters,” per TipRanks.

Over the last three months, two of the six analysts covering BLNK stock have recommended a Buy, while the other four have recommended a Hold. The stock has a Moderate Buy consensus rating on TipRanks. The average Blink Charging stock price target is $7.83, which is 100% higher than the current price.

Trading at 1.5 times 2024’s projected sales, Blink Charging appears to be quite cheap. Analysts predict its revenue to grow by 30.9% year-over-year to $173.3 million in 2024.

Conclusion

In the electrifying race toward sustainable transportation, Blink Charging and ChargePoint Holdings stand as key players, each contributing in their own unique way to the development of the EV space. While ChargePoint has a broader market footprint, Blink Charging has gained traction due to its localized focus and user-friendly approach. However, Blink is now spreading its roots globally as well.

According to Statista, the EV market is expected to grow at a CAGR of 18% from 2023-28 to reach a valuation of $162 billion. Though it might take a long while for these companies to match up to Tesla, with their unique strengths, both have the potential to become successful players in the rapidly expanding EV space.

This is most likely why Wall Street expects BLNK stock to rise by 100% and CHPT stock to rise by 182% over the next 12 months. Therefore, like most analysts, I am optimistic about Blink Charging and ChargePoint Holdings’ long-term prospects.