Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL)(NASDAQ:GOOG) have been hogging the headlines of late for their AI moves. Still, I’d look for the other FAANG firms with strong artificial intelligence (AI) capabilities to punch their ticket to the AI race, given how much there is to gain.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Undoubtedly, OpenAI’s ChatGPT has been one of the biggest innovations to come out of the FAANG pipeline in quite a while.

With Bing search and AI poised to clash with Alphabet’s Google Search and Bard AI (its competing chatbot), excited investors seem willing to put money into innovation again, even as the Fed continues to raise interest rates.

Undoubtedly, Microsoft and Alphabet are fully aware of what could be at stake as they duke it out for the future of search and productivity. Bard AI’s recent fumble and Microsoft’s ambitious AI plans have been the talks of the town of late, and it’s this AI-centered enthusiasm that I think has taken away from the other FAANG firms that are more than capable of competing on the AI front.

Indeed, the FAANG companies seem to be getting more similar to one another by the day. Streaming pioneer Netflix (NASDAQ:NFLX) was the sole play to buy for video-streaming exposure. Nowadays, Amazon (NASDAQ:AMZN) and Apple (NASDAQ:AAPL) can be considered alternative ways to play the future of video.

Therefore, let’s take a look at two FAANG stocks with impressive AI capabilities of their own.

Netflix (NASDAQ:NFLX)

Netflix is probably the last FAANG stock that comes to mind when one thinks of AI. Still, the company has been harnessing the power of AI for years, helping its customers discover what they may want to watch next. Indeed, content curation and tailoring a slate of movies are just one application of AI.

Looking ahead, I’d look for Netflix to flex its AI muscles in AI-generated content production. The streaming behemoth noted a “labor shortage” as a reason behind incorporating an AI-generated background in one of its anime projects, “Dog and Boy.“

Undoubtedly, AI-generated content could help Netflix differentiate itself from peers that have flocked into the video-streaming space in recent years. As Netflix’s AI expertise grows, it wouldn’t be too far-fetched to see more content making good use of generative AI technologies.

In any case, Netflix is an AI underdog that I’d not look to count out. At writing, the stock trades at 35.2 times trailing earnings. That’s well below historical averages but remains rich relative to other streamers.

I think the premium multiple is warranted because of Netflix’s innovative capabilities. Though I’m not a fan of Reed Hastings’ departure from the CEO office, I am bullish on NFLX stock.

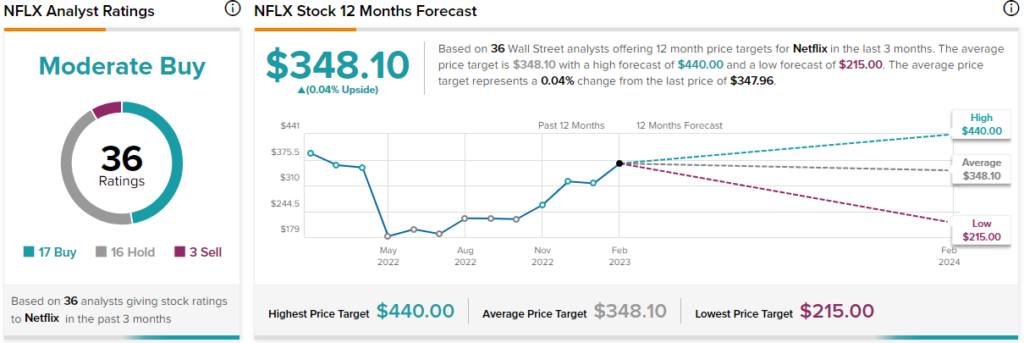

What is the Price Target for NFLX Stock?

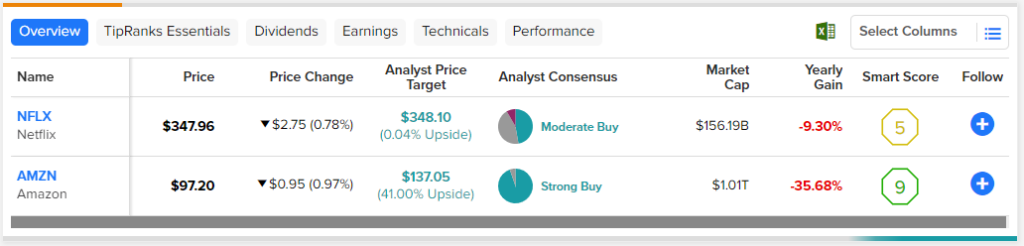

Wall Street has a “Moderate Buy” on Netflix, with 17 Buys, 16 Holds, and three Sells. The average NFLX stock price target of $348.10 implies no upside or downside potential from here.

Amazon (NASDAQ:AMZN)

Amazon is definitely not a firm to count out of the AI game. In fact, Amazon may have as much to gain as Microsoft or Google from the advancement of autonomous technologies. The company has already used robotics to improve efficiency and safety at its warehouses. I am bullish.

With impressive new robots going to work at the local Amazon warehouse, I think it’s not too far-fetched to believe that the e-commerce and cloud behemoth can evolve to become a firm that’s mostly automated in the future.

Innovation investor Cathie Wood boldly stated that robots could surpass human workers by 2030. It sounds far-fetched, but I’m in complete agreement with Wood. At this pace, Amazon is a top dog when it comes to automating demanding manual tasks.

Now down around 47% from its high, AMZN stock may also be the best bargain of the FAANG basket.

At 97 times trailing earnings, shares don’t seem too cheap, given headwinds that could weigh on consumer spending and the cloud. Still, I think investors fretting too much over recent overinvestments in capacity and macro headwinds. Looking further into Amazon’s increasingly automated future, today’s headwinds seem forgivable.

What is the Price Target for AMZN Stock?

Wall Street has a “Strong Buy” on Amazon, with 36 Buys and three Holds. The average AMZN stock price target of $137.05 implies a 41% return from here.

The Takeaway

As Microsoft and Google set the benchmarks on what to expect from consumer-faced AI applications, I do expect other FAANG firms will take notice and wish to get a piece of the action. At this juncture, Netflix and Amazon are two FAANG stocks with much to gain as AI advances.