Needless to say, every investor is looking for big returns and while there are many routes to follow in trying to achieve that goal, tracking the moves made by Wall Street’s most successful investors is surely a good place to start.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

One investor sitting pretty near the top of the pile is Izzy Englander. Interested in the stock market from an early age, Englander was already trading stocks in high school. By 1989, he established the Millennium Management hedge fund with $35 million in seed money, which by the end of last year boasted $57.5 billion in assets under management. So, it’s only natural that when Englander gets the cheque book out, investors would like to get a peek inside his shopping bag.

With this in mind, we’ve pulled up the details on three of the investing giant’s recent purchases and ran them through the TipRanks database to see what the Street’s experts make of his choices. Turns out, all are rated as Strong Buys by the analyst consensus. Let’s find out why they are ticking all the boxes right now.

Ranger Oil Corporation (ROCC)

The first Englander-backed stock we’ll look at is an independent oil and gas firm, Ranger Oil Corporation. The company specializes in the development and production of crude oil, natural gas liquids, and natural gas onshore. Ranger’s main activities take place in South Texas’ Eagle Ford Shale, where the company’s operations comprise of drilling unconventional horizontal development wells and running its producing wells.

From the company’s latest set of quarterly results, it’s clear to see Ranger has enjoyed the 2022 natural gas and oil boom. In Q3, Ranger generated revenue of $305.09 million, amounting to a 117.7% year-over-year growth and coming in ahead of Street expectations by $40.09 million. It was a similar story on the bottom-line, with EPS of $5.26 coming in some distance above the $3.13 expected by the analysts.

Energy stocks have done very well in 2022, having entirely sidestepped the bear and Ranger is no different. The shares are up by 31% year-to-date, although Englander must still believe they offer excellent value. He opened a new position in Q3 by snapping up 692,054 shares, now worth over $24 million.

He’s not the only one seeing value here. Scanning the Q3 print and assessing its prospects, Truist analyst Neil Dingmann thinks the company is making all the right moves.

“Ranger continues to pull the right levers to position the company for record 2023 production/ earnings/FCF versus many other E&Ps who will see results trail off,” the 5-star analyst wrote. “Most recently the company added a third rig and acquired a significant working interest in pads that will soon be drilled, both helping drive absolute production growth. We expect ROCC will judiciously use its potential record future FCF to scale the business and provide shareholder returns (specifically share buybacks) depending on which selection provides the highest near-term returns.”

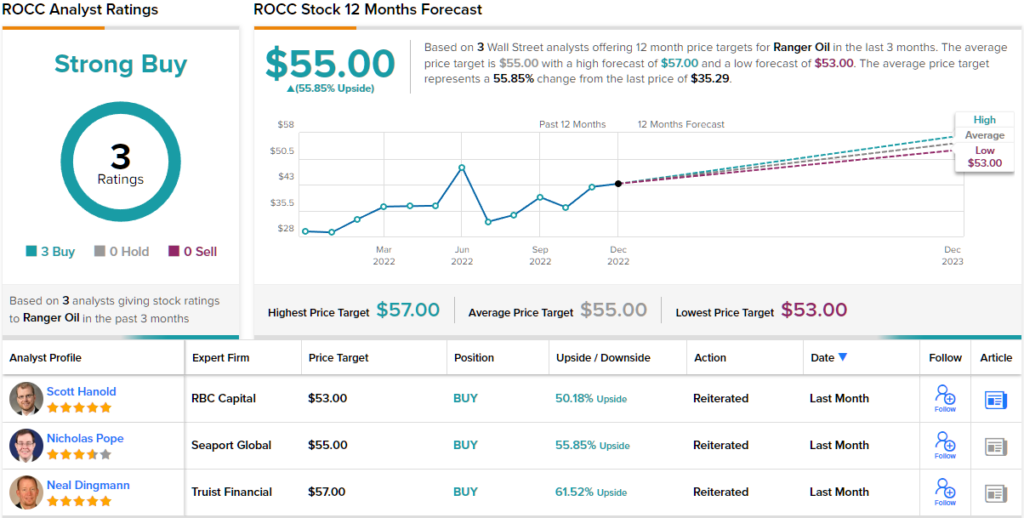

Unsurprisingly, Dingmann puts a Buy rating on ROCC shares while his $57 price target makes room for 12-month returns of a robust 61%. (To watch Dingmann’s track record, click here)

Turning now to the rest of the Street, other analysts echo Dingmann’s sentiment. 3 Buys and no Holds or Sells add up to a Strong Buy consensus rating. Going by the $55 average target, the shares will climb ~56% higher over the one-year timeframe. (See ROCC stock forecast on TipRanks)

Dolby Laboratories (DLB)

Famous for inventing the Dolby Noise Reduction system, Ray Dolby formed Dolby Labs in London, England, back in 1965. Based in the U.S. since the mid-70s, the company is an audio innovator and pioneer, with its tech such as audio noise reduction, spatial audio, audio encoding/compression, and HDR imaging basically deemed to be the industry standard, and all providing consumers of digital content – songs, video games, films – with a richer experience. The company makes almost all of its revenue by granting licenses to clients for the use of its proprietary patents via which it collects royalties.

Like many others, however, 2022 has been no easy ride, as was evident in the company’s recent fiscal Q4 report. Revenue fell by 2.4% from the same period a year ago to $278.2 million, falling short of the consensus estimate by $27.03 million. Adj. EPS also missed expectations, coming in at $0.54, below the $0.71 forecast.

The outlook was nothing to shout about, either. For the fiscal first quarter, the company expects revenue in the $300 million and $330 million range, and EPS between $0.46 and $0.61. The Street was looking for $366 million and $0.80, respectively.

Nevertheless, with the shares down by 23% since the turn of the year, Englander must think they represent good value. He made DLB stock a new addition to the portfolio in Q3, purchasing 350,354 shares, now worth north of $25.5 million.

Sharing his enthusiasm, Tigress 5-star analyst Ivan Feinseth expects the company to overcome the current difficult conditions and eyes a big opportunity ahead.

“Near-term headwinds continue to create a long-term buying opportunity as the ongoing integration of key DLB technologies in the ever-growing audio and video entertainment products and content production ecosystem, along with increasing integration in entertainment production equipment and computing technologies, will continue to drive accelerating growth,” Feinseth wrote.

“The Metaverse’s emergence creates a new paradigm for audio and video integration. The Metaverse will create an even more interactive and immersive environment that will be enhanced by greater customization of content integration on an increasingly individualized basis,” the analyst added.

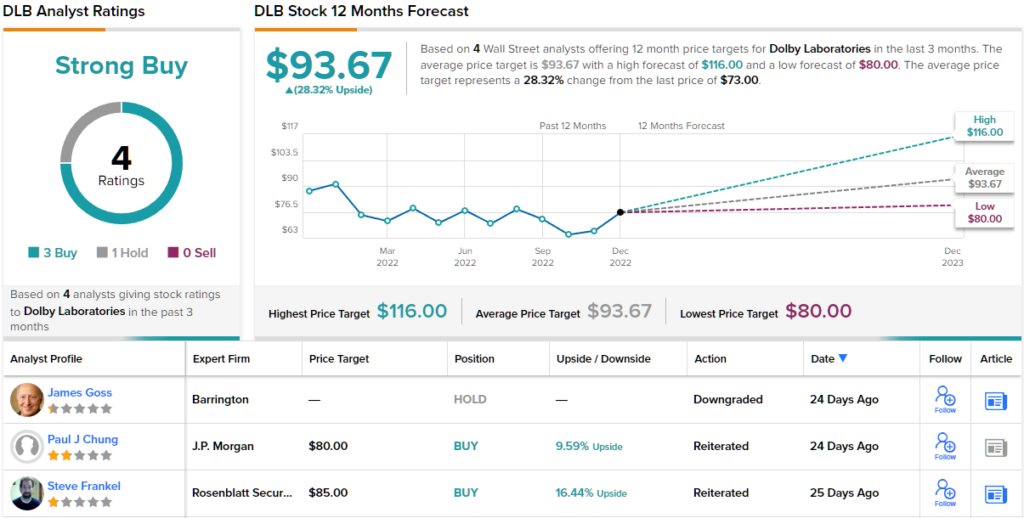

Accordingly, Feinseth recommends investors Buy in, and his $116 price target implies one-year share appreciation of 59%. (To watch Feinseth’s track record, click here)

Overall, Wall Street tends to agree with the bull. The 4 recent analyst reviews include 3 Buys and 1 Hold, for a Strong Buy consensus rating, and the $93.67 average price target indicates a 28% upside potential from the current share price of $73. (See DLB stock forecast on TipRanks)

Apellis Pharmaceuticals (APLS)

The final Englander-endorsed name we’ll look at is Apellis Pharmaceuticals, a biopharma company with a remit to discover and bring to market therapeutics for autoimmune and inflammatory diseases.

Setting out with the aim of becoming the first company to create a targeted C3 therapy for major complement-driven disorders – a feat many scientists thought it was difficult, if not impossible, to do – Apellis achieved its goal when the FDA approved Empaveli (pegcetacoplan) for the treatment of adults with paroxysmal nocturnal hemoglobinuria (PNH) last year. So far, it is the first and only approved targeted C3 therapy.

The company’s pipeline boasts various candidates in different stages of development earmarked to treat rare, retinal, and neurological diseases, but of interest here is the company’s attempt to bring to market the first potential treatment for geographic atrophy (GA), a condition that can result in blindness and which impacts more than five million people across the globe.

Following the FDA’s acceptance of an amendment to the New Drug Application (NDA) for intravitreal pegcetacoplan, the company’s GA treatment, a PDUFA date has been set for February 26, 2023.

It’s quite possible Englander reckons its chances of success are quite good, as he purchased 257,869 APLS shares – making the stock another new addition to his fund’s portfolio. These are now worth more than $12.6 million.

We can’t tell for certain if the drug is heading for approval, but going by the FDA’s comments, Cowen analyst Phil Nadeau is pretty confident in a positive outcome.

“The language in the FDA’s Standard Operating Procedure for Major Amendments suggests the review of unsolicited amendments is up to the discretion of the FDA, and that the new information is considered ‘where the amendment may support an approval in that review cycle,’” the 5-star analyst wrote. “Though the FDA’s mindset cannot be known until the PDUFA, this appears to us to be another datapoint that pegcetacoplan is on its way toward approval. If not, then the FDA would not have accepted the amendment and extended the PDUFA, but rather a CRL would have been issued on the original PDUFA.”

These comments underpin Nadeau’s Outperform (i.e., Buy) rating while his $70 price target suggests the shares are undervalued by 42%. (To watch Nadeau’s track record, click here)

Overall, 12 analysts have offered their views on APLS and these break down into 9 Buys and 3 Holds, providing the stock with a Strong Buy consensus rating. At 76.17, the average target implies shares will deliver returns of ~54% over the coming months. (See APLS stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.