With the Kellogg spin-off finally in the books, investors may be wondering if it’s better to go after shares of Kellanova (NYSE:K) or WK Kellogg (NYSE:KLG) amid the recent spill-over in consumer staples stocks. Indeed, shares of K and KLG have been under considerable pressure following their recent debuts. For now, most analysts are in no rush to recommend either name out of the gate, with Hold consensus ratings assigned to both.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Undoubtedly, Kellanova doesn’t just have the more enticing company name; it’s the most exciting of the two, as it’s a play on Kellogg’s snacking and frozen food portfolio (though it’s noteworthy it still has exposure to cereals internationally) — a part of the Kellogg business that looks a heck of a lot sweeter for growth-savvy investors.

Meanwhile, WK Kellogg is the way to invest in the cereal business here in North America, which has been relatively sluggish as consumers — especially Millennials — pay fewer visits to the cereal aisle at the grocery store.

Although Kellanova seems to be the better buy due to its growth focus and greater agility to make major strides in the snacking market, investors should pay careful attention to the valuation as even the low-growth firm may stand to be a better buy if the price of admission is overly depressed. In any case, Kellanova and WK Kellogg faced prominent headwinds in their first weeks as independent publicly traded entities.

Therefore, let’s use TipRanks’ Comparison Tool to stack up the two Kellogg firms to see which looks more enticing going into year’s end.

Kellanova (NYSE:K)

Kellanova looks interesting after its post-spin-off sag to under $50 per share. Argus Research analyst Taylor Conrad recently praised the stock for its valuation. He’s a believer in the company’s management, noting that they’re aware of what they’re up against and are prepared to adapt accordingly.

Indeed, Kellanova’s move into healthier food could bring its snack food portfolio to greater heights as consumers continue to prioritize health consciousness. Further, Conrad thinks the spin-off will do the company a lot of good as it looks to focus on innovation and driving margins higher. I think Conrad is right about Kellanova; it’s way too cheap here after its spin-off stumble.

At writing, shares of K (the same as the old Kellogg) trade at 20.2 times trailing price-to-earnings (P/E) to go with a 4.7% dividend yield. That’s a bit lower than some other snack food pure-plays out there, most notably Mondelez (NASDAQ:MDLZ), which goes for 21.1 times P/E alongside a much smaller dividend yield of 2.7%.

Arguably, Kellanova deserves to trade at a higher multiple than Mondelez, given its exposure to healthier snack options like RXBar. Additionally, weight-loss drugs, like Ozempic, seem like less of a headwind for K compared to most other snacking firms that are more reliant on sugar and high-fat content. All things considered, I’m bullish on Kellanova, even if most analysts aren’t yet ready to recommend it as a Buy.

What is the Price Target of Kellanova Stock?

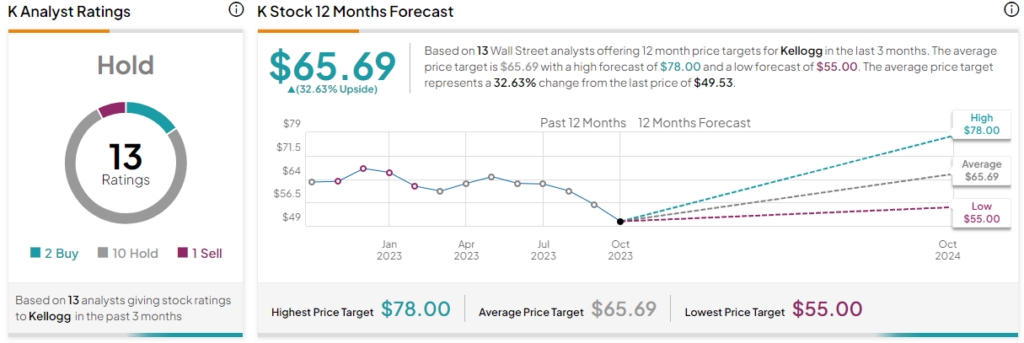

Kellanova stock is a Hold, with two Buys, 10 Holds, and one Sell rating assigned in the past three months. The average K stock price target of $65.69 entails a nice 32.6% gain, however.

WK Kellogg (NYSE:KLG)

WK Kellogg is a far less interesting stock for investors who don’t consider themselves deep-value hunters. At writing, the stock has zero Buy ratings. As the firm awaits its first Buy rating, investors will have to go against the grain and find a thesis that the Street isn’t currently as upbeat on quite yet. Given a lack of catalysts and what could be the secular demise of cereals as consumers seek healthier options, I have to stay neutral on the stock, just like most analysts.

Even Mad Money host Jim Cramer is not enthused by the stock after the Kellogg spin-off.

For now, the spin-off brings some hope for WK Kellogg as it looks to keep investing in the supply chain to sustain long-term margin expansion. Though automating pricy and less efficient parts of the supply chain could help unlock additional value, it could take some time before such initiatives pay off.

For now, WK Kellogg is likely to stay in a slump, and with recent pressure hitting consumer staple stocks, I’m also in no rush to buy the dip in the name, even if the stock is way cheaper than Kellanova at a mere 10.5 times trailing P/E and 0.36 times price-to-sales (P/S). That said, it’s cheap for a reason. And at this time, its cheapness is all the stock has going for it.

What is the Price Target of WK Kellogg Stock?

WK Kellogg is a Hold, with three Holds and one Sell rating from analysts. The average KLG stock price target of $12.75 suggests 27.4% upside from here.

The Takeaway

Kellanova looks to be the far better bet, in my opinion. Additionally, analysts also have two Buys on the stock to WK Kellogg’s zero. Given its more attractive and higher-growth mix of goods, I view Kellanova as not only a better bet than WK Kellogg but a better value than many of its snacking industry rivals. As shares sag further, K stock remains one name to watch!