Booking Holdings (NASDAQ:BKNG) and Expedia (NASDAQ:EXPE) are travel agency firms with a lot on the line with the rise of generative AI. Fortunately, both tech-savvy companies seem to be on the right side of innovation and could turn AI into a meaningful tailwind that could help reinvent their businesses.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Either way, various technology giants — think Alphabet (NASDAQ:GOOGL) — could use their AI prowess to break into and disrupt new markets, travel booking included. While new rivals with profoundly impressive technical capabilities are always a cause for concern, I think the moats of Booking and Expedia are wide enough to make it challenging for Google to gain any meaningful share, at least over the medium term.

For now, Booking Holdings and Expedia are playing their cards right when it comes to AI. They realize how profound the technology is and its implications for the travel booking industry. For these reasons, I remain bullish on shares of both companies, as I believe they’ll ultimately benefit from the looming AI revolution by making it easier (and perhaps cheaper) for prospective vacationers to book.

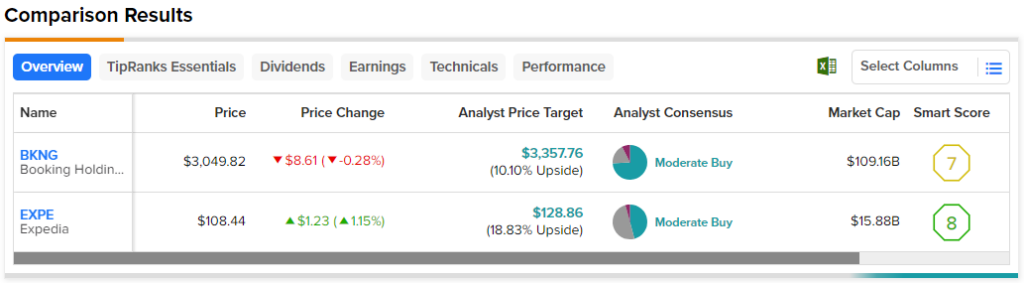

Therefore, let’s check in with TipRanks’ Comparison Tool to see how the two travel giants stack up in these early innings of the AI race.

Booking Holdings (NASDAQ:BKNG)

Booking Holdings is off to the races, thanks partly to hot travel demand and momentum in its vacation rental business. Shares of BKNG are sitting at a new all-time high of around $3,200 per share following the release of some better-than-expected second-quarter earnings per share (EPS) numbers of $37.62, ahead of the $28.98 consensus.

The company’s biggest strength as a travel-booking firm is its impressive network, especially in the European region.

In a prior piece, I stated Booking “had the network to beat” thanks to its “greater exposure to the European region,” a market in which “smaller boutique hotels are more popular” than in America, where big hotel chains dominate. I continue to view Booking’s European presence as a top reason to prefer it over the peer group.

As the company brings its incredible network into the generative AI age, I believe Booking can widen the gap between itself and its smaller rivals. In late July, the company introduced the AI Trip Planner feature in its mobile application to a closed group of American travelers. The product, which is in beta, is reportedly backed, in part, by OpenAI’s ChatGPT. Undoubtedly, anything OpenAI and ChatGPT touches seems to turn into gold.

As the AI product moves from beta, I believe Booking could have something special up its sleeves. Who knows? Your next travel agent may be a Booking large-language model (LLM).

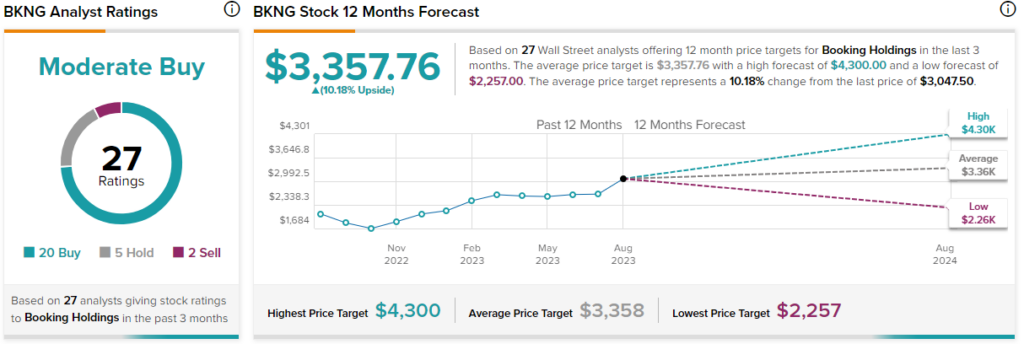

What is the Price Target for BKNG Stock?

Booking Holdings is a Moderate Buy, with 20 Buys, five Holds, and two Sells. The average BKNG stock price target of $3,357.76 implies 10.2% upside potential.

Expedia (NASDAQ:EXPE)

As Booking shot to new highs, Expedia has been sinking back to a range it spent most of the past decade in. At writing, shares of EXPE are right back to where they were in June 2015, and the stock stands out as a better value option to play the travel space, with its mere 11.2 times forward price-to-earnings multiple.

However, there are reasons for Expedia stock’s discount compared to Booking, and though AI could help address some of what’s weighing the stock down, many investors seem to be losing patience with a stock that hasn’t left shareholders much to show for their investment.

For the second quarter, Expedia beat on the bottom line, with earnings per share of $2.89, ahead of the $2.32 consensus. Despite the quarterly beat driven by recovering travel demand, though, gross bookings failed to impress, coming in at $27.32 billion, below the $28.89 billion estimate.

While I viewed the results as solid, it’s clear that Expedia could use a new feature to claw back a bit of market share from some competitors. Indeed, AI could be a growth lever management can pull to help turn the tides back on its side.

Like Booking, Expedia has a foot in the generative AI waters as it seeks to even the playing field with the likes of its top rival, Booking. The company brought the power of ChatGPT to its Android app, which could help enhance and simplify the trip-planning process and drive sales while the remaining travel season stays hot into the late summer.

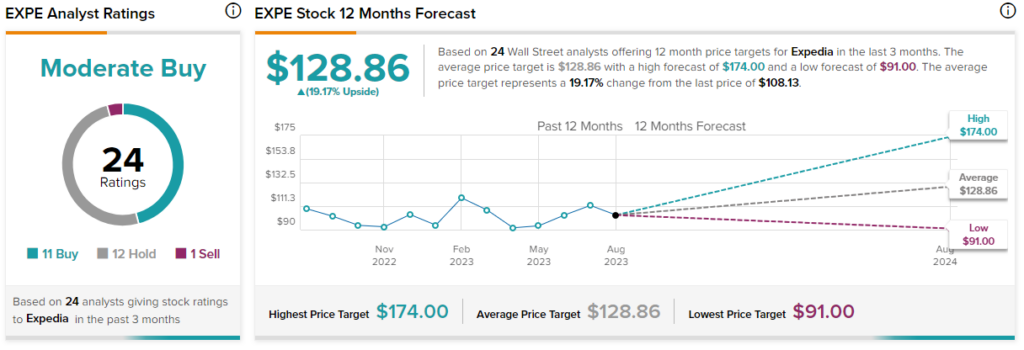

What is the Price Target for EXPE Stock?

Expedia is a Moderate Buy on TipRanks, with 11 Buys, 12 Holds, and one Sell. The average EXPE stock price target of $128.86 implies 19.2% upside potential.

The Bottom Line

The top travel firms have embraced generative AI with open arms. Only time will tell how things play out as the public tries out AI trip planners from both companies. For now, though, Wall Street sees more upside in EXPE stock, with 19.2% in expected upside versus BKNG stock’s 10.2%.