With decades-long success on Wall Street, and personal wealth valued at ~$6.5 billion, legendary stock picker Ken Fisher obviously knows a thing or two about investing and what segments currently represent the best opportunities.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Fisher Investments founder recently shared his insightful recommendation for savvy investors, suggesting that investing in luxury goods stocks could be a smart and profitable move. Fisher believes that luxury goods companies have a unique ability to thrive even during challenging economic times. These companies, known for their premium brands and top-notch craftsmanship, tend to attract a dedicated customer base that values exclusivity and quality.

“Times are good for global luxury goods,” Fisher said. “Heated inflation didn’t dent their robust gross profit margins, which have remained above 55 per cent since 2021.”

There are other positive developments happening too. Despite concerns of a stalling economic recovery, big French and Swiss companies have been racking up robust sales in China, and as wealth in India spreads wider, big global names are now penetrating there too, causing a “luxury goods spending boom.”

“Look around you in the Middle East and North Africa,” he goes on to add. “The big global brands are expanding everywhere, particularly in the UAE.”

With that in mind, then, we opened the TipRanks database and got the lowdown on two luxury goods names well-liked by certain Wall Street analysts, who see both having plenty of room to run in the coming months. Let’s see what makes them appealing investment choices right now.

Tapestry, Inc. (TPR)

The first name we’ll look at is Tapestry, a renowned luxury brand that has cemented its place as a global leader in the fashion and accessories industry. Tapestry operates three distinct labels: Coach, Kate Spade New York, and Stuart Weitzman. Each brand brings its own thing to the market, catering to different segments of its luxury consumer base.

Flagship brand Coach combines classic elements with modern touches, appealing to both men and women seeking out elegant and functional pieces. Kate Spade New York, on the other hand, is known for its playful and vibrant approach, while Stuart Weitzman is recognized for its high-quality footwear.

Despite a slowdown of luxury purchases in the US, boosted by sales in China rising by 20%, the company delivered a strong top-line in its latest quarterly report, for the fiscal third quarter of 2023 (March quarter). In total, revenue climbed by 5% year-over-year to $1.51 billion, whilst beating the Street’s forecast by $70 million. Likewise on the profitability profile, EPS of $0.78 trumped the analysts’ $0.60 forecast.

The company also increased its outlook for the fiscal year. The company now expects revenue growth of 3% compared to 2% to 3% beforehand and anticipates delivering a profit of $3.85 to $3.90 a share, vs. the prior $3.75. Additionally, Tapestry remains on course to repurchase around $700 million in common stock in the current fiscal year.

All of the above posits Tapestry as his “Industry Baby,” says Guggenheim analyst Robert Drbul.

“We believe high profitability, experienced management, strong balance sheet, and healthy brand equity of the Coach brand deserves a seat at the luxury and accessible luxury table,” the analyst explained. “We expect this management team to continue to execute against its FY25 $5.00+ EPS target and believe there is significant potential share price upside from current levels. We remain confident in management’s ability to execute its strategy, which we would expect to drive significant multiple expansion. While we are mindful of recessionary concerns, we believe this management team and portfolio of brands has the ability to weather the downturns.”

Putting these thoughts into gradings and numbers, Drbul rates Tapestry shares a Buy, backed by a $60 price target. This suggests the shares will climb 38% higher over the coming months. (To watch Drbul’s track record, click here)

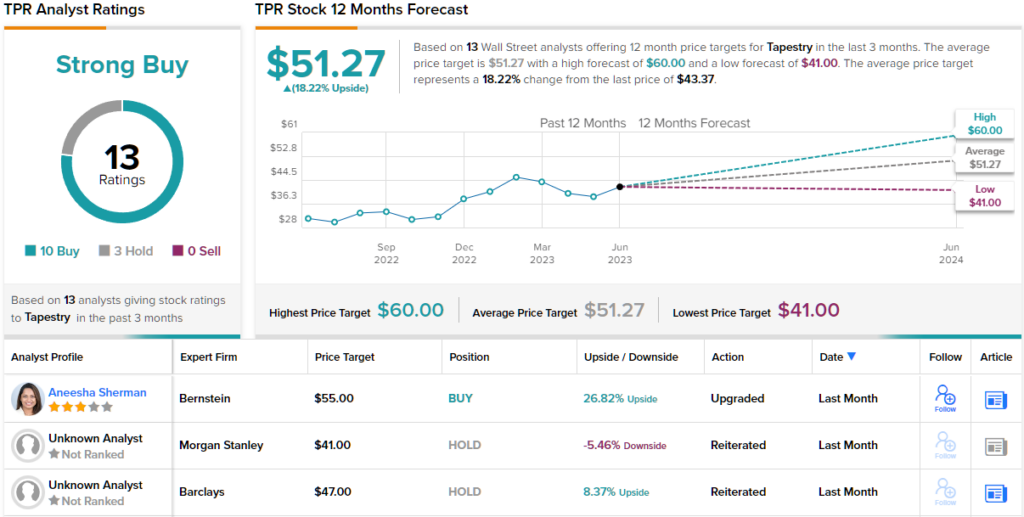

Most analysts agree with Drbul’s take. The stock claims a Strong Buy consensus rating, based on 10 Buys vs. 3 Holds. At $51.27, the average target makes room for one-year gains of ~18%. As an added bonus, Tapestry also pays out a dividend. The current quarterly payout stands at $0.30 and yields 2.65%. (See Tapestry stock forecast)

Capri Holdings (CPRI)

We’ll stay in the same vicinity for our next luxury brand name. Capri Holdings is a leading global fashion luxury group with three iconic brands operating under its umbrella: Michael Kors, Versace, and Jimmy Choo. This company has also established a strong presence in the luxury fashion industry and is well-known for its craftsmanship, glamour and innovation. Each brand in the portfolio has its distinct identity and offers a wide range of products, including apparel, accessories, footwear, and fragrances.

That said, revenues fell across the board in the latest quarterly readout, for the fiscal fourth quarter of 2023 (March quarter). With its brands seeing year-over-year declines, total revenue dropped by 10.1% to $1.34 billion. Still, the drop was expected on the Street and the figure actually managed to beat expectations by $60 million. At the other end of the spectrum, adjusted earnings per share of $0.97 met the prognosticators’ forecast.

Moving forward, Capri sees full-year F2024 revenue of ~$5.7 billion, a touch below consensus at $5.73 billion. On the other hand, the estimated EPS of $6.40 is higher than the Street’s $6.28 forecast.

Despite the luxury brand segment’s success this year, Capri stock has been excluded from the rally and is down by 36%. Nevertheless, following talks with management, BMO analyst Simeon Siegel thinks the shares’ valuation is way too low, and he believes they offer good value at current levels.

“Our recent management meetings addressed topics including guidance puts-and-takes, pricing/GM, brand-strategy, inventory and capital allocation,” Siegel said. “Management expressed confidence in guidance given self-help (staffing/product initiatives etc) and easing compares. CPRI’s one of our best ‘guide-beaters’ but, to be fair, their ‘reiterated’ guides have also seen subsequent cuts. However, we believe it shouldn’t matter as shares are already pricing meaningful cuts/miss. We commend management’s focus on maintaining brand equity, believe shares inexpensive and reiterate our Outperform rating given intrinsic value mismatch.”

That Outperform (i.e., Buy) rating comes alongside a $68 price target, which implies shares will post growth of 84% over the one-year timeframe. (To watch Siegel’s track record, click here)

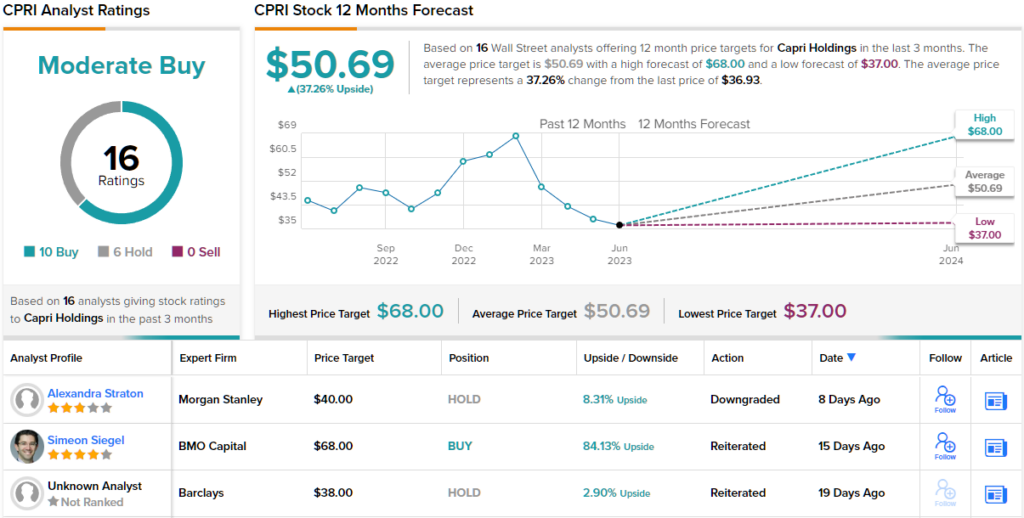

Elsewhere on the Street, the stock garners an additional 9 Buys and 6 Holds for a Moderate Buy consensus rating. Going by the $50.69 average target, a year from now, investors will be pocketing returns of 37%. (See CPRI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.