At first glance, plant-based food specialist Beyond Meat (NASDAQ:BYND) might initially appear to be an extreme contrarian opportunity. Yes, shares suffered a horrendous loss this year. At the same time, the underlying industry is relevant, especially for the emerging young consumer demographic. Still, its latest earnings report may have extinguished hope for a comeback. I am bearish on BYND, as circumstances continue to look poor for this troubled stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Q3 Earnings Knocked the Wind Out of the Fake Meat Producer

While Beyond Meat represented one of the hottest initial public offerings due to young consumers’ penchant for sustainable lifestyles – which include transitioning to plant-based diets – the realities of operating in a competitive and low-margin industry took its toll. Since the summer of 2021, BYND stock lost traction. Unfortunately, the latest earnings print doesn’t offer a clear pathway to recovery.

Specifically, for the third quarter, Beyond Meat rang up sales of only $75.31 million, falling well below the consensus target of $87.91 million. As well, the latest revenue tally fell by nearly 9% against the year-ago quarter’s result of $82.5 million. If that wasn’t bad enough, Beyond posted a loss per share of $1.09. In contrast, Wall Street anticipated a loss of 85 cents.

In fairness, the poor results may not be entirely related to the plant-based meat provider’s business decisions. As CEO Ethan Brown remarked, “We expected a modest return to growth in the third quarter of 2023, which did not materialize as category-specific and broader consumer headwinds continued and drove weaker-than-expected sales volumes, reduced promotional effectiveness and adverse changes in our product sales mix.”

To be sure, Brown has a point. While the latest economic print shows that consumer prices showed signs of disinflation, they may remain stubbornly high. Therefore, as the Federal Reserve indicated months ago, it’s not out of the question to see increased benchmark interest rates.

Of course, the problem is that BYND stock suffers under current conditions. If conditions worsen – which is a possibility – that doesn’t speak of great confidence for Beyond Meat.

Beyond the Headline Print

When corporate executives speak, they sometimes provide clues to inspire greater analysis. In Brown’s case, that clue centered on the comment related to reduced promotional effectiveness. Yes, on many levels, the statement related to gross margins, but there was more to it than that.

Since Q2 2021, BYND’s gross margin has generally been on a downward track. Even more problematic, there have been a few quarters where gross margin sat in negative territory. Effectively, such a circumstance suggests that BYND stock has already lost before it even took the green flag.

Broadly speaking, the gross margin contraction implies that Beyond can’t generate positive momentum without promotional deals. This argument loosely aligns with Brown’s commentary. However, the more worrisome aspect may be that the company may be dependent on unique captive-audience frameworks that rarely materialize.

In an article posted by the National Institutes of Health website, researchers noted that the COVID-19 impact on meat production facilities contributed to less meat being offered in the grocery aisles during the worst of the crisis. Sure enough, Beyond enjoyed a record gross profit of $122.28 million in 2020.

However, as society – and more specifically, the food supply chain – normalized, Beyond’s financials started to falter conspicuously. Without a “forced” catalyst, Beyond took to margin-hurting promotions by its own admission. Sadly, those promotions haven’t worked.

Valuation Metrics Aren’t Appealing at All

Obviously, with Beyond Meat not being profitable, it’s impossible to value BYND stock on an earnings basis. Even a forward (projected) earnings basis is dubious, given that investors don’t know when (or if) Beyond will turn a profit. Realistically, then, market participants may largely turn to revenue-based valuation.

However, even here, BYND stock isn’t that attractive. Presently, shares trade hands at about 1.2x trailing-year sales. In contrast, the price-to-sales ratio for the packaged foods industry runs at a slightly lower 1.14x. Still, even if BYND was undervalued relative to sales, it would probably be a value trap. That’s because its annual revenue is declining and lacks any signals that it will rise anytime soon.

Is BYND Stock a Buy, According to Analysts?

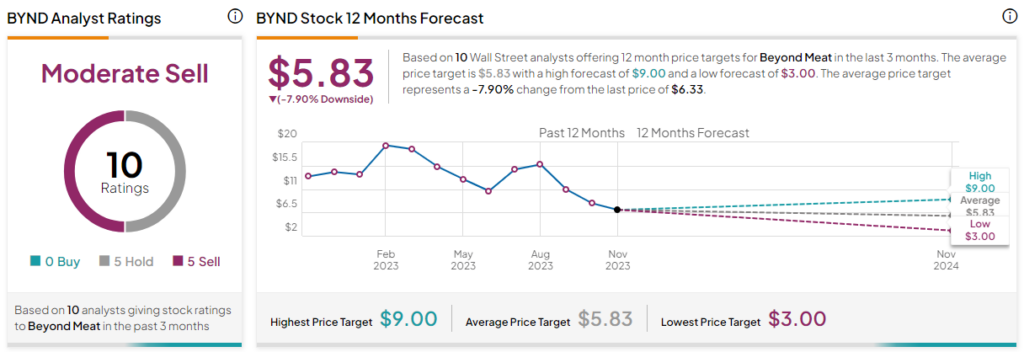

Turning to Wall Street, BYND stock has a Moderate Sell consensus rating based on zero Buys, five Holds, and five Sell ratings. The average BYND stock price target is $5.83, implying 7.9% downside risk.

The Takeaway

Usually, speculators gamble on beaten-down enterprises not because they’re cheap but rather because they anticipate an overlooked catalyst to reinvigorate sentiment. For BYND stock, it’s possible that the security is just “cheap” but without the catalyst. With both the financials and the fundamentals pointing in the wrong direction, even extreme gamblers might want to step away.