Beyond Meat (NASDAQ: BYND), once a highly valued stock, has failed to gain traction in recent months. The stock took a nearly 50% hit over the last year alone, with its market capitalization following suit. It is evident in Beyond Meat’s financials that its momentum has been brought to a halt; recent initiatives seem promising for the company, which remains confident in its outlook, but is it too late?

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Beyond Meat produces plant-based proteins emulating the same qualities as the animal-based proteins it aims to replace. The company prides itself in formulating such products without the use of hormones, GMOs, and antibiotics. However, with such a large focus on the social function of the firm, working toward bettering diets and resolving global issues, the managerial and entrepreneurial functions have lagged behind.

I’m neutral on Beyond Meat.

Undesirable Performance

The public may not be eager to change their investing diets upon review of Beyond Meat’s financials.

The company currently has operating and net margins of -23.46% and -27.33%, respectively, which are surprisingly better compared to its history, once having lows of around -150% for both figures.

In the third quarter, gross profit declined to $23 million from $25.5 million the previous year, with a loss of $54 million from operations, a greater loss than the $18.5 million loss of the previous year. The same trend continued in the form of a $54.7 million net loss, computing a net loss per share of $0.87.

These metrics can largely be attributed to the company’s negative economic profit, or the difference between the return on invested capital (ROIC), and the weighted average cost of capital (WACC), essentially measuring how effectively a business is managing the capital it raises. Whereas positive and rising economic profit is ideal, Beyond Meat has had negative economic profit for a prolonged period, equaling -29% in 2020.

Similarly, return on equity and return on assets are also negative, at -43.04% and -7.05%, respectively. This, along with declining free cash flow, may certainly reduce investor’s confidence in Beyond Meat’s ability to create shareholder value.

On the contrary, while the 3-year EBITDA growth rate is -1.5%, the 3-year revenue growth rate is 110.2%, representing a stark difference from the aforementioned results.

Regardless, over the last year, Beyond Meat’s return is -49.39%, compared to the 28.40% return of the S&P 500. Consistently trading below the 20, 50, and 200-day moving averages suggests this downward trend will continue.

There may be hope, however, based on recent initiatives Beyond Meat has announced.

A Business Built on Innovation

The success of Beyond Meat’s offerings largely depends on innovation, in which the company has heavily invested. To facilitate this, the company has hired scientists, engineers, and managers to translate the characteristics of animal-based meat into plant-based meat, using the most health-conscious ingredients. This was initially facilitated through Beyond Meat’s campus, which housed the Manhattan Beach Project, focusing on creating new iterations of their products.

Most recently, Beyond Meat announced that it secured the lease on a state-of-the-art R&D center in Shanghai, the first of its kind outside of the United States. While fostering global expansion, new laboratories and technology, such as sensory testing capabilities, will not only enable further development of existing products, but create new products specifically for the Asia-Pacific region; process and product innovation will increase the efficiency of operations and allow products to enter the market promptly, maintaining the scale of global operations while creating unique products to appeal to certain regions.

Dr. Dariush Ajami, Chief Innovation Officer of Beyond Meat, exclaimed the importance of this facility, stating, “The best-in-class R&D team we are building in Shanghai represents the next leg in our journey to become a global protein company.”

While the outcome of this facility is yet to be seen, with plans to open in 2022, this indicates that Beyond Meat is likely moving in the right direction.

Scale: Partnering with the Major Players

The market for plant-based products is fairly niche, and many are wary to even try such offerings, much less change their diet entirely. To mitigate this problem, in addition to marketing techniques such as placing the products in the animal-based meat section of retail stores, Beyond Meat has partnered with established brands such as Starbucks (SBUX), KFC China (YUMC), and most notably, McDonald’s (MCD), inserting products into various markets and establishing economies of scale.

In early 2021, Beyond Meat secured a three-year global strategic agreement with McDonald’s Corporation. Such deal made Beyond Meat the “preferred supplier” for the patty in the new “McPlant” burger offered by McDonald’s.

Realizing the potential of this relationship, Ethan Brown, Beyond Meat Founder and CEO, stated, “We will combine the power of Beyond Meat’s rapid and relentless approach to innovation with the strength of McDonald’s global brand to introduce craveable, new plant-based menu items that consumers will love.”

In addition to the “McPlant” burger, this agreement could also lead to further opportunities for plant-based meat to replace chicken and pork.

While this strategy may proliferate the introduction of Beyond Meat’s products into the market, the underlying problem of customer attraction will still be present and require a great deal of effort to overcome, especially when competing with other brands.

Fierce Competition in a Rising Market

Beyond Meat is not the only company that has been able to secure a deal with a fast-food chain. Impossible Foods has already partnered with Burger King to produce plant-based offerings, and did so at a rapid pace.

Furthermore, while not direct competition, Beyond Meat is also challenging existing brands associated with the animal-based protein industry, valued at a substantial $44,090.0 million in 2019 and expected to reach $58,500.3 million by 2027.

With respect to solely plant-based meat, though companies are still battling to obtain the largest share of the industry, it can be concluded that the market is an oligopoly, and arguably a near-duopoly of Beyond Meat and Impossible Foods. As a result, a small number of relatively large sellers, in conjunction with restrictions to entry, could certainly grant a great deal of pricing power to these firms.

The results of all these initiatives have yet to be seen, however, and given Beyond Meat’s previous performance, Wall Street is not convinced they will be successful this time around.

Wall Street’s Take

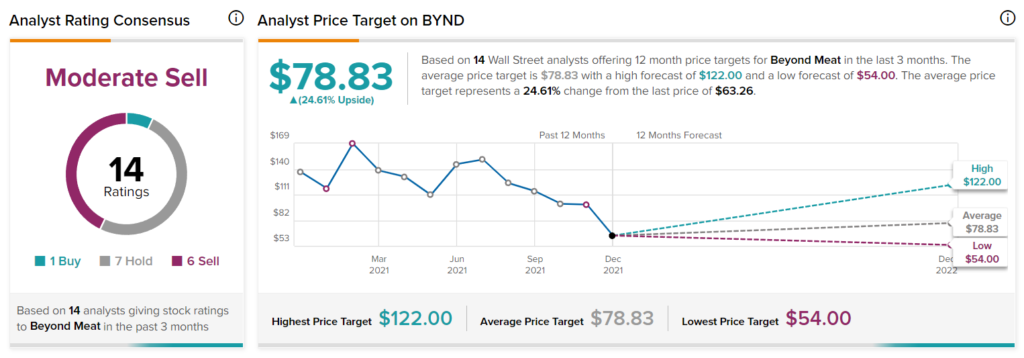

BYND currently has a Moderate Sell consensus rating based on one Buy rating, seven Hold ratings, and six Sell ratings. Average analyst BYND price target of $78.83 implies a 24.61% upside, with a high price target of $122 and a low of $54.

The Bottom Line

Beyond Meat has not been effective in instilling confidence in investors. Recent strategies and advancements in the company have promise, but will future success be on the menu?

Only time will tell.

Disclosure: At the time of publication, Brandon Humbert did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >