The American Depository Shares (ADS) of BHP Group Limited (NYSE: BHP) (GB: BHP) increased 1.6% in the extended trading session on Monday after the company announced impressive results for the Fiscal Year 2022 (ended June 30, 2022). High commodity prices, mainly coal, helped the company triple its attributable profits in the year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It is worth noting that BHP Group’s ADS was up 2.6% early Tuesday, at the time of writing. The $138.3-billion Australian company engages in the exploration and production of oil and natural gas, and the extraction of metals like iron ore, copper, gold, and zinc.

Highlights of BHP Group’s Fiscal 2022 Results

- High coal prices boost attributable profit by 173% year-over-year to $30.9 billion

- The underlying attributable profit of $23.8 billion surpassed the consensus estimate of $20.9 billion

- Free cash flow grew 24% to $24.3 billion

- Announced final dividend of $1.75 per share

- Revenues were $65.1 billion, up 14.4% year-over-year

The company noted that growth in attributable profit in Fiscal 2022 was driven by high commodity prices, especially of coal. Average realized prices surged 225% for metallurgical coal and 271% for thermal coal.

Also, realized prices for copper grew 9% and for nickel expanded 43%, partially offset by a 13% decline in iron ore prices. In addition to commodity prices, a gain from the divestment of the petroleum business boosted profits in the year.

Cash generated from operating activities was $29.3 billion, and capital and exploration expenditure totaled $6.1 billion in the year. The company used its available resources to repay debts, with net debt down from $4.1 billion in Fiscal 2021 to $0.3 billion in Fiscal 2022.

Talking about rewards to shareholders, BHP Group’s dividends for its stakeholders amounted to $3.25 per share. This amount includes the impact of the company’s final dividend payment of $1.75 per share.

Earnings were $6.11 per share in Fiscal 2022, up 173% year-over-year. Also, underlying earnings advanced 39% to $4.71 per share in Fiscal 2022. The consensus estimate for earnings was $6.14 per share.

Revenues totaled $65.1 billion in the year versus the consensus estimate of $65.5 billion. On a year-over-year basis, the top line grew 14.4%, driven by sales growth of 7.1% for Copper, 201.7% for Coal, and 23.4% for Group and unallocated items segments. The sales of the Iron Ore segment decreased 10.8% year-over-year.

Production of copper in the year was down 4% year-over-year, while that of metallurgical coal and energy coal was down 9% and 4%, respectively. Also, the production of nickel declined 14% but remained flat for iron ore.

CEO’s Comment

The CEO of BHP Group, Mike Henry, said, “These strong results were due to safe and reliable operations, project delivery and capital discipline, which allowed us to capture the value of strong commodity prices.”

Henry said, “BHP enters the 2023 financial year in great shape strategically, operationally and financially, and well prepared to manage an uncertain near-term environment.”

The CEO opined that BHP Group “expect China to emerge as a source of stability for commodity demand” while seeing “a slowdown in advanced economies as monetary policy tightens, as well as ongoing geopolitical uncertainty and inflationary pressures.”

“The direct and indirect impacts of Europe’s energy crisis are a particular point of concern. Tight labour markets will remain a challenge for global and local supply chains. Waves of COVID-19 infection continue to occur in the communities where we operate, and we are planning accordingly,” Henry added.

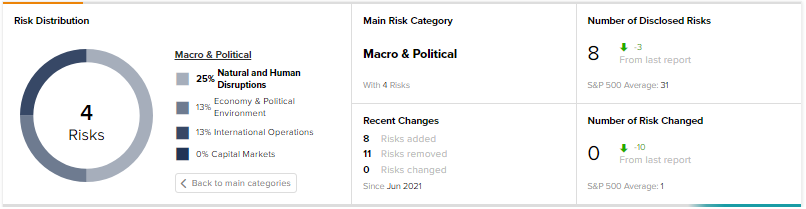

According to the TipRanks Risk Analysis tool, BHP Group’s prime risk category is Macro & Political. This category accounts for four risks of the total eight risks identified for the company.

Is BHP Stock a Buy or Sell?

As of now, BHP stock is neither a Buy nor a Sell. On TipRanks, BHP Group has a Hold consensus rating based on one Buy and three Holds. BHP’s average price forecast of $59 mirrors 7.78% upside potential from the current level.

Considering BHP’s risk profile, the macroeconomic challenges (especially rising interest rates and geopolitical uncertainties), and analysts’ neutral view on the stock, a wait-and-watch approach could be a good idea for prospective investors in the near term.

Read full Disclosure