The Federal Reserve finally pulled the trigger last week, trimming rates by a quarter-point and kicking off what many expect will be a full cycle of cuts running well into next year. Investors cheered the move – stocks barely paused before surging to fresh all-time highs. The S&P 500 has climbed 13% this year, while the tech-heavy NASDAQ is up an even stronger 17%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Rate cuts lower borrowing costs and tend to favor growth-oriented sectors, and once again, tech has been the clear beneficiary. AI continues to set the pace, keeping institutional money flowing toward the sector.

Glenn Purves, Global Head of Macro at BlackRock, underscores this as a defining element of his firm’s strategy: “We stick with the AI theme,” Purves said recently, and went on: “The AI theme keeps driving U.S. equity performance, with the tech sector accounting for over 40% of total return and a similar share of earnings growth, LSEG data show. We think this can persist. Yes, these companies are generating less free cash flow, but only modestly. We think elevated valuations can be justified if they keep delivering on expected 15% to 20% future earnings growth. Their credit spreads – a sign of balance sheet health – have also held steady near historic lows but we watch them as a potential warning sign of market concerns.”

BlackRock has put its money behind that stance, buying into 2 AI stocks, BigBear.ai (NYSE:BBAI) and Serve Robotis (NASDAQ:SERV). While not household names, each company offers an interesting route into the AI world. Let’s give them a closer look, and find out what Wall Street’s analysts think of these AI choices.

BigBear.ai Holdings

The first AI stock we’ll look at is BigBear.ai, a tech firm that puts AI and machine learning technologies to work in the public and private sectors. The company provides decision intelligence solutions, using its AI savvy to bring order to complex data, identify blind spots, and predict outcomes – all in the service of enabling smarter, faster, and more accurate decisions.

The company puts this service into play for customers in the defense sector, the intelligence community and commercial businesses, too. BigBear.ai’s customers rely on the firm for predictive analytics that can be used to clarify complex environments while keeping a focus on the mission at hand. The company’s services have supported, and continue to support, a wide array of critical operations, including global supply chain optimization and cybersecurity, and have even found applications in such disparate fields as facial recognition and logistic software simulations.

BigBear.ai has been adept at attracting new customers, especially in defense- or security-related fields. A look at some of the firm’s recent contract wins will show this.

In May of this year, BigBear.ai entered into a collaboration, as a subcontractor, with Hardy Dynamics, for the US Army’s Project Linchpin. This project focuses on integrating AI and machine learning tech into the Army’s future combat capabilities. This was followed in June by BigBear.ai’s confirmation that its biometric software has been deployed at multiple US Ports of Entry, including major international airports. The software is used in Enhanced Passenger Processing at these travel hubs.

More recently, BigBear.ai announced in August that it had joined with Narval Holding to launch a new generation of cargo security management solutions in Panama – the location of the Panama Canal, one of the world’s key oceanic trade gateways. And just this month, BigBear.ai announced that its Enhanced Passenger Processing was deployed at Nashville International Airport, speeding up passenger movements through security and customs at a major state capital.

These are just a few of the contract wins that BigBear.ai announced during the second and third quarters this year. The key point here is that the company is able to expand its customer base and workload with an eye toward the future.

This potential for future success could explain BlackRock’s interest in BigBear.ai. During the second quarter this year, the global asset manager bought into BBAI to the tune of 12,107,360 shares, a stake that is now worth ~$83 million.

This leading-edge tech company has caught the eye of H.C. Wainwright analyst Scott Buck, who outlines a path forward for the company. Buck writes, “We believe BigBear.ai is well positioned to be a beneficiary of the One Big Beautiful Bill, which substantially increases investment in areas aligned with the company’s core competencies. This includes $170.0B of incremental funding to the Department of Homeland Security… We see an improved balance sheet and favorable industry and legislative trends as catalysts for long term growth. As a result, we suspect operating results and outlook should look materially stronger a year from now.”

Buck goes on to reiterate his Buy rating on the stock, and he accompanies that with an $8 price target that suggests a one-year upside of 17% for the shares. (To watch Buck’s track record, click here)

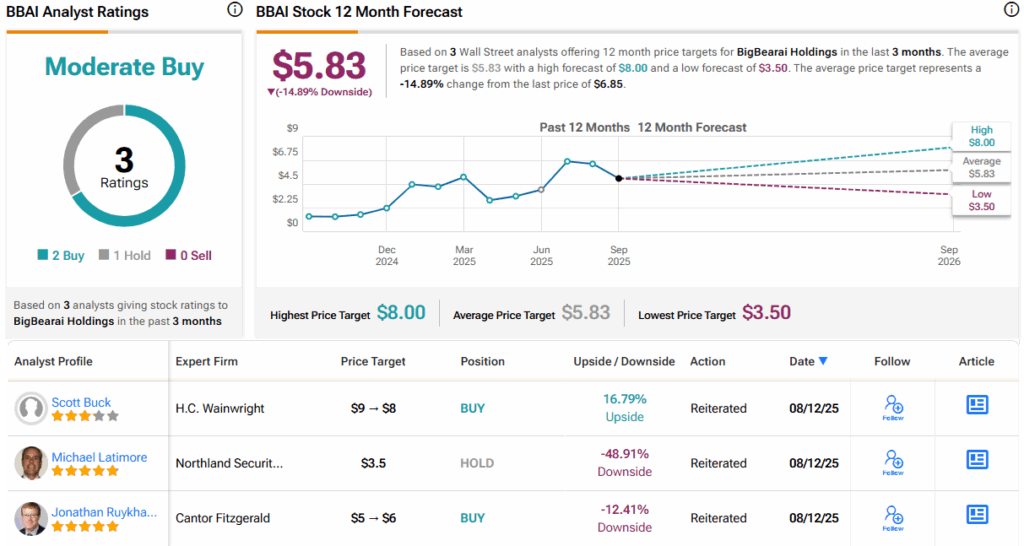

BBAI stock offers a bit of a conundrum right now. On the one hand, it holds a Moderate Buy consensus rating, based on 3 reviews that break down 2 to 1 in favor of Buy over Hold. However, the stock is trading for $6.85 and its $5.83 average price target implies a downside for the coming year of 15%. With that in mind, keep an eye out for either price target hikes or rating downgrades shortly. (See BBAI stock forecast)

Serve Robotics

The next stock we’ll look at is a small-cap tech firm, Serve Robotics. Serve is working on a practical application for both AI and robotics technologies: the development of small, autonomous delivery robots, capable of providing fast, efficient foot deliveries in urban areas. The company was formed as a spin-off from Uber in 2021, and since then it has built a business based on scalable multi-year contracts. While Serve has partnerships with such large names as Uber Eats and 7-Eleven, the company is also willing to start with small contracts and work towards larger goals.

Uber Eats provides a sound example of this. Serve has been working with its former parent company since 2021, starting with sidewalk deliveries in Los Angeles. The company developed an app-based process, allowing customers to order their food via Uber Eats, receive the delivery from a Serve robot, and unlock the robot using the Uber Eats phone app. Serve markets its services to the larger provider by asking a simple question: Why would you deliver a 2-pound burrito meal with a 2-ton car?

The upstart tech firm’s answer is a cost-efficient robot, a delivery vehicle approximately the size of a shopping cart that is capable of carrying four 16-inch pizzas. The robotic vehicle is battery-powered, travels at 11 miles per hour, and has a single-charge range of 48 miles. The company’s AI-powered robots have achieved Level 4 autonomy, allowing them to travel on sidewalks within specifically defined areas – without human intervention. Since early 2022, these robots have completed more than 100,000 deliveries in the LA area, and the company boasts that its autonomous vehicles are 99.8% accurate – which gives them a lower error rate than human drivers.

Serve is currently working to expand its working arrangement with Uber Eats, with the aim of deploying 2,000 autonomous delivery vehicles by the end of this year. This past April, the company started off Q2 by announcing that it was launching its Uber Eats partnership service in Texas, specifically in the Dallas-Fort Worth area, a major metropolitan area of a fast-growing economic powerhouse state. The company finished Q2 by launching the service in several areas of Atlanta, Georgia. Serve Robotics had 250 vehicles deployed under this plan at the end of Q1; the company hopes to have 700 in operation at the end of Q3, with the remainder to be deployed in Q4.

The fast growth of Serve’s delivery network is reflected in its fast revenue growth this year. The company finished Q1 with $440,000 in revenues, for a 150% increase over the final quarter of 2024; in 2Q25, the company reported $642,000 in revenue, for quarter-over-quarter growth of 46%. During Q2, the company delivered 120 of its new robots ahead of schedule, and recorded a 78% quarter-over-quarter increase in delivery volume. Internationally, the company has also completed a Middle East pilot program in Doha, Qatar.

And it isn’t just restaurants and delivery apps lining up, BlackRock is paying attention too. The hedge fund giant snapped up 1.83 million SERV shares in Q2, a stake now worth over $25.5 million.

Since the second quarter ended, Serve has been making moves to further expand its partnerships and technology. The company announced in August its acquisition of Vayu Robotics, a company that specializes in the pioneering use of large-scale AI models for urban robot navigation systems. This acquisition is expected to both expand Serve’s roadmap and enhance the accuracy of its delivery robots’ navigational autonomy. Also in August, Serve announced that it had entered into a partnership with Little Caesars, the third-largest pizza delivery chain in the US, for pizza deliveries in Los Angeles. Looking ahead, the company has plans to launch its service in Chicago.

For 5-star analyst Michael Latimore, of Northland, a key point to Serve’s future success lies in the Vayu acquisition. Latimore says of the company, and particularly of that transaction, “Serve will integrate Vayu’s models and software into the Serve platform. This will effectively make Serve’s robots smarter and faster. Vayu accelerates Serve achieving their roadmap, in particular as it relates to mobile robotic autonomy. Vayu’s foundation model approach includes an end-to-end model where significant training occurs via simulation before real world use. The approach not only improves robot intelligence, but also makes model training less expensive relative to Serve’s strategy (which combines classic machine learning and foundation models)… We continue to view Serve as one of the best physical AI investments given their leading technology, which Vayu further enhances.”

Quantifying this stance, Latimore has an Outperform (i.e., Buy), and his $23 price target points toward a robust one-year upside potential of 64.5%. (To watch Latimore’s track record, click here)

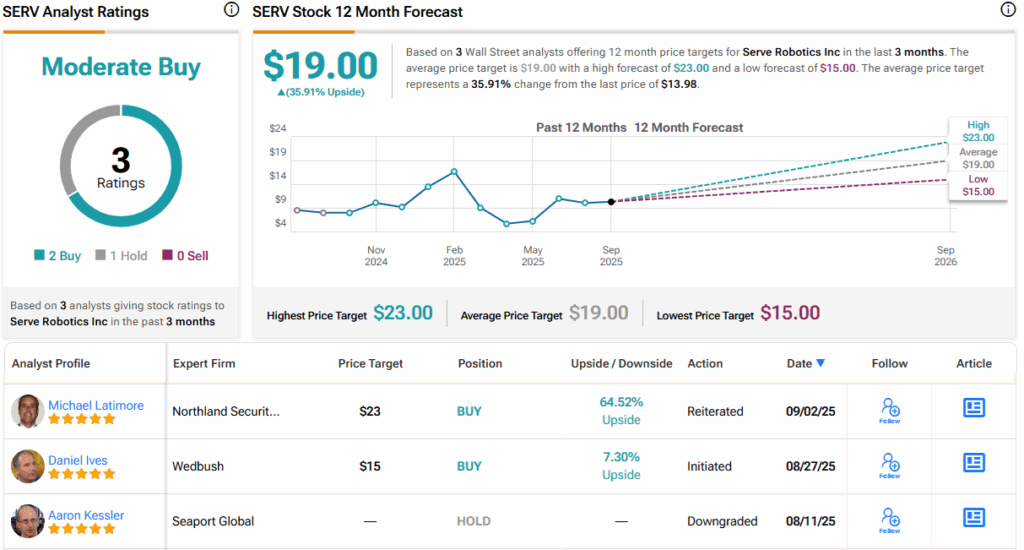

The 3 recent analyst reviews include 2 Buys and 1 Hold for a Moderate Buy consensus rating. The shares are priced at $13.98, and their $19 average target price implies a gain of 36% in the year ahead. (See SERV stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.