BlackRock (NYSE:BLK) is scheduled to release its first-quarter results before the market opens on April 14. The investment management company’s performance might have been hurt by a slowdown in the Investment and Advisory segment. This is due to the likelihood that the recent banking crisis and concerns about the impending recession affected investors’ appetite during the quarter.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The Street expects BlackRock to post earnings of $7.78 in Q1, lower than the prior-year quarter figure of $9.52. Meanwhile, analysts expect the company to report net revenue of $4.25 billion, down 6.7% from the same quarter last year.

According to Bank of America Securities analyst Craig Siegenthaler, long-term net inflows for Q1 should range between $60 billion and $70 billion. The analyst expects the long-term net flows to probably continue to increase in the second quarter.

Further, Siegenthaler believes that BlackRock will experience annual organic growth in the range of 5% to 6% in 2023. The analyst has maintained a Buy rating on BLK stock and raised the price target to $868 from $813.

Is BLK a Good Stock to Buy?

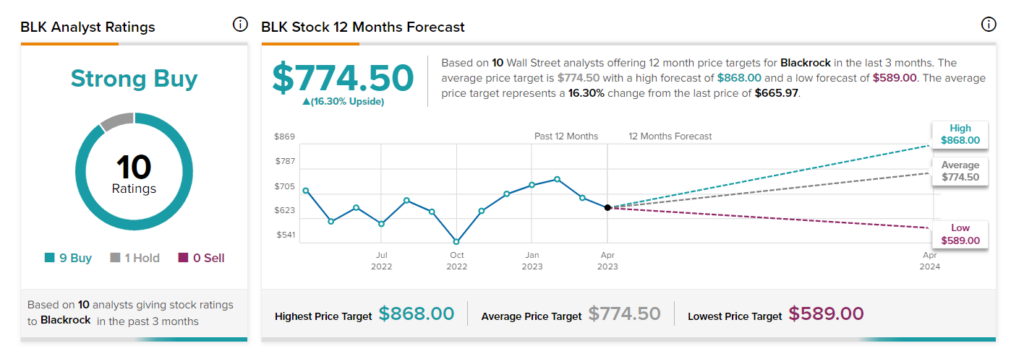

BLK stock commands a Strong Buy consensus rating on TipRanks based on nine Buy and one Hold recommendations. The average price target of $774.50 implies 16.3% upside potential from the current level. Shares of the company have fallen 5.6% so far in 2023.

Ending Thought

BlackRock’s topline performance is probably going to be less impressive given the bear market because its fees are based on asset levels and market performance. BlackRock has nevertheless become a diversified manager with scaled distribution capabilities thanks to its acquisitions. Additionally, BLK’s dividend yield of about 3% continues to draw in investors.