There has been no respite for the markets since Fed Chair Jerome Powell took to the podium at Jackson Hole and suggested the central bank will do whatever it needs to do in order to tame inflation, and if more rate hikes are required – so be it.

The market might have gotten a case of the heebee jeebees in response, but it’s a plan that billionaire hedge fund manager Bill Ackman thinks is going to work. By next year, the CEO and founder of Pershing Square Capital expects inflation will be slashed at least by half.

In the meantime, Ackman offers some tried-and-tested advice for those wondering how to deal with the roughshod conditions. “We think ultimately if you own great businesses, you can ride through a challenging time like this,” Ackman explained. “Our biggest fear was inflation and that’s why I wanted the Fed to raise rates quickly and soon.”

So, let’s dig into the details of two stocks which make up a big chunk of Pershing’s $7.46 billion portfolio. Evidently, Ackman sees these as quality stocks, but he’s not the only one showing confidence in these names; according to the TipRanks database, Wall Street’s analysts rate both as Strong Buys.

Howard Hughes Corporation (HHC)

We’ll start with real estate company The Howard Hughes Corporation, a developer of ‘master-planned communities’ (MPCs). HHC manages every part of the community, from strategic development to managing build-to-suit commercial assets. It does so by operating via three main business segments: MPCs, Strategic Developments, and Operating Assets. By using a synergistic strategy, HHC is able to control the cash flows of the entire business, which ultimately fosters a constant cycle of value creation.

It’s a business strategy which appears to be working, even in the face of tough macro conditions. Despite the economic downturn, soaring inflation, and fears of a recession, the company delivered a strong Q2 report.

Second quarter net income reached $21.6 million, translated to $0.42 per diluted share vs. the net income of $4.8 million – $0.09 per diluted share – in the same quarter a year ago. The figure also handily beat the loss of 39 cents a share expected by the analysts. The top-line figure also bettered expectations. Revenue increased by ~30% year-over-year to $276.71 million, coming in some way above the $203.7 million analysts predicted.

It’s the kind of performance that will no doubt please Ackman, whose Pershing fund owns 26.5% of HHC. It currently holds 13,620,164 shares, valued at 862.56 million at the current share price.

Also taking a decidedly positive stance is BMO analyst John Kim, who finds plenty of reasons to back the real estate firm, while also noting the stock’s 2022 performance (down by 38%) is not indicative of the business’ prospects.

“HHC offers investors a unique inroad to the real estate market as the largest public Master Planned Community (MPC) developer and operator throughout top MSAs in the U.S. HHC stands to benefit from attractive fundamentals due to a favorable housing supply/demand imbalance which should continue to bolster housing prices,” Kim noted.

“We believe the underperformance year-to-date is disproportionately correlated to homebuilder performance as HHC benefits from recurring NOI (net operating income) via its commercial assets and cash flows from condo sales, and as such its current market price creates an attractive risk-reward profile for investors,” the analyst added.

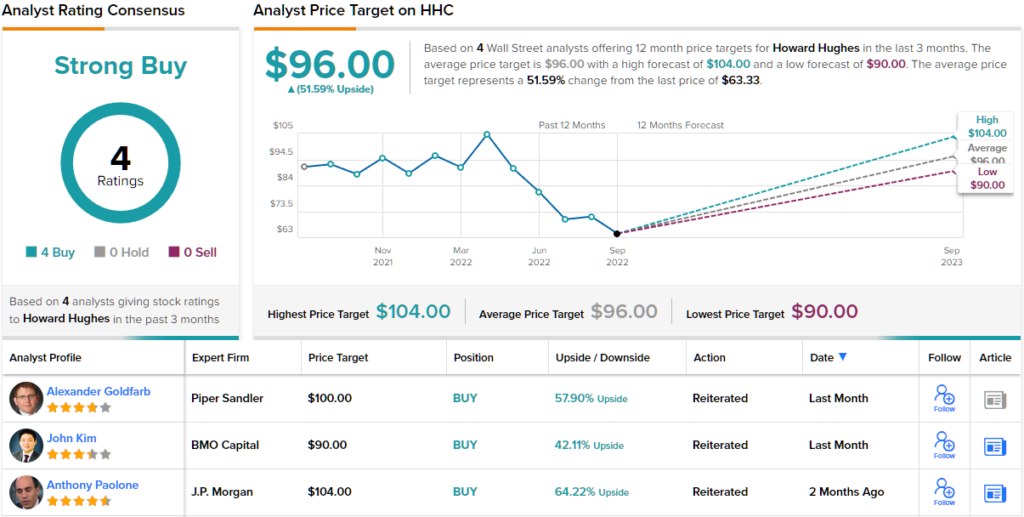

Accordingly, Kim rates HHC an Outperform (i.e. Buy) while his $90 price target makes room for 12-month share appreciation of ~42%. (To watch Kim’s track record, click here)

Joining Ackman and Kim in the bull camp, all 3 other recent Street reviews are positive, making the consensus view here a Strong Buy. The forecast calls for one-year gains of ~52%, considering the average target clocks in at $96. (See HHC stock forecast on TipRanks)

Lowe’s (LOW)

Next up we have the famous home improvement specialist Lowe’s. What began as a single hardware store in North Carolina back in 1921 has evolved into one of the world’s biggest home improvement retailers – in fact, it is second only to the Home Depot, both domestically and globally. At the start of the year the company had under its umbrella 1,971 home improvement and hardware stores; Lowe’s touts itself as well-positioned to keep taking share of the $900 billion home improvement sector.

Apart from the current usual array of macro concerns– rising inflation and the possibility of a recession – impacting consumers’ behavior, Lowe’s business has been affected by the shifting priorities of the post-pandemic era. After demand soared during the pandemic as consumers used the stay-at-home mandates to spruce up their houses, more money is now being spent on out-of-the home activities. As such, the near-term demand for DIY products in some segments has waned.

This was evident in the company’s latest quarterly report – for 2Q22. Revenue declined by 0.3% year-over-year to of $27.48 billion, missing Street expectations by $680 million. That said, the company has been managing the profitability profile well; EPS climbed by 9.8% year-over-year to $4.67, while coming in above the $4.58 expected by the analysts.

Ackman remains long and strong, and made no changes to his position during the quarter. Pershing owns 10,207,306 shares worth ~$1.97 billion right now, which amounts to almost 24% of his fund’s portfolio.

Scanning the Q2 print, Truist analyst Scot Ciccarelli is not concerned by slowing DIY sales, and believes the business is in good nick.

“We think 2Q22 (and all of 1H22) DIY sales were heavily impacted by tough comparisons and this year’s shortened Spring season, causing the company to expect the low-end of their comp guide of +/-1% for the year,” the 5-star analyst explained. “However, through productivity initiatives, EBIT margins actually increased despite the top-line shortfall, and earnings are projected to come in at the high-end of their $13.10-$13.60 forecast.”

“Overall, we believe trends remain solid, DIY sales are starting to inflect positively, profitability remains well-controlled and we believe that the stock may continue to re-rate higher in late ‘22/early ’23 if trends persist as we expect,” Ciccarelli summed up.

To this end, Ciccarelli has a Buy rating on LOW shares, backed by a $263 price target. The implication for investors? Potential upside of 34% from current levels. (To watch Ciccarelli’s track record, click here)

Looking at the consensus breakdown, with 15 Buys overpowering 5 Holds, the stock claims a Strong Buy consensus rating. The average price target stands at $241.35, indicating shares have room for 23% growth in the year ahead. (See LOW stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.