In 2022, even against an unforgiving bear market backdrop, billionaire Ken Griffin’s Citadel hedge fund achieved record profits of $16 billion – the most ever seen on Wall Street.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

If you can attain that kind of performance in harsh bear market conditions, it only stands to reason that during a bull market, you can also expect Griffin to do rather well, and lo and behold, that’s what happened in 2023.

On the back of a year of double-digit returns, Citadel intends to distribute approximately $7 billion in profits to investors. Its flagship Wellington fund, which employs a multi-strategy approach, achieved an impressive 14.8% return through November of this year. For comparison purposes, that is far above hedge funds’ average gains of 4.35%.

As Griffin has been quoted as saying, his success is based on a lot of time and effort put in by his team in search of the best opportunities.

“The day job of all my investment team is to understand stocks and companies, it’s to meet with management teams,” the billionaire, who has a net worth of $36 billion, explained. “It’s really hard as a retail investor, who trades stocks in the free minutes of their day, to compete with people whose entire life comes down to researching and understanding business models and the pricing of securities.”

So, for Investors looking to gain an edge in the market, catching a ride on Griffin’s coattails makes sense. With this in mind, we thought we’d take a look at two stocks Griffin has recently been loading up on. These aren’t just any names but rather respective giants of their industries – Eli Lilly (NYSE:LLY) and Microsoft (NASDAQ:MSFT).

These picks also get plenty of love on Wall Street; According to the TipRanks database, both are rated as Strong Buys. Let’s see what makes them so.

Eli Lilly & Co

Our first Griffin-backed name is global pharma colossus Eli Lilly, a company founded all the way back in 1876 by Colonel Eli Lilly. Over the years, it has grown to become one of the largest and most influential players in the pharmaceutical industry. Eli Lilly is renowned for its focus on research and development in areas such as diabetes, oncology, neuroscience, and immunology and has a rich history of innovation. The company introduced several groundbreaking medications, such as the first commercially available insulin product for diabetes treatment and Prozac in the 1980s, thereby revolutionizing the treatment of depression.

However, the company is hardly resting on its laurels. Among its recent successes, Mounjaro stands out. Approved as a diabetes treatment last year, Mounjaro achieved impressive sales of $1.4 billion in Q3, marking a substantial increase from the $187 million generated in the same period a year ago. Throughout the first nine months of the year, Mounjaro’s total revenue reached nearly $3 billion, representing about 12% of the company’s total revenue haul.

In a significant development in November, Eli Lilly received FDA approval for its Zepbound injection, crafted from the same active ingredient as Mounjaro – tirzepatide. Zepbound is the first and sole obesity medication of its kind that activates both GIP (glucose-dependent insulinotropic polypeptide) and GLP-1 (glucagon-like peptide-1) hormone receptors.

Investors have evidently liked what’s been on offer this year, sending shares up by a market-beating 65%. The same could be said of Griffin, who increased his LLY position by 40% in Q3. Griffin added 213,671 shares during the quarter, bringing his total holdings to 759,793 shares. These currently command a market value of $441 million.

Jefferies analyst Akash Tewari also sees plenty to like here, and counts several reasons for keeping a bullish stance: “1) LLY has an attractive growth profile in a recessionary environment; 2) we’re bullish on GLP1 & see it as being one of the biggest drug classes of all time… Strong SELECT data opens the door for broader payer adoption and potential CMS coverage for the GLP-1 class in obesity; 3) we like LLY’s next-gen oral GLP-1 & think it could come close to Mounjaro-like efficacy LT; 4) we think there is potential near-term upside for LLY on rev and EPS growth.”

Quantifying his take, the 5-star analyst rates LLY shares a Buy, while his $708 price target factors in gains of ~23% for the coming year. (To watch Tewari’s track record, click here)

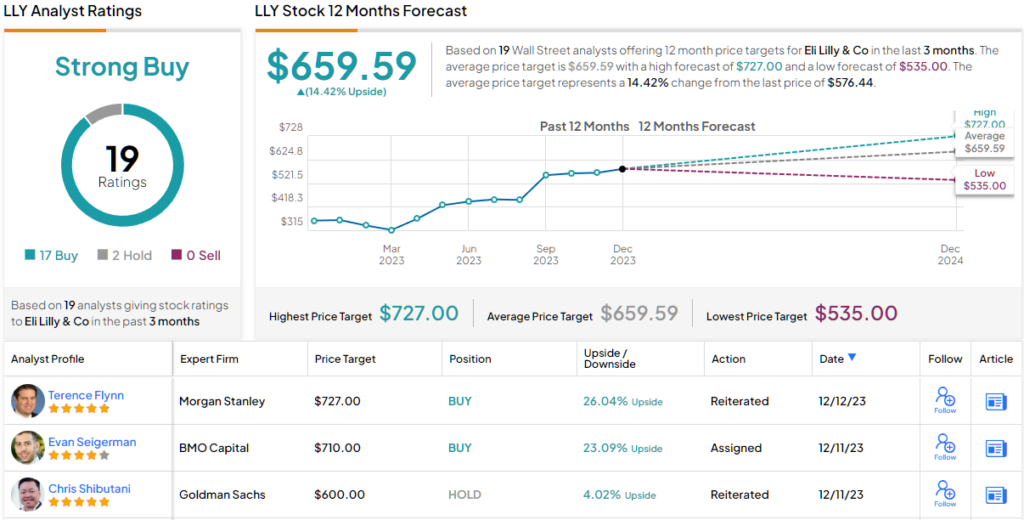

Almost all of Tewari’s colleagues agree. Based on a total of 17 Buys vs. 2 Holds, the stock claims a Strong Buy consensus rating. At $659.59, the average target suggests upside of 14% in the months ahead. (See Eli Lily stock forecast)

Microsoft

We’ll stay in the big leagues for our next Griffin pick, for a closer look at Microsoft. In fact, barring its long-standing tech giant rival, Apple, the company is the most valuable company in the world, boasting a market cap of $2.78 trillion.

Of course, Microsoft has played a pivotal role in shaping the modern tech landscape, with its products permeating our everyday lives. These products span from the Windows operating system, which is the world’s most dominant operating system, to the Microsoft 365 product suite, its increasingly important cloud computing platform Azure, and hardware products, including the Surface line of devices, Xbox gaming consoles, and peripherals, amongst plenty of other offerings.

Not to mention, Microsoft is highly involved in this year’s biggest buzzword: AI. It is heavily invested in ChatGPT maker OpenAI, and there was plenty of fanfare last month when its Copilot AI assistant tool became generally available in Microsoft 365.

Its excellent positioning in the AI space has also led to some handsome stock market gains this year, with investors pocketing returns of 57%. Meanwhile, Griffin has been adding to his already considerable MSFT stack. During Q3, he bought 1,631,542 shares, representing a 48% increase in his holdings. His total share count now stands at 5,037,676, which at the current price amounts to almost $1.9 billion.

For Truist analyst Joel Fishbein, there are two major tailwinds blowing at the company’s back, and these position Microsoft for further outperformance.

“Over the course of the next year, we believe that the stock performance will be driven by early results from their Copilot launches which we expect to drive upside to current expectations,” the 5-star analyst said. “We think that the AI opportunity ahead of the company could serve as a catalyst to accelerate both their top and bottom-line growth. Though our base case model calls for ~$5B in enterprise Copilot for Office contribution by FYE26, we believe that the ultimate opportunity could be in the tens of billions of dollars.”

“Over the last four quarters we estimate that Azure growth has eclipsed AWS growth on a dollar-basis, despite their smaller overall size. Given the accelerating growth that we project in these two business lines, along with the relative stability that we expect in the remainder of their business, we believe that upside to current expectations could drive a rerate higher in shares,” Fishbein went on to add.

These comments underpin Fishbein’s Buy rating, while his Street-high $600 price target implies shares will gain another 60% over the one-year timeframe. (To watch Fishbein’s track record, click here)

There’s almost unanimous agreement on Wall Street that this is a stock to own. Barring one skeptic, all 36 other recent reviews are positive, naturally making the consensus view here a Strong Buy. Going by the $421.79 average target, a year from now, investors will be pocketing returns of 14%. (See Microsoft stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.