In this uncertain market environment, the educated investor would do well to seek out some signal that can cut through the noise and indicate the sound stock purchase choices. Following the legendary investors, the traders who build multi-billion-dollar fortunes on the stock market trading scene, is a popular strategy.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Among these Wall Street titans is Israel “Izzy” Englander. Englander serves as the Chairman, CEO and Co-Chief Investment Officer of Millennium Management, the hedge fund he founded in 1989. Speaking to his impressive track record, he took the $35 million the fund was started with and grew it into more than $58 billion in assets under management.

Recently, Englander has been busy padding the portfolio with some big buys, and we’ve tracked down two of his recent purchases.

Do these choices sit well with the Street’s stock experts? Turns out they certainly do. According to the TipRanks database, both are rated as Strong Buys by the analyst consensus. Not to mention substantial upside potential is also on the table.

Golar LNG (GLNG)

The first Englander-backed stock we’ll look at is Golar LNG, a company that provides liquefied natural gas (LNG) transportation services. That is, Golar designs, constructs, owns and oversees marine infrastructure – or, floating liquefied natural gas (FLNG) facilities – that transforms natural gas into LNG and LNG back into natural gas. As an industry leader in the development of floating terminals, the company prides itself on producing more LNG from a floating facility than any of its competitors.

That said, it has not all been plain sailing recently with the company delivering a mixed 4Q22 report. Revenue fell by 48.6% year-over-year to $59.14 million, and at the same time came in $8.74 million below expectations. On the other hand, Q4 net income of $71 million came in some distance above the $8 million generated in the same period a year ago, while adjusted EBITDA of $87 million compared well to the $56 million delivered in 4Q21.

Englander must think the positives far outweigh the negatives here. In Q1, he bought 1,974,028 shares, and now holds 5,216,087 in total. His current ownership stake in the company stands at 4.9% and amounts to over $110 million.

The hedge magnate is not the only bull here. Assessing the company’s prospects, Stifel analyst Benjamin Nolan thinks the stock is currently undervalued.

“In our view, Golar has done just about everything right over the course of the past year… The company has strengthened the balance sheet and invested counter-cyclically, but still, shares have languished in the past six months because the promised growth in new projects has simply not materialized. Consequently, GLNG shares are trading well below liquidation value. The company is proactively pursuing an incremental project which we believe could catalyze shares and at these values, we believe there is very little downside risk,” Nolan explained.

These comments form the basis for Nolan’s Buy rating on GLNG, while his $35 price target suggests the shares will climb 64% higher in the year ahead. (To watch Nolan’s track record, click here)

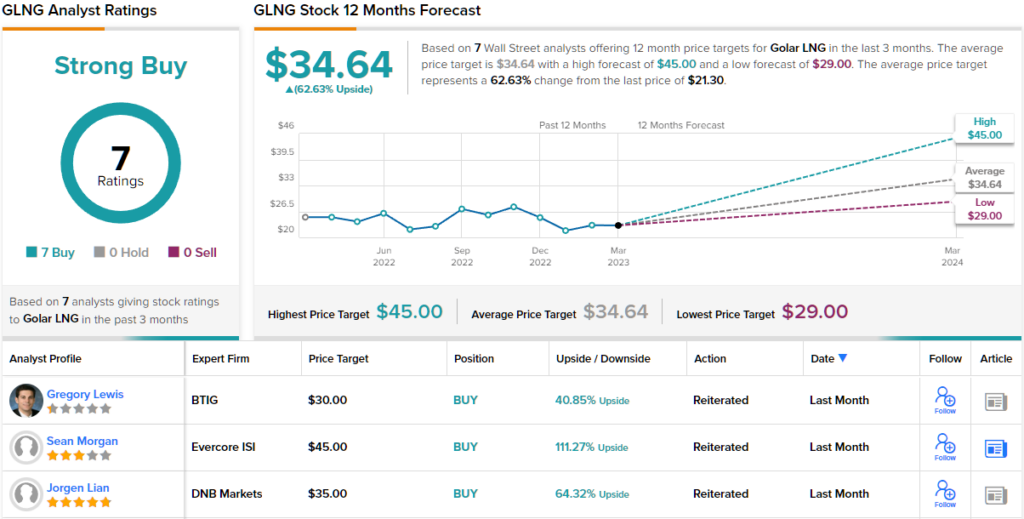

Other analysts are no less enthusiastic; based on Buys only – 7, in total – the stock claims a Strong Buy consensus rating. The $34.64 average target is only slightly lower than Nolan’s objective and implies ~63% upside from current levels. (See GLNG stock forecast)

Evolus, Inc. (EOLS)

For our second Englander pick, we will shift our focus to an entirely different segment. Evolus is a performance beauty company, targeting the self-pay aesthetic neurotoxin market, which, at $12 billion, accounts for the biggest chunk of the global medical aesthetics market.

The company also has a product available commercially; in 2019, Jeuveau was approved by the FDA for the treatment of adult patients with moderate to severe glabellar lines (wrinkles between the eyebrows). The company launched the European version of Jeuveau (Nuceiva) in England in 4Q22 and in Germany and Austria this quarter. An Australia launch is slated for the second half of the year.

The company has been delivering consistent year-over-growth for a while, a trend that continued in the most recently reported quarter, for 4Q22.

The company’s revenue reached a record high of $43.65 million, reflecting a 26% year-over-year increase. However, the Q4 EPS of -$0.23 missed the forecast of -$0.21. For the full year of 2022, revenue amounted to $148.6 million, a 49% uptick from the previous year. Looking ahead to 2023, the company anticipates revenue growth between 21% to 28%, expecting revenue to be between $180 million and $190 million, which is more than double the aesthetic neurotoxin market’s anticipated growth rate.

Englander enters the frame here with the purchase of 1,871,407 shares in Q1 and now holds a total of 3,328,597 shares. His current ownership stake in the company stands at 5.9%, and is valued at $27.63 million.

Englander is not the only one backing EOLS’ cause. Covering this stock for Cantor, analyst Louise Chen makes it clear she believes there’s an overlooked opportunity brewing here.

“We believe Jeuveau’s (Nuceiva) value proposition is underappreciated and that it can pick up meaningful market share in what we view as a fast-growing and highly under-penetrated market (we estimate ~10% penetration now, and believe it could be 30-40% over time),” Chen explained. “EOLS aspires to reach an organic net revenue target of $500MM by 2028. We also believe the U.S. and international launches, as well as the addition of new products to the company’s product portfolio, should drive EOLS’ stock higher.”

To this end, Chen rates EOLS an Overweight (i.e. Buy) to go alongside a $20 price target. Should that figure be met, investors stand to pocket returns of a strong 139% a year from now. (To watch Chen’s track record, click here)

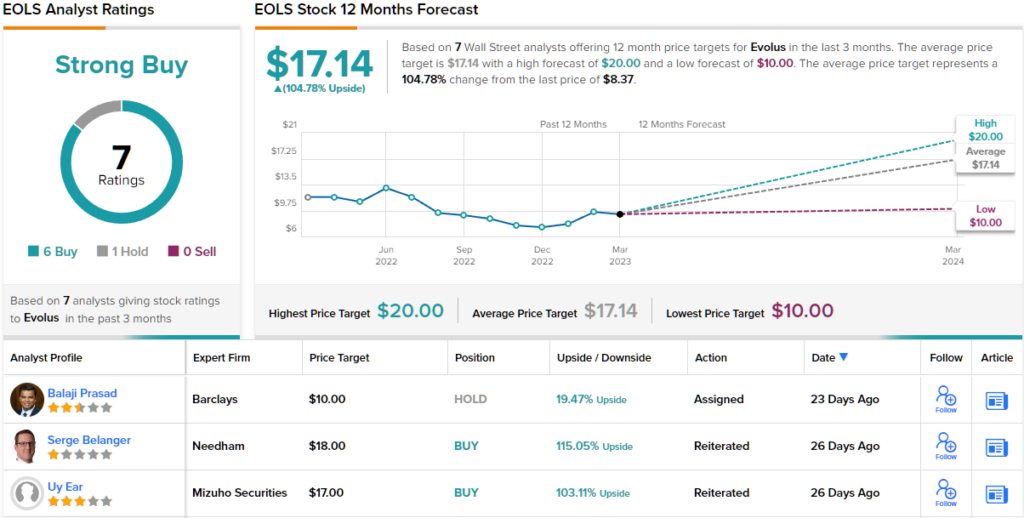

EOLS also gets robust support from the rest of the Street; barring one fencesitter, all 6 other recent analyst reviews are positive, making the consensus view here a Strong Buy. Moreover, the average target is an upbeat one; at $17.14, the figure suggests shares will post growth of ~105% over the coming year. (See Evolus stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.