Every investor is looking to gain an edge and beat the market and there are numerous strategies that can help in this undoubtedly difficult endeavor.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

One obvious game plan is to follow in the footsteps of Wall Street’s investing titans, and you can certainly put Ken Griffin in that bracket. The billionaire not only has a decades-long history of investing success, but his Citadel hedge fund also raked in the profits last year – a Wall Street record of $16 billion, in fact – done against a general backdrop of harsh bear market conditions. So, it’s definitely worth keeping an eye on the Citadel Investment Group Founder and CEO’s transactions.

Recently, Griffin has been loading up on two names and we opened the TipRanks database to get the lowdown on the pair and find out what Wall Street’s cadre of analysts think of these stocks. Turns out it’s not only Griffin showing confidence here; both are rated as Strong Buys by the analyst consensus, too. So, let’s see what makes them compelling additions to a portfolio right now.

2seventy bio (TSVT)

We’ll head to the biotech space for our first Griffin-backed stock. 2seventy bio is a company with a mission to alter the cancer treatment landscape and help patients in urgent need. It aims to do so by developing at a fast pace therapies for cancer and that’s where the name comes from – as per the company, 2seventy refers to the “maximum speed of human thought.” That occurs at 270 miles per hour.

The ultimate goal of a biotech company is to successfully develop and gain FDA approval for a new drug, a feat that few are able to accomplish. However, 2seventy has already achieved this milestone with its drug Abecma, which was developed in collaboration with Bristol Myers. In March 2021, the FDA approved Abecma as the first cell-based gene therapy to treat multiple myeloma. As part of their partnership, both companies share the profits and losses related to the drug equally within the US.

Sales appear to be going well. Bristol Myers reported that the drug generated revenues of $118 million in Q1, amounting to a 26% year-over-year uptick.

The two are also working on expanding Abecma’s remit into earlier lines of therapy. In fact, based on the Phase 3 KarMMa-3 study in adults with r/r MM who have received an immunomodulatory agent, a proteasome inhibitor, and an anti-CD38 monoclonal antibody, the FDA recently accepted an sBLA (supplemental biologics license application) for Abecma; a PDUFA date has been set for December 16, 2023. Furthermore, the pair intend to move ahead with a front-line MM study this year.

Griffin evidently likes what’s on offer here. He bought 1,974,028 shares this year, increasing his current ownership stake in the company to 2,051,053 shares. These are currently valued at $21.12 million, representing a 4.1% stake in the company.

2seventy has also scored fans within the analyst community. Among them is Wedbush analyst David Nierengarten, who rates the stock an Outperform (i.e. Buy), while his $24 price target implies a one-year upside of 131%. (To watch Nierengarten’s track record, click here)

Backing his stance, the analyst writes: “Successful approval of Abecma in 3L+ MM could generate $200-300 million in operational income for TSVT in the 2024-2025 period. The company’s strong cash position and a potential revenue stream from the approval of Abecma in earlier lines of treatment is guided to support development of its pipeline into 2026. We expect to see updates from several of its clinical and near clinical programs in 2023…”

“We continue to believe share of TSVT remain significantly undervalued and believe now is the time to own TSVT ahead of the likely sBLA approval of Abecma in 3L+ MM and data catalysts from the company’s clinical pipeline,” Nierengarten summed up.

It’s not just Nierengarten predicting big gains. The Street’s $28.33 average target allows for 12-month returns of an even better 173%. Moreover, all 3 recent ratings are positive, providing the stock with a Strong Buy consensus rating. (See TSVT stock forecast)

Western Alliance Bancorporation (WAL)

The next Griffin-endorsed stock under the spotlight here is Western Alliance Bancorporation. Headquartered in Phoenix, Arizona and boasting over $65 billion in assets, the company prides itself on being one of the US’s top performing banks and has the accolades to back up that claim. Both American Banker and Bank Director ranked it as the #1 top-performing large bank with assets greater than $50 billion in 2021 while the company takes 13th position on the 2023 Forbes list of America’s Best Banks.

The company’s main subsidiary is Western Alliance Bank, but other subsidiaries include the retail-focused Bank of Nevada, Bridge Bank, a San Francisco Bay Area-based commercial bank and First Independent Bank, a retail bank located in western Nevada.

Against a backdrop of multiple banks collapses, the company delivered a strong set of results in the recently reported Q1 statement. Adj. net revenue climbed by 28.2% year-over-year to $712.2 million, while adj. EPS climbed from $2.22 in Q1 2022 to $2.30. Both metrics beat Street expectations. Importantly, while the company witnessed outsized net deposit outflows in the immediate aftermath of other banking failures, deposit balances stabilized toward the end of the quarter.

However, despite the strong Q1 results and post-earnings surge, the stock has been the victim of the banking sector’s woes, and the shares have shed 39% of their value year-to-date.

Nevertheless, Griffin must see plenty of value here. Having purchased 4,468,967 shares this year, his current ownership stake in the company stands at 5.3%, equivalent to 5,781,968 shares worth $198.26 million.

Mirroring Griffin’s confidence, Truist analyst Brandon King salutes the firm’s “balance sheet repositioning efforts” and finds WAL in good health despite acknowledging understandable investor concerns.

“The company is now in a much stronger position with deposit stabilization, improved liquidity, and visible trajectory to at least peer level capital levels,” King said. “Additionally, the company’s sharpened focus towards more profitable relationship lending should result in a lower implied cost of capital compared to previous higher growth ambitions. That said, we still think some investors could be more hesitant to buy shares given the potential credit risk and elevated economic uncertainty, but we still believe losses will be manageable medium term and lower than peers. We think this dynamic provides a very attractive entry point…”

These comments underpin King’s Buy rating while his $65 price target makes room for 12-month returns of 91%. (To watch King’s track record, click here)

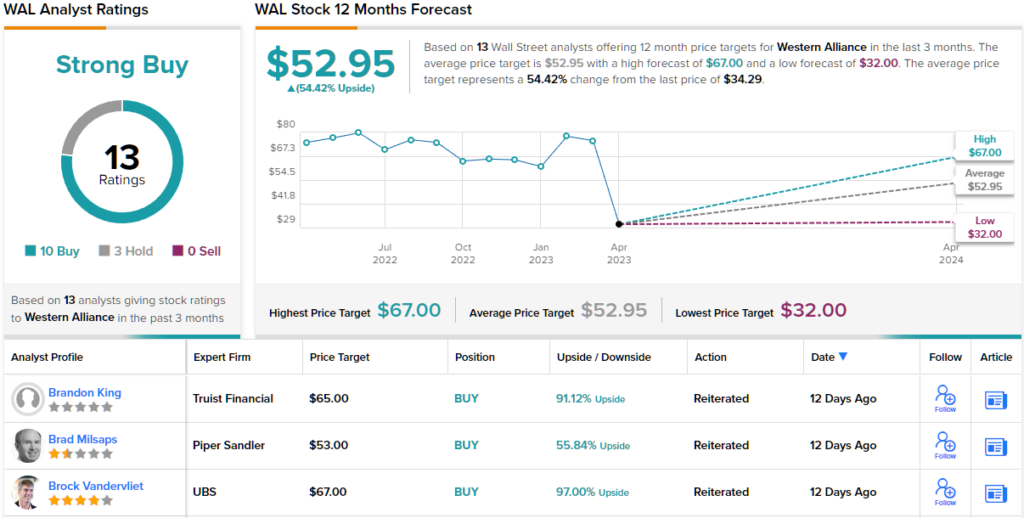

Most agree with that thesis. The stock claims a Strong Buy consensus rating, based on 10 Buys vs. 3 Holds. The analysts see shares gaining 54% over the next year, considering the average target stands at $52.95. (See WAL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.