Shares of Blade Air Mobility (NASDAQ:BLDE) have rebounded strongly and are up about 44% in one month. While this penny stock (learn more about penny stocks here) registered significant gains, analysts’ average price target suggests BLDE stock could trend higher and deliver outsized returns from current levels.

Blade is an air mobility platform providing a cost-effective air transportation solution. It utilizes helicopters and amphibious aircraft for passenger routes. Further, the company is a leading air medical transportation provider for organ transplants worldwide.

Factors Driving Growth

The notable recovery in BLDE stock is fueled by its solid Q3 performance, wherein the company delivered its first quarter of positive free cash flow and adjusted EBITDA while sustaining momentum in both the Passenger and Medical segments. Additionally, Blade’s flagship urban air mobility service, Blade Airport, continued to deliver stellar growth, achieving profitable passenger seat utilization for the first time in Q3. The service also maintained a robust growth trajectory in the average checkout price per seat.

The company’s solid execution of growth initiatives, coupled with a focus on cost efficiencies, augurs well for growth.

What is the Forecast for BLDE Stock?

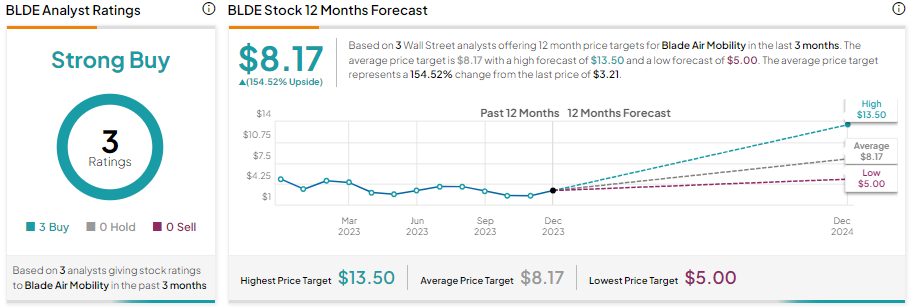

Three analysts cover Blade Air Mobility stock, and all recommend a Buy. Further, the average BLDE stock price target of $8.17 indicates that this penny stock has the potential to rise by a whopping 154.52% from current levels.

Bottom Line

Blade Air Mobility’s asset-light business model, strength in its flagship offering, and momentum in its Passenger and Medical segments provide a solid foundation for growth. Also, its focus on expanding profit margins, optimizing its cost base, and adding profitable new business lines like new organ matching services to maximize free cash flow generation bode well for future growth.

While Blade Air Mobility stock offers significant upside potential, as reflected by analysts’ average price targets, investors can use TipRanks’ penny stock screener to find more such attractive penny stocks.