Many financial experts are talking up the prospect of a recession hitting this year and one legendary investor agrees with that line of thought.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

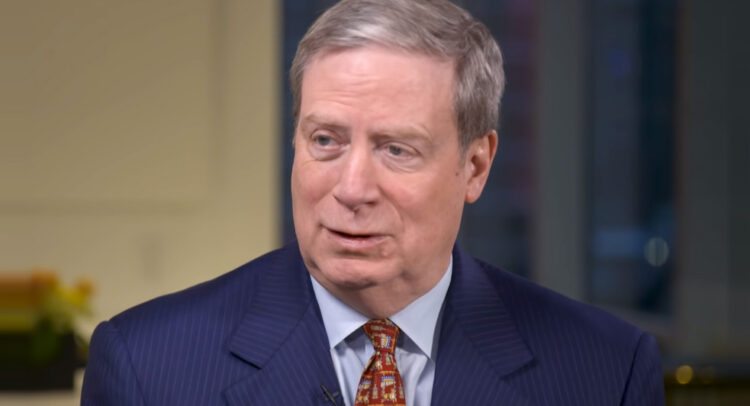

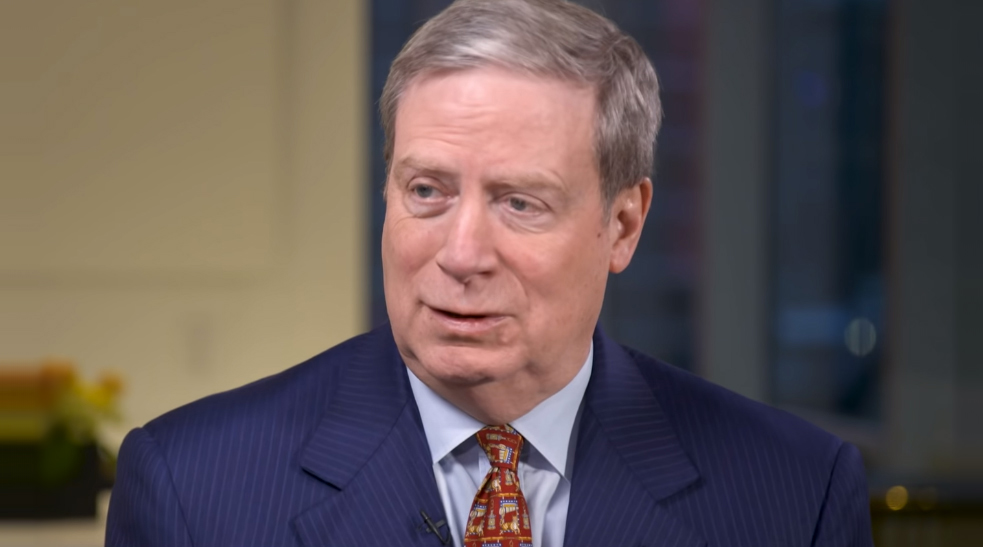

“We’re gonna have a hard landing and a bad recession in the U.S,” Stanley Druckenmiller has said, “probably sometime later this year.“

Druckenmiller now manages his investing affairs through his Duquesne Family Office, yet he had outsized success as a hedge fund manager for 30 years and is worth ~$6.4 billion. So, it’s definitely worth listening to his thoughts on the investing landscape. And even though Druckenmiller sees doom ahead for the U.S. economy, he thinks the coming period will bring with it massive opportunities, especially for those willing to bide their time.

Explaining his take on how he sees the market environment unfolding, Druckenmiller said, “I think the way to make money the next two years in the equity space is to be patient because I do think we have possibly some rough roads ahead and I do think the central bank will respond in some crazy way that will give you a period like ’70 to ’72 where you can make money or ’76 to ’78 when you could have made a lot of money, I think the opportunities are going to be amazing as this movie unfolds in the next year in macro and in equities.”

Druckenmiller obviously has his own ideas on where those opportunities will manifest themselves best, and his portfolio includes heavy bets on some specific names. We opened the TipRanks database to get the lowdown on a pair of his picks, so let’s find out what the Street’s analysts have to say about these choices.

Chevron Corporation (CVX)

The first stock Druckenmiller has a big stake in is oil and gas giant Chevron. With a market cap of $302 billion, the company is one of the largest oil firms in the world, operating in the downstream, midstream, and upstream segments of the industry and boasting a presence in more than 180 countries. Chevron’s upstream operations involve the exploration, production, and transportation of crude oil and natural gas, while its downstream operations involve the refining, marketing, and distribution of petroleum products. Boosting its core oil and gas operations, Chevron also has investments in alternative energy sources such as geothermal and solar.

Despite weak production and lower oil and gas prices in Q1, Chevron was able to bolster its earnings through successful refining operations, resulting in a strong quarter overall. Revenue fell by 6.6% year-over-year to $50.79 billion, but came in $1.3 billion above expectations. Chevron dialed in adjusted earnings of $6.7 billion, up from $6.5 billion in the same period a year ago, which resulted in adj. EPS of $3.55, bettering the $3.41 expected by the analysts.

Chevron is also a member of the exclusive Dividend Aristocrat club – a group of firms with over 25 years of repeated dividend raises. The current payout stands at $1.51 and yields 3.6%.

Druckenmiller obviously has big faith in Chevron’s ongoing success. CVX is the third largest holding in his portfolio (8.73%), and currently worth $155 million.

The company also has a fan in Raymond James’ Justin Jenkins. Looking ahead, the 5-star analyst thinks investor worries about production are set to subside from here on in.

“With a strong financial base, high relative shareholder payout, and an attractive relative asset portfolio, we think Chevron still offers the most straightforwardly positive risk/reward in a market that’s become tougher to differentiate among the oil & gas majors,” Jenkins explained. “1Q earnings were solid in CVX’s Upstream portfolio while downstream results added to upside. As execution continues to a 2H23+ weighted production profile in the Permian, we think investor concerns will ease.”

These comments form the basis for Jenkins’ Outperform (i.e., Buy) rating, while his $208 price target suggests the shares will post growth of 32% over the coming year. (To watch Jenkins’ track record, click here)

Overall, 16 analysts have chimed in with CVX reviews over the past 3 months and these breakdown into 6 Buys and 10 Holds, for a Moderate Buy consensus rating. The average target stands at $190.25, implying shares will gain ~21% in the months ahead. (See CVX stock forecast)

Coupang, Inc. (CPNG)

Accounting for the biggest holding in his portfolio (14.76%), and worth almost $350 million, the next Druckenmiller-endorsed stock we’ll look at is Coupang, the largest e-commerce platform in South Korea.

Offering a range of products including electronics, clothing, beauty products, and groceries, Coupang is known for its unique same-day delivery service, which allows customers to often receive their orders within hours of placing them. The company has also expanded its services to include Coupang Eats, a food delivery service, and Coupang Play, a streaming service that offers movies, TV shows, and music. The company prides itself on its innovative and customer-centric approach which has made it one of the most valuable companies in South Korea, with a market cap over $30 billion.

We’ll see Coupang’s 1Q23 results on May 9, but we can look back at its 4Q22 report for an idea of where the company stands. During that quarter, revenue climbed by 4.3% year-over-year to $5.3 billion, falling $70 million short of the consensus estimate. However, net income improved dramatically from a loss of $405 million in the year ago period to a record $102 million. This led to EPS of $0.06, surpassing the $0.05 consensus estimate.

Among the bulls is Goldman Sachs analyst Eric Cha who thinks the risk-reward for Coupang is “skewed to the upside.”

“The company’s continued momentum in gaining market share, as shown in the large gap between Coupang’s current market share (c.20% of domestic e-commerce TAM) and its share of growth (c.50%+), is backed by its defensive moat (i.e., nationwide coverage of next-day delivery and low ASP), and we think the market share gain momentum is offsetting industry headwinds as well as generating strong profitability improvement through economies of scale. Additionally, we believe Coupang appears poised to tap into other opportunities (e.g. fintech, OTT, overseas expansion, etc.),” Cha opined.

How does this all translate to investors? Cha rates the shares a Buy and backs it up with a $26 price target, indicating a potential upside of ~52% from the current levels.

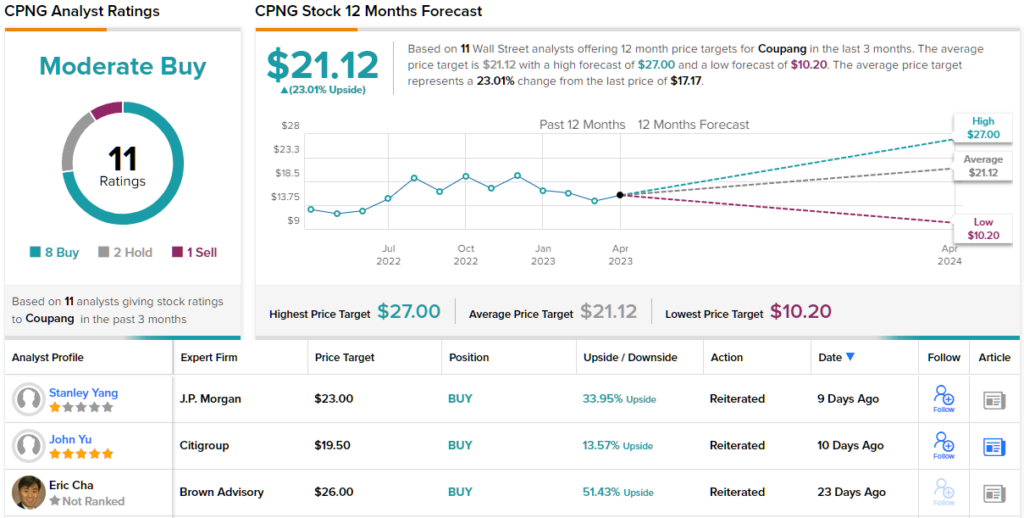

Elsewhere on Wall Street, the stock garners an additional 7 Buys, 2 Holds and 1 Sell, all coalescing to a Moderate Buy consensus rating. Shares are expected to change hands for a 23% premium a year from now, considering the average target currently stands at $21.12. (See CPNG stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.