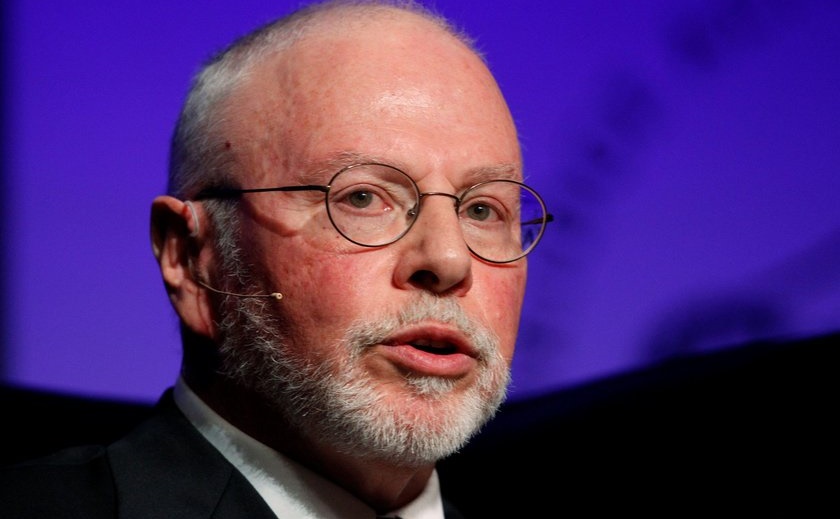

Investors hoping to get a good readout on where the markets might be heading – switch off now, as Billionaire Paul Singer has some bad news for you. The founder of Elliott Management – a firm with around $56 billion in assets under management – says the US economy is staring at an “extraordinarily dangerous and confusing period.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

On top of the challenging macro environment, Singer cites high valuations, the prospects of paltry returns in real estate and financial assets and the “significant chance of recession” as headwinds plaguing the outlook.

It’s not as if Singer doesn’t know what’s he talking about. Personal wealth of ~$5.5 billion aside, Singer foresaw the subprime mortgage crisis of 2008, and issued a warning on post-pandemic inflation at the beginning of the Covid-19 crisis.

That’s not to say Singer is packing up shop and putting his stock investing activities to rest. Despite the recession fears, he remains heavily invested in certain names. We ran a couple of equities sitting in his portfolio through the TipRanks database to see whether the Street’s stock experts agree these are stocks worth holding onto right now. Turns out they also think they are ones to own; both are rated as Strong Buys by the analyst consensus. Let’s find out why.

Endeavor Group Holdings (EDR)

Singer might think a recession is about to hit, be he evidently believes people are still going to keep on consuming plenty of entertainment. Part of his portfolio – 3,000,000 shares, worth ~$67 million at the current market price – is dedicated to Endeavor, a global entertainment, sports, and content firm.

The company is one of the largest and most influential players in the entertainment business, representing and managing a diverse roster of clients, including athletes, actors, musicians, and other creative professionals. In addition to talent representation, Endeavor provides event management, marketing, and licensing services. Moreover, it owns and operates several media properties, production companies, and streaming platforms, with subsidiaries under its wing including the Ultimate Fighting Championship (UFC) and Professional Bull Riders (PBR) and the Euroleague.

Endeavor dialed in mixed results in its latest financial statement – for 1Q23. Revenue climbed by 8.8% year-over-year to $1.6 billion, beating the Street’s forecast by $30 million, although EPS of $0.03 fell short of the $0.10 expected by the analysts.

That said, since the quarter’s end, the company has made some big and potentially some game-changing moves. In April, Endeavor disclosed a deal to combine UFC and WWE to form a new global sports and entertainment company, with its value estimated at $21 billion or more. WWE will be the parent company although Endeavor will hold a 51% interest in the business. And in the same month, the company announced an agreement to sell its sport education business IMG Academy for $1.25 billion.

These transactions inform Deutsche Bank analyst Brian Kraft’s bullish thesis for the Beverly Hills, California-based firm.

“We continue to believe Endeavor is an attractive investment given its favorable secular positioning, low valuation multiples, and attractive growth outlook,” Kraft recently wrote. “However, we like Endeavor even more now that the company has announced two de-leveraging and value unlocking transactions (the UFCWWE merger and the sale of IMG Academy). Furthermore, these deleveraging transactions will allow Endeavor to begin returning capital to shareholders this year and, as such, the company announced a $300M initial share repurchase program, as well as plans to initiate a dividend (up to $25M) next quarter.”

These comments back Kraft’s Buy rating, while his $35 price target suggests shares will climb ~57% higher over the coming year. (To watch Kraft’s track record, click here)

All of Kraft’s colleagues agree on this one. Based on Buys only – 8, in total – the stock claims a Strong Buy consensus rating. At $32.25, the average target implies shares will appreciate by 44% over the 12-month timeframe. (See EDR stock forecast)

Noble Corporation (NE)

Let’s turn now from entertainment to the energy industry and Noble Corporation, one of the world’s biggest offshore drilling contractors. In business for more than a century, from a one rig operation Noble has become a go-to source for exploration and production companies seeking to tap into offshore oil and gas reserves. The company operates a modern fleet of drilling rigs, including dynamically positioned drillships, semisubmersibles, and jackups, which come equipped with advanced technologies to ensure safe and efficient operations in challenging offshore environments.

The company has a global presence, serving major oil and gas markets across the Americas, Europe, the Middle East, Africa, and the Asia Pacific region and its value proposition evidently served it well in the most recently reported quarter – for the first quarter of 2023.

Revenue reached $610 million, in what amounted to a 190.5% year-over-year increase whilst outpacing the consensus estimate by $73 million. Adj. EPS of $0.19 also came in ahead of the $0.11 forecast. For the full year 2023, the company stuck to its previous guide for total revenue in the range of between $2.35 to $2.55 billion. Consensus was looking for $2.42 billion. As of the start of May, Noble said its backlog stood at $4.6 billion.

Singer is evidently keen on this offshore drilling firm. He holds a big NE position, owning 2,850,000 shares. These are currently worth north of $112 million.

The company also has a fan in Benchmark analyst Kurt Hallead, who believes Noble has what it takes to withstand any negative macro developments. He writes, “Noble’s backlog puts it on pace to generate circa $775mn in EBITDA and $250mn in FCF in 2023 with more than 50% upside in 2024… We see 2023 as a bridge year that will set the stage for strong financial performance between 2024-2027. The long cycle nature of offshore projects provides relative immunity to near-term macro risk.”

Quantifying this stance, Hallead rates NE shares a Buy and backs it up with a $50 price target. The implication for investors? Upside of 27% from current levels. (To watch Hallead’s track record, click here)

All in all, NE stock has received 3 reviews over the past 3 months, and all are positive, making the consensus view here a Strong Buy. Going by the $53 average target, a year from now, investors will be sitting on returns of 34%. (See NE stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.