The elections are behind us, the latest inflation data showed an easing back in the rate of increase, and markets finished last week with their best trading sessions in months. The signs have aligned for investors to feel good. Or should they?

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Billionaire investor Carl Icahn believes otherwise, and in a recent interview he laid out the case for the bears.

“I am still quite bearish on what is going to happen. A rally like this is of course very dramatic to say the least, but you have them all the time in a bear market, and I still think we’re in a bear market… inflation is not going away for the near term, and you’re going to have more of a recession, more of an earnings decrease… The Fed has to keep raising,” Icahn opined.

While Icahn is bearish on the markets, that hasn’t stopped him from buying into two specific stocks. They are interesting stock choices, though Wall Street’s analysts are clearly mixed here. Opening up the TipRanks platform, we’ve pulled up the details on these two ‘Icahn picks;’ here they are, with some recent analyst commentary.

Crown Holdings (CCK)

The first stock on our list of Carl Icahn’s picks is Crown Holdings, a company you probably haven’t heard of – although it’s highly likely that you’ve used some of its products. Crown works in the packaging industry, where it specializes in metal packaging. Crown’s products include metal cans for beverages and foods – think the ring-pull pop-tops on soda cans – as well as cans for aerosols. The company also produces metal closures for specialty packaging. If you’ve opened a can of pickles, or popped open a soda, or twisted the metal cap off of a glass bottle – then you have likely used a Crown product.

The ubiquity of packing – whether for food storage or product transport – in the modern world gives Crown a profitable niche to exploit, and that’s clear from recent years’ revenue totals. The company brought in $9.4 billion in 2020, and saw that rise to $11.4 billion last year. For the first nine months of this year, Crown has already realized $9.94 billion at the top line, up 12% year-over-year.

Looking at the most recent quarterly report, for 3Q22, the company showed a top line of $3.25 billion, up 11% year-over-year, and realized earnings of $1.06 per share compared to 79 cents one year ago. Adjusted EPS, however, came in at $1.46, well below the $1.76 forecast and down ~13% from the $2.03 reported in the year-ago quarter.

Of interest to return-minded investors, Crown has an active commitment to holding up share prices, and has repurchased $722 million worth of CCK shares so far this year. In addition, the company pays out a modest dividend, of 22 cents per common share, with the next payment due on November 25. The div payment annualizes to 88 cents per common share, and give a yield of 1.11%.

As for Carl Icahn, he opened up a new position in CCK in the last quarter, buying 1.04 million shares of the stock. His holding is currently worth over $82 million.

Shares in Crown have been falling since March of this year, and for the year-to-date, the stock is down by 28%. In the eyes of Morgan Stanley analyst Angel Castillo, however, this is no reason to avoid the stock. Castillo feels that this sell-off is overdone, and says, “There’s no denying that Crown’s results and outlook were materially worse than expected… However, we think the sell-off may be an overreaction and remain buyers of Crown (CCK) on this weakness…”

Among the reasons for owning Crown shares, says Castillo, are: “1) the fundamental EBITDA outlook provided by the company amounts to a much more modest ~4% implied revision (at the midpoint) to 2023 consensus; 2) Crown reiterated confidence in its +10% North America volume growth for 2023; 3) de-stocking shifts are typically a 2-3 quarter phenomenon, so we would expect the near term volume challenges to abate sometime in early 2023 and for secular tailwinds to resume driving healthy growth thereafter; 4) CCK continues to have the strongest balance sheet among its peers, and along with steady growth and lower capex should enable healthy amounts of shareholder returns…”

To this end, Castillo rates Crown shares an Overweight (i.e. Buy) and his $110 price target implies a one-year upside potential of 36%. (To watch Castillo’s track record, click here)

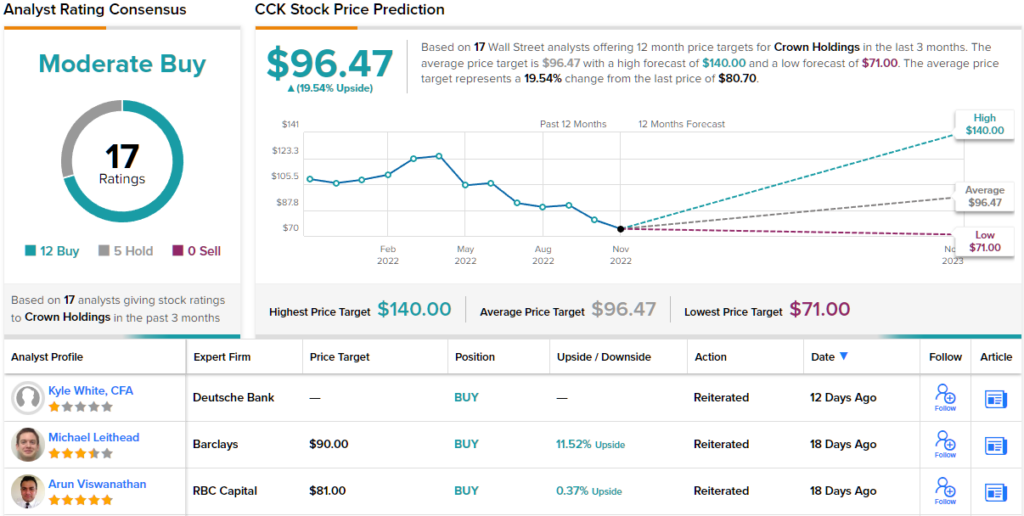

Carl Icahn and Morgan Stanley aren’t the only bulls on this stock. The shares have 17 recent Wall Street analyst reviews, breaking down to 12 Buys and 5 Holds, for a Moderate Buy consensus rating. CCK is trading for $80.70 and its average price target, at $96.47, suggests a gain of ~20% for the next 12 months. (See Crown stock forecast on TipRanks)

Southwest Gas Corporation (SWX)

The next Icahn pick we’re looking at is Southwest Gas, a natural gas utility company, based in Las Vegas, Nevada and serving more than 2 million customers in Arizona, Nevada, and Southern California. The company’s operations include Southwest Gas, the regulated utility, and Mountain West Pipelines, a regulated operator of some 2,000 miles of interstate natural gas transmission pipelines, stretching across Utah, Wyoming, and Colorado. The third business segment, Centuri Group, is an unregulated strategic infrastructure services company operating in the US and Canada.

Overall, Southwest Gas brought in $3.68 billion in total revenue last year. Southwest is on track to beat that revenue total in 2022, and its 9-month top line already stands at $3.55 billion.

Despite the revenue growth, the company reported a consolidated net loss of 18 cents per diluted share during Q3, slightly below the 19-cent loss reported in 3Q21 and well below the profits recorded in Q1 and Q2 of this year. It should be noted, though, that gas utilities in the northern hemisphere frequently show their best results in the first half of the year, on seasonal use.

The company declared a Q4 dividend, in September, of $0.62 per common share. This payment gives an annualized common share dividend of $2.48, which in turn makes the yield 3.73%.

This company has been conducting a strategic alternatives review for the future disposition of its business segments. Issues under consideration include alternatives for the Mountain West pipeline ops, and a possible sale or spin-off of Centuri Group. So far, the review is progressing but no action has been taken as yet.

Southwest Gas has clearly caught the eye of Carl Icahn; he increased his existing holding in SWX by 30% in the last quarter, buying 1,508,509 shares of the stock. His holding in Southwest Gas now totals 6,611,630 shares, valued at more than $419 million.

Southwest Gas’s prospects, however, don’t appear too favorable amongst Wall Street’s analysts, who prefer to stay on the sidelines.

In coverage of the stock for JPMorgan, analyst Richard Sunderland writes: “We have limited incremental insight beyond earnings datapoints and related commentary now firmly pressuring the 2023 outlook. We expect the construction debate will only grow in reaction to these developments, with arguments split between the downside risk of potentially selling at a low versus a longer path to realizing upside value under a construction spin.”

In line with this view, Sunderland puts a Neutral (i.e. Hold) rating on the shares, but his $77 price target implies an upside potential of ~18% for the coming year. (To watch Sunderland’s track record, click here)

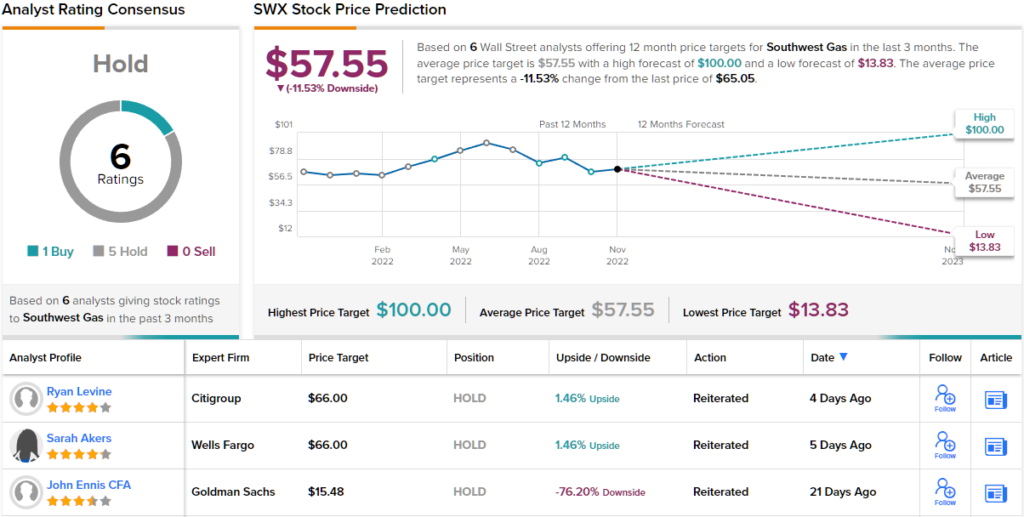

The majority of the Street sides with the JPMorgan analyst’s cautious take on Southwest Gas, as TipRanks analytics demonstrate the stock as a Hold (Neutral). This is based on 6 analyst reviews that include 5 Hold ratings and 1 Buy. The stock is trading for $65.05, and its average price target of $57.55 suggests it will slip ~12% over the course of the next year. (See SWX stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.