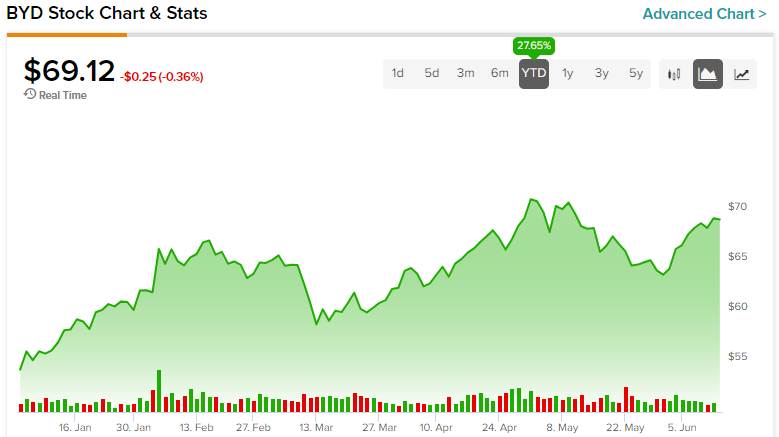

What intrigues me the most about the casino-gaming giant Boyd Gaming (NYSE:BYD) is its stock price performance. The stock has jumped considerably from its lows of $6.44 seen during the COVID-19 pandemic to around $69 currently, close to its all-time high. Year-to-date, the stock has shot up more than 27%, outperforming the underlying S&P 500 (SPX) benchmark.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, there are still reasons to stay invested in the stock. These reasons include its well-diversified gaming presence and considerable growth potential stemming from its online portfolio. The stock is further supported by robust business fundamentals, substantial returns through share buybacks, and strong cash flows.

With 28 wholly-owned gaming entertainment properties across 10 states in the U.S., Boyd Gaming also owns and operates Boyd Interactive, a business-to-business (B2B) and business-to-consumer (B2C) online casino gaming business.

Record Q1 Results Show Off Business Resilience

Putting concerns over an imminent consumer slowdown to rest, Boyd Gaming reported upbeat Q1 results on April 25. Earnings per share (EPS) easily surpassed Wall Street’s expectations for the ninth consecutive quarter ($1.71 vs. estimates of $1.51). This is highly commendable, given the continuous rise in interest rates and an uncertain macroeconomic outlook.

Robust demand and momentum in online gaming were able to set off lowered revenues from its core land-based casinos. Further, Q1 EBITDAR (EBITDA adjusted for rent expenses) improved 8.4% year-over-year, fueled by EBITDAR from online operations that more than doubled, aided by newly-launched sports-betting operations.

Strong Shareholders Returns Via Buybacks and Dividends

Boyd has consistently returned value to its shareholders in the form of increased share buybacks and dividends.

During its recent earnings call, the company reaffirmed its plans to continue returning $100 million per quarter to shareholders via share buybacks. At the current market cap of $7 billion, it implies that the company will continue to return 5.7% of its outstanding shares per year, creating value for shareholders. In 2022, the company bought back 9.4 million shares worth $542 million, reflecting an impressive 8% return via buybacks.

To add to investors’ glee, Boyd added a new share repurchase program worth $500 million on May 5. This clearly reaffirms the company’s belief that its shares are undervalued.

On top of that, BOYD has consistently grown its dividend. While dividends were temporarily suspended during the COVID-19 pandemic, the quarterly dividends more than doubled from $0.07 in December 2019 to $0.15 in March 2022. Now, the current quarterly dividend of $0.16 implies a yield of 0.9%.

Notably, the company has ample cash flows to support the dividends and buybacks. During 2022, the company registered free cash flow of $6.49 per share, implying a yield of 9.4% at current prices, which is very impressive.

Robust Demand for Sports Betting and Online Gaming

Sports betting was banned in the U.S. until 2018. However, it’s now benefiting from rising betting demand. It’s no wonder, then, that Boyd Gaming started reporting its revenues from online gaming as a separate revenue segment in its recently reported earnings. The Online segment includes online gaming operations in the U.S. and Canada, as well as operations from the acquisition of Pala Interactive.

While there is a reported slowdown in growth for the company’s core Gaming business, BYD has seen more than 100% year-over-year growth in its Online business as of its most recent quarter. Though still a small percentage (13%) of total revenues, online gaming presents a huge growth opportunity for Boyd.

Boyd has a sturdy long-term growth plan in place to capture the growth potential in the online gaming space. Leveraging its pre-existing physical presence, massive database, and strong customer loyalty, BOYD plans to gain a significant foothold in the regional U.S. iGaming markets.

On a positive note, with Boyd’s recent acquisition of Pala Interactive now complete, the growth outlook is promising. Pala’s established casino-centric proprietary technology and management expertise, combined with Boyd’s extensive reach, are set to significantly accelerate Boyd’s pace of growth.

On top of that, Boyd’s collaboration (5% stake) with FanDuel in retail and online sports betting will also add to the growth story in the online gaming space.

Is Boyd Gaming Stock a Buy, According to Analysts?

As per TipRanks, the Wall Street community is cautiously optimistic about Boyd Gaming stock. Overall, BYD commands a Moderate Buy consensus rating based on eight Buys, one Hold, and one Sell. Boyd Gaming stock’s average price target of $79.33 implies 14.5% upside potential from current levels.

Despite record results and a recent stock price rally, Boyd Gaming is currently trading at a P/E ratio of 10.8x, reflecting a 32% discount from its five-year average of 15x. Further, it’s trading at a 14.4% discount to the peer group average of 12.7x. Therefore, I believe the discounted valuation presents a great opportunity to consider BYD stock, given its strong business fundamentals.

Conclusion: BOYD Looks Attractive for the Long Term

What sets BYD apart is its well-diversified portfolio that has grown over the years through meaningful acquisitions and partnerships. The cherry on the cake is the strong growth potential from its online, mobile gaming, and non-gaming operations.

I believe Boyd Gaming will continue to return considerable value to shareholders. Overall, the risk-reward profile looks favorable, and the company’s sturdy business model can allow it to capture a more significant market share in the online gaming space in the coming years.