Tech has been driving this year’s market rally and that has been good news for chipmakers. These are the companies whose products power a whole host of technologies, from AI to EVs, and whose offerings have been subject to a surge in demand as these new technologies have permeated the mainstream. That success has been reflected in the markets; the PHLX Semiconductor index – the main chip industry barometer – is up by 52% year-to-date, even putting the tech-heavy NASDAQ’s 36% gain in the shade.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Investors have evidently been warming to the theme and so has one of Wall Street’s legendary stock pickers. Ken Griffin, the founder and CEO of hedge fund Citadel, who boasts a net worth of ~$35.2 billion, has been busy loading up on two semi giants – Nvidia (NASDAQ:NVDA) and AMD (NASDAQ:AMD) – stocks whose success has far outstripped that of most big names this year but for whom Griffin must see more good times ahead.

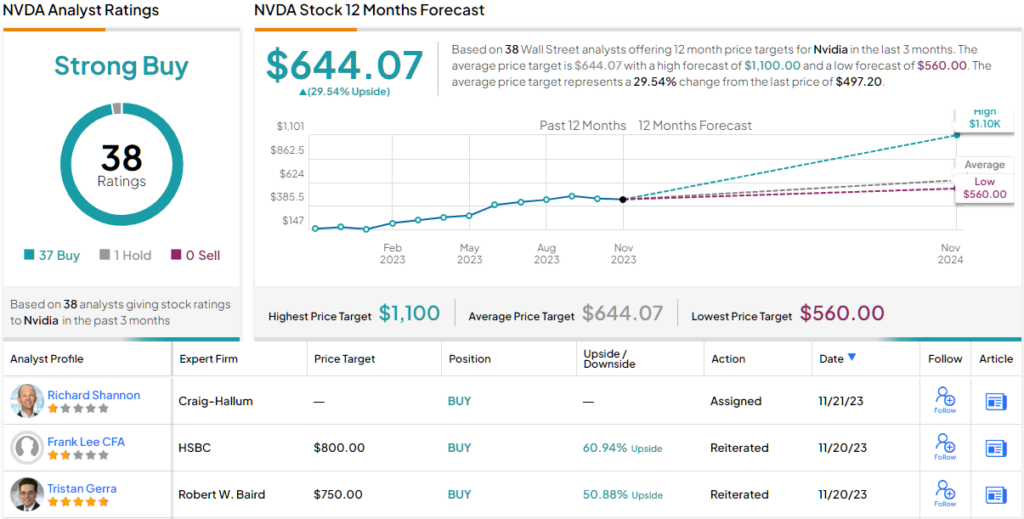

Griffin is certainly not alone in conveying confidence in these names. According to the TipRanks database, both are seen as Strong Buys by the analyst consensus. Let’s find out what makes them so.

Nvidia

If there’s one stock that embodies this year’s tech rally, then Nvidia is probably it. The shares are up by an awesome 252% since 2023 entered the frame with the stock now claiming a spot in the very exclusive environs of the $1 trillion+ market cap club. The gains have come as the semiconductor firm has positioned itself as the undisputed AI chip king, a market segment which it dominates with more than an 80% share.

Nvidia’s success has been founded on its trailblazing development of the graphics processor unit (GPU) with the company initially concentrating on Gaming applications and PC graphics technology. Nowadays, its products are primarily employed to enhance the speed of complex computational tasks with the Data Center sector providing the bulk of revenue.

And that is some impressive bulk. Nvidia has been delivering some slam dunk earnings reports this year with beat-and-raises par for the course.

That was the case in August, when the company released its fiscal second quarter of 2024 (July quarter) report. With Data Center revenue reaching a record $10.32 billion, total revenue hit $13.51 billion, amounting to a 101.6% year-over-year increase while beating the Street’s forecast by $2.43 billion. Likewise, at the other end of the equation, adj. EPS of $2.70 beat the analysts’ forecast by $0.61.

Revenue for FQ3 is expected to be $16.00 billion (plus or minus 2%), far above the $12.42 billion expected by consensus at the time of the F2Q print. That has now changed dramatically in anticipation of the October quarter (FQ3) readout. Nvidia will announce its quarterly haul today after the close (November 21), with the Street now expecting revenue of $16.11 billion and adj. EPS of $3.39.

Griffin must think another strong readout is on the way. During the quarter, he increased his NVDA holdings by 57% with the purchase of 738,327 shares. His total stake now stands at 2,053,872 shares, currently worth over $1.03 billion.

Rosenblatt analyst Hans Mosesmann, an analyst ranked right at the top end of Street experts, has no doubt another excellent print is about to hit.

“NVDA remains one of our top plays as the company still stands in a league of its own when it comes to software and AI solutions,” the 5-star analyst said. “Nvidia’s October quarter setup is for another beat-and-raise with the ongoing dynamic being supply constraints amid a mad and accelerating pace of new product launches. We see Nvidia’s earnings potential for CY25 in the high-$20s, which we view as attainable as Nvidia is a best-in-class AI play with growth vectors into next generation networking/DPU adoption and early-days of autonomous driving S/W kicker. We like the opportunity for Nvidia in several markets for years to come.”

Mosesmann’s confidence is borne out not only by his Buy rating but also by a Street-high price target of $1,100, which suggests the shares will add further gains of 121% over the coming year. (To watch Mosesmann’s track record, click here)

Almost all of Mosesmann’s colleagues agree with that assessment. Barring one skeptic, all 37 other recent reviews are positive, making the consensus view here a Strong Buy. Going by the $644.07 average target, the shares will deliver 12-month returns of ~30%. (See Nvidia stock forecast)

Advanced Micro Devices

It’s quite fitting that for our next Griffin-endorsed stock will follow up Nvidia with AMD, a company that is often seen as representing its main competitor in the AI chip game. Nvidia should certainly watch its back, not only from the impending launch of the AI-focused next-gen AMD Instinct MI300 data center GPU accelerator family, but also because AMD has had previous success in reining in a segment leader.

Under Lisa Su’s astute leadership, the company rose from one flirting with bankruptcy around a decade ago to become a chip powerhouse, taking advantage of Intel’s missteps in the CPU market to steadily eat away at its dominance.

And like Nvidia, AMD stock has delivered the goods for investors this year, with the shares up by 90% year-to-date, the gains fueled by strong quarterly reports such as the recent Q3 print.

Revenue climbed by 4.1% from the same period a year ago to $5.8 billion, in turn beating the consensus estimate by $110 million. At the other end of the equation, Q3 adj. EPS of $0.70 outpaced the analysts’ forecast by $0.02.

Meanwhile, Griffin must have enjoyed those results whilst thinking there is likely more upside on the way. During Q3, he added 533,996 AMD shares to his portfolio, bringing his total stake to 2,498,982. At the current share price, these are now worth ~$303.7 million.

Will check in again with Rosenblatt’s Mosesmann, who has nothing but praise for this semi giant. “AMD remains one of our top conviction ideas as the company is in the early stages of disrupting the CPU and GPU markets through superior chip design and manufacturing execution,” he said. “We believe AMD can capture at least 50% share in data center CPUs over the next 2-3 years based on clear TCO advantages, with continued share gains in other segments. The MI300 GPU compute series is just incremental opportunity in the $ billions.”

These comments underpin Mosemann’s Buy rating, which is once again backed by a Street-high target of $200, suggesting shares will climb 69% higher over the one-year timeframe.

Like Mosemann, the rest of the Street is bullish on AMD. Based on 23 Buy recommendations, and 7 Holds, the stock boasts a Strong Buy consensus rating. The shares have an average price target of $127.13, suggesting 7.5% one-year gain from the current trading price of $118.44. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.