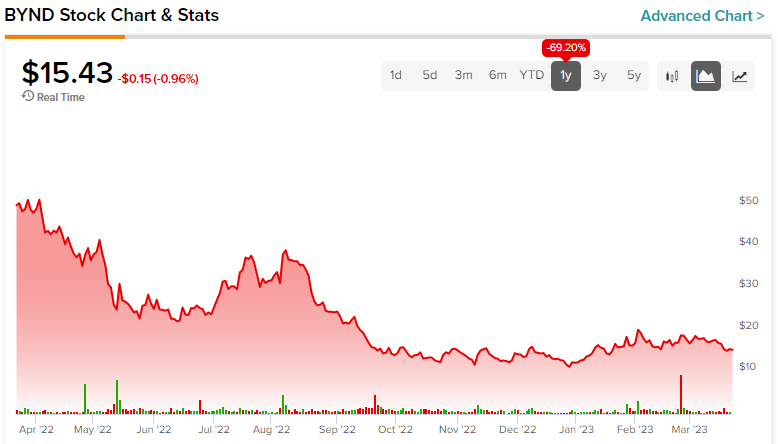

Beyond Meat’s (NASDAQ:BYND) investment case has turned out to be a recipe for disaster, with the company’s developments falling short of the overambitious expectations that were set for it. Revenues have tumbled, while the company has been recording wide losses in its fruitless attempt to expand. Thus, shareholders’ equity has been going down the drain, which explains the stock’s near-70% decline over the past year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As Beyond Meat continues to face financial challenges, including burning through cash, taking on more debt, and diluting shareholders to maintain operations, it seems that the stock’s trajectory is likely to remain on a downward trend. Accordingly, I am bearish on the stock.

Why Does Beyond Meat Struggle to Grow?

The fundamental issue with Beyond Meat has been its struggle to grow. While the company has seen some success, including various partnerships with QSR giants such as McDonald’s, Pizza Hut, Taco Bell, and KFC, it has not been able to gain as much market share as some may have previously expected. In fact, the company even appears to be losing its momentum altogether, starting to record a decline in sales.

In its most recent Q4 results, net revenues came in at $79.9 million, a year-over-year decline of 20.6%. Management attributed this decline in sales to a 16.9% decline in total pounds sold and a 4.4% decline in net revenue per pound, primarily citing demand issues. For Fiscal 2022, net revenues were $418.9 million, also implying a decline of 9.8% year-over-year. In my view, several factors may have contributed to Beyond Meat’s inability to attract adequate demand, and I’ve outlined the most critical ones below.

1. Stiff Competition

Stiff competition has been a significant headwind for Beyond Meat, with multiple players striving to succeed in the plant-based meat market. Companies like Impossible Foods, Morningstar Farms, and Gardein offer similar products, which makes it challenging for Beyond Meat to stand out and gain market share.

2. Unattractive Pricing

It turns out that producing “fake meat,” as many like to call it, is not as cheap as real meat. In turn, Beyond Meat’s products tend to be more expensive than traditional meat products, which can be a deterrent for some consumers. So, while some consumers may be willing to pay a premium price tag for plant-based alternatives, this market is certainly not affordable to everyone. To counter this issue, in its Q4 results, Beyond Meat explained that it had implemented price cuts both in the U.S. and the EU. Yet, it cited demand issues, suggesting that its products still remain rather overpriced for the average consumer.

3. Lack of Availability

Finally, a significant reason that has contributed to Beyond Meat’s lack of meaningful growth is the lack of product availability. Beyond Meat’s products are not as widely available as traditional meat products in most areas of the world, as the company has largely struggled with its expanding its distribution network. Growing the distribution network of frozen foods can be a tough and expensive journey, which, combined with the underlying issues of demand and pricing, can take a real toll on the company’s expansion prospects and financials.

Shareholders’ Equity Going Down the Drain

Beyond Meat’s lack of growth has resulted in a lack of sustainable profitability, which in turn, has driven shareholders’ equity down the drain. Just to illustrate how unsustainable the company’s business model is, following the aforementioned price cuts in Q4, Beyond Meat’s gross margin came in at a negative 3.7%. Yes, the company is losing money with each patty it sells.

With gross margins being negative, how can one expect the company to service its other obligations (e.g., interest expenses), let alone pursue its growth its expansion targets, which require tons of capital expenditures? It is an impossible situation that continues to drive the company into bleeding money. It’s no wonder why net losses were $66.9 million in Q4 and an even scarier $366.1 million in Fiscal 2022.

The result of Beyond Meat’s never-ending losses and continuous need for fresh capital to stay afloat can be illustrated with the following facts:

- Since Beyond Meat’s IPO, its total debt has increased from nearly $31 million to $1.19 billion as of Q4-2022 (overburdened balance sheet).

- Since Beyond Meat’s IPO, its share count has risen from 58.1 million to 64.1 million (ongoing dilution).

- In the meantime, the company’s cash position has plummeted from its peak of $1.13 billion following these capital increases to a mere $309 million as of Q4 2022.

As just mentioned, the company lost more money last year than it currently has in the bank! Therefore, further injections of capital (via debt/equity issuances) are certainly going to take place this year if the company is to keep being in business.

Is BYND Stock a Buy, According to Analysts?

Turning to Wall Street, Beyond Meat has a Moderate Sell consensus rating based on three Holds and five Sells assigned in the past three months. At $11.50, the average Beyond Meat stock forecast implies 23.6% downside potential.

Conclusion

Sadly, it doesn’t look like Beyond Meat’s disappointing performance is about to undergo a turnaround anytime soon. Positive catalysts, such as the company’s initial debut in an up-and-coming market, or more mature ones, such as achieving partnerships with giants in the QSR space, have already taken place.

And yet, Beyond Meat is nowhere near achieving satisfactory levels of growth, let alone sustainable profitability. As it stands, Beyond Meat is poised to continue losing money, which will further erode shareholder equity. Hence, I would avoid the stock at all costs in its current state.