As we reach the tail end of the 2Q23 earnings season, it’s time to take stock of the current market landscape and gauge the resilience of equities.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

To start with, the pace of inflation is falling – but remains above the 2% target. Against a background of inflationary pressures and recessionary fears, the second quarter earnings were stagnant – but while the bar was low, most firms cleared it, beating the expectations.

In a recent note, BlackRock’s Global Chief Investment Strategist, Wei Li, has outlined the implications for investors, with a focus on enhancing margins.

“U.S. earnings are stagnating. Market expectations of a pickup in margins over the next year look rosy as worker shortages keep pressure on wages… We see inflation on a rollercoaster as the labor shock takes over from the spending mismatch. If companies attempt to safeguard margins against these wage pressures in a stagnant economy, this could contribute to inflation pressures and potentially result in even higher central bank policy rates,” Li opined.

Against this backdrop, BlackRock has been buying up dividend stocks. These are the classic defensive plays for a difficult economic situation, and one of BlackRock’s buys is yielding as high as 14%. We’ve delved into TipRanks’ database to see what Wall Street analysts have to say about whether these stocks make compelling investments. Let’s take a closer look.

DHT Holdings, Inc. (DHT)

We’ll kick off with DHT, a holding company in the global oceanic transport sector. The firm is an independent crude oil tanker company, with a modern fleet of 24 very large crude carriers (VLCCs), the largest oil tankers plying the trade routes today. Only 4 of DHT’s vessels were built before 2011, and all are classed between 299K to 320K deadweight tonnage.

On the operational side, DHT manages its fleet through integrated management firms based out of Singapore, Norway, and Monaco. DHT combines a high market exposure with a fixed-income business model based on charter contracts for the fleet.

DHT’s business model brought in solid income during the last reported quarter, 2Q23. The company’s performance was based on its time charter equivalent earnings that averaged $56,300 per day. This average figure was in turn derived from a $36,200 daily rate for time charters and a $64,800 daily rate for spot market VLCC tanker operations.

In the headline numbers, this led to total shipping revenues of $152 million for the quarter, up from $99.2 million in the year-ago period. The company’s adjusted net revenues, of $112.9 million, more than doubled from the $54.1 million in 2Q22, and beat the forecast by $3.2 million. At the bottom line, DHT’s non-GAAP EPS came in at 35 cents, in-line with Street’s expectations.

Turning to the dividend, we find that DHT next pays out the common share distribution on August 30, at a rate of 35 cents per share. This annualizes to $1.40 per share, and gives an impressive yield of 14.5%.

BlackRock has been busy purchasing DHT stock, picking up 1,731,800 shares in Q2. The investment and asset manager now holds a total of 9,579,402 shares in the shipping company worth over $91 million.

DHT also gets the support of 5-star Evercore analyst Jonathan Chappell, who writes: “That 3Q ‘raise’ is the only EPS or dividend estimate change through 2024 as DHT continues to hold costs at a manageable level and as our outlook for the crude tanker markets remains unchanged from our optimistic view for the next 6 months… A seasonal uplift in VLCC rates entering the winter season should act as a catalyst to the shares.”

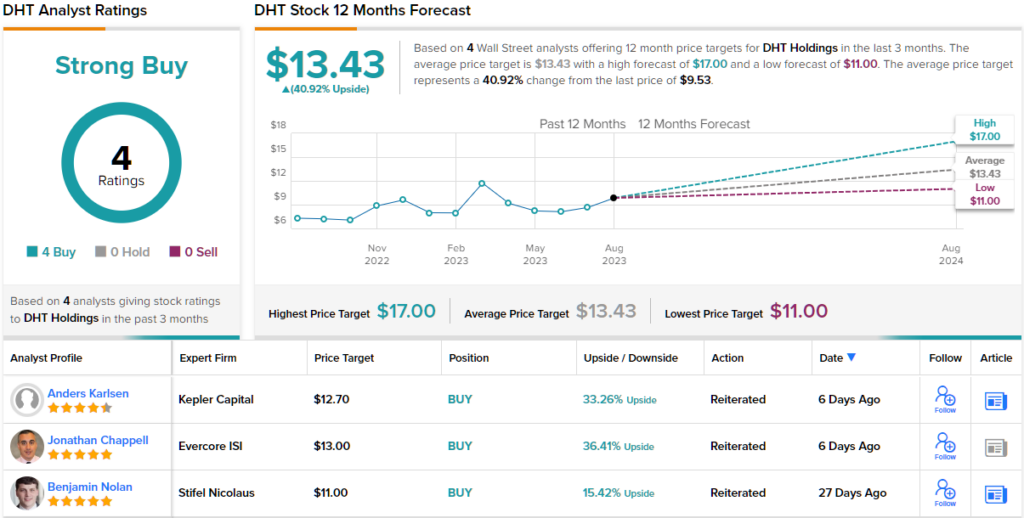

Looking ahead, Chappell sees fit to put an Outperform (i.e. Buy) rating on DHT shares, alongside his $13 price target, which implies a 36% one-year upside potential. (To watch Chappell’s track record, click here)

Overall, there are 4 recent analyst reviews on file for DHT stock – and they all agree that this is one to buy, making the Strong Buy consensus rating unanimous. The shares are trading for $9.53 and they have an average price target of $13.43, pointing towards ~41% potential gain in the year ahead. (See DHT stock forecast)

NewtekOne, Inc. (NEWT)

The next stock on Blackrock’s radar is NewTekOne. This technology and financial services firm specializes in partnering with the business world, offering a range of financial solutions tailored to companies of all sizes – from small businesses to larger enterprises. The company offers business banking, financing options for lending, enhanced payment processing, seamless omni-channel POS systems for sales and operations, and even HR and payroll solutions for the workforce. In short, NewTekOne puts all of the finance and technology needs of the modern business into one package.

From the enterprise customer perspective, perhaps the most important attributes that NewTekOne offers are less tangible than the revenue-generating services. The company brings with it a proven track record of helping its customers grow their businesses and can draw upon more than 20 years of experience in devising solutions for customer issues.

This company started out 2023 on a high note, closing its acquisition of the National Bank of New York City in early January. The acquisition move was announced in August of 2021, and this past December, NewTekOne became a bank holding company as part of the transaction.

Working with the business world has worked for NewTekOne. In the firm’s 2Q23 report, the last financial results released, it reported a combination of ‘record deposit growth and loan fundings,’ the twin cornerstones of its business. Total deposits were $447.4 million as of June 30, up 220.6% from December 31, while the total commercial loan closings in Q2 reached $251.2 million, for a y/y increase of 6.4%.

The company’s revenue was reported at $52.1 million, missing the forecast by $1.1 million but growing y/y by over 170%. The bottom line, a GAAP EPS of 26 cents, was 2 cents lower than expected; the non-GAAP EPS, however, also 26 cents, came in 9 cents ahead of the estimates. NewTekOne had $256.3 million in cash and liquid assets as of the end of Q2, a total that included $66.7 million worth of restricted cash.

On the dividend front, NewTekOne last paid out on July 21 at a rate of 18 cents per common share. This annualized to 72 cents per common share, and gave a yield of 4%, about double the market average.

Clearly, BlackRock liked what it saw here in Q2, as the firm opened a new position on NEWT, buying 1,631,088 shares of the stock during the quarter. These shares are now worth ~$29 million.

This stock also caught the attention of 5-star analyst, Bryce Rowe, of B. Riley. Rowe likes the National Bank of New York City transaction, and sees it as revenue generator gong forward. He writes, “We continue to consider NEWT to be in the very early innings of its transition from BDC to bank/financial holding company that began with the closing of its acquisition of National Bank of New York City in early January. 2Q23 was the first full quarter as a financial holding company and included highlights of why the transition from BDC to financial holding company makes sense for NEWT, with the most important being the ability to fund its primary loan product [SBA 7(a) loans] with deposits and the ability to fold its payments and technology solutions functions into the operating structure of a bank.”

Looking ahead, Rowe adds his outlook for the near future: “We believe NEWT’s valuation has potential to work higher given the asset-light nature of its operating model that is projected to generate a return on assets in excess of 3.0% vs. a projected 2023 average of roughly 1.09% for $5-$50B banks.”

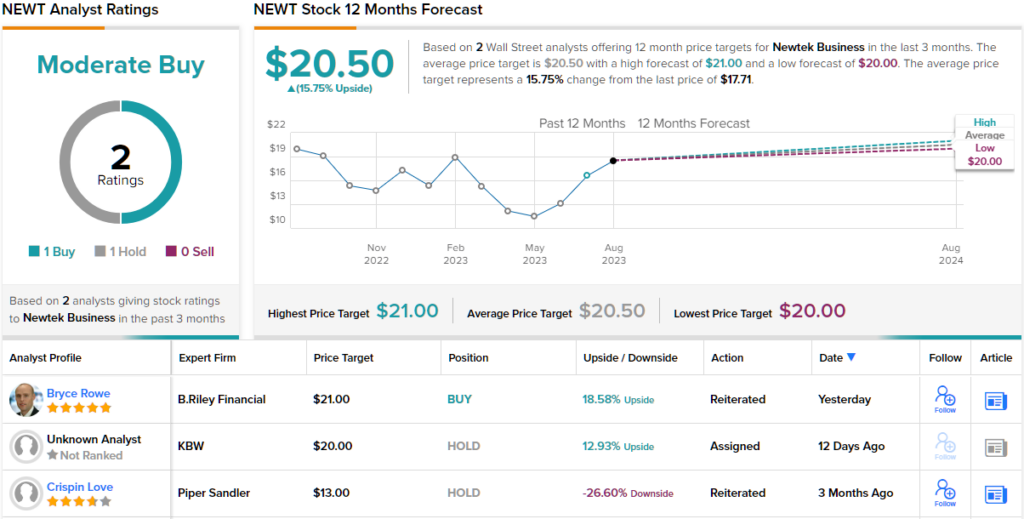

To this end, Rowe bumped up his price target on NEWT, from $20 to $21, suggesting the stock will appreciate ~19% in the coming months. Unsurprisingly, his rating here is a Buy. (To watch Rowe’s track record, click here)

Some stocks fly under the radar, and NEWT is one of those. There are only two analyst reviews on file here, and they include 1 Buy and Hold, each, all coalescing to a Moderate Buy consensus rating. The shares are priced at $17.71, with an average price target of $20.50 indicating a runway toward ~16% upside for the next 12 months. (See NEWT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.